In any welfare state, one of the biggest jobs of the government is to look after the rising needs of its people and the country’s development. And how is that done? Mostly through public spending.

India, being a developing nation, has limited resources but still tries to fulfill the role of a welfare state. The main way it collects money is through taxes. At first, taxes were just about raising money for services, but over time they became much more than that. Today, they are also used as a tool of fiscal policy—basically, a way to boost the economy and guide growth.

“Collect taxes from the citizens as honeybees collect nectar from flowers, gently and without inflicting pain”

- Chanakya

So, What Exactly is Tax?

By definition, a tax is a financial burden placed on individuals or property owners to support the government. It’s not a choice, not a donation—it’s something enforced by law.

In plain words, tax is the money we pay to the government, and that money comes back to us in the form of public services like roads, hospitals, education, and security.

“Taxes, after all, are dues that we pay for the privileges of membership in an organized society.”

- Franklin D. Roosevelt

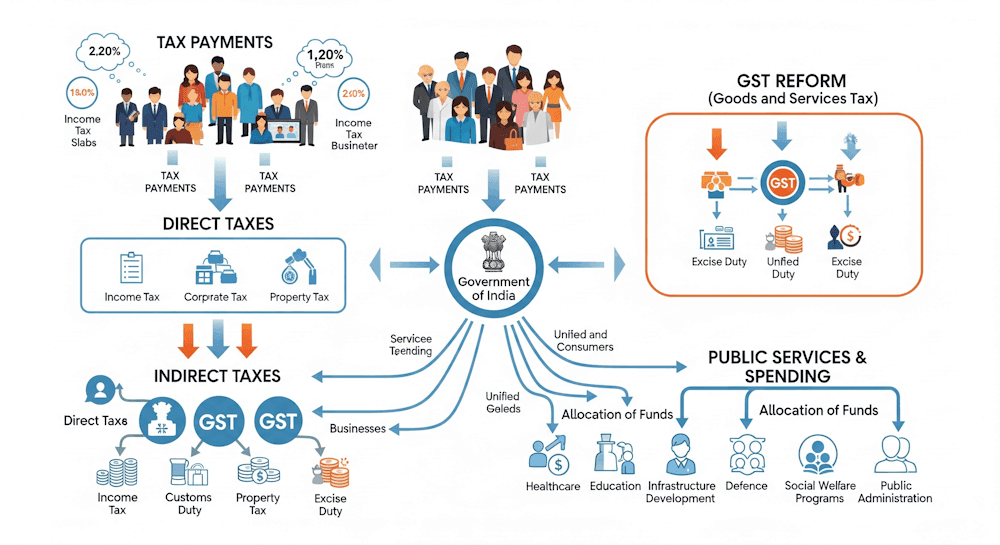

Direct Taxes

A direct tax is the kind of tax that you pay straight to the government without passing it on to anyone else. The taxpayer carries the entire burden.

- It can’t be shifted.

- It is collected directly from the person or company.

- The biggest example in India is income tax.

So, if you earn a salary or profits, you yourself are the one responsible for paying the income tax on it.

Indirect Taxes

Now, indirect taxes work differently. Here the one paying the tax at first (like a manufacturer or seller) just passes it on, and in the end, the consumer bears the cost.

- These taxes are placed on goods and services, not on income or property.

- They are also known as consumption taxes.

- The problem is, they are regressive—everyone pays the same, whether rich or poor.

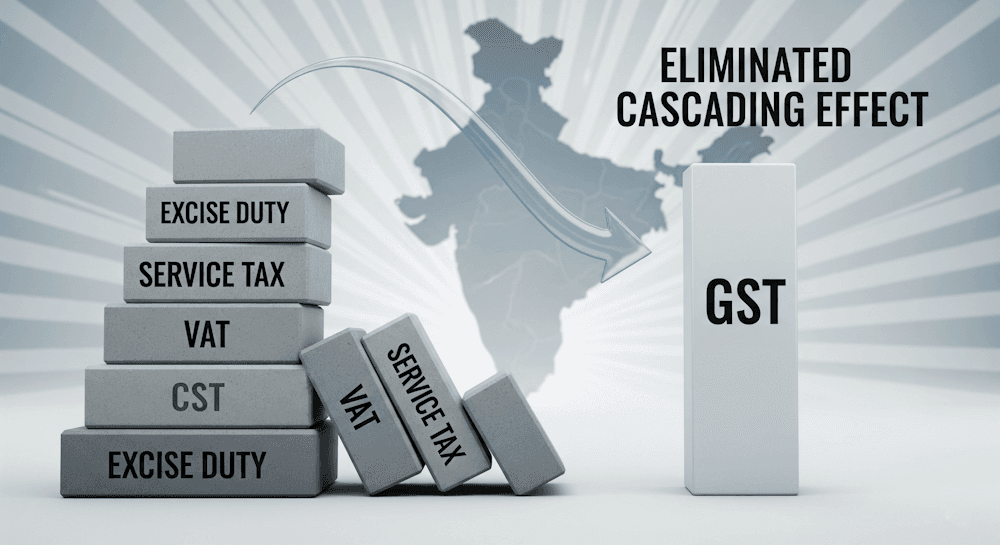

Old Indirect Taxes (Before GST)

Before 2017, India had a long list of indirect taxes:

- Excise duty

- Customs duty

- Service tax

- Central Sales Tax (CST)

- VAT (Value Added Tax)

- Entry tax, Purchase tax

- Entertainment tax

- Luxury tax

- Tax on lottery, betting, gambling

- Advertisement tax

This system was messy, with multiple layers of taxes, and that’s where GST came in.

GST – A Turning Point

On July 1, 2017, India rolled out the Goods and Services Tax (GST). This was one of the biggest reforms in indirect taxation.

Instead of dozens of separate taxes, GST created one unified system—“one nation, one tax.”

- It replaced most central and state indirect taxes.

- Customs duty, however, still exists even after GST.

- It made things more transparent and easier for both businesses and consumers.

Economists agree that both direct and indirect taxes are needed, as they balance each other.

“The hardest thing in the world to understand is income tax.”

- Albert Einstein

And if Einstein found it tough, you can imagine why most people feel the same!

What You’ll Study at the Intermediate Level

At the intermediate stage, you don’t learn the entire GST law, but you do cover the main building blocks like:

- What is “supply” under GST

- When GST is charged and what exemptions exist

- Basics of time, value, and place of supply

- Input Tax Credit (ITC)

- GST registration rules

- Tax invoice, credit and debit notes

- Accounts and records you need to keep

- E-way bill system

- GST returns and payment process

At the final stage, the rest of GST law and the full customs law are covered in detail.

Wrapping Up

India’s taxation system has moved a long way from complicated, scattered taxes to a cleaner and more unified structure. Direct taxes like income tax make sure people contribute based on their earnings, while indirect taxes like GST ensure the government collects revenue from consumption.

Together, they form the backbone of India’s economy. And with GST, the system is now simpler and more efficient compared to what it was before 2017.