1. Introduction

When the Goods and Services Tax (GST) rolled out in 2017, it promised a unified system that would simplify indirect taxation in India. It merged multiple taxes like excise, VAT, and service tax into one single framework.

But two areas still confuse many businesses and individuals — imports and petroleum products.

Why? Because while GST covers almost every good and service, there are special rules for imports, and a few key items like petrol, diesel, and natural gas are still kept outside GST’s scope.

Let’s break down both these topics in simple terms — how GST works on imports and why petroleum products still follow the old tax system.

2. GST on Imports – The Basic Concept

The government treats imports as inter-State supplies under GST law, even though they come from outside India.

As per Section 7(2) of the IGST Act, 2017, import of goods or services into India is considered an inter-State transaction, and therefore, IGST (Integrated GST) applies.

So, when goods enter India from another country, IGST is levied in addition to customs duties. This ensures that imported goods are taxed just like domestically produced ones — keeping competition fair.

3. What Is “Import of Goods”?

According to Section 2(10) of the IGST Act, “import of goods” means bringing goods into India from a place outside India.

The moment the goods cross Indian customs territory, they become subject to Indian tax laws — including IGST.

Example:

A company in Delhi imports machinery from Germany worth ₹10 lakh. When the goods arrive in India, the company has to pay:

- Basic Customs Duty (BCD) – say 10% = ₹1,00,000

- IGST – 18% on ₹11,00,000 = ₹1,98,000 So total payable = ₹2,98,000.

The good part? That ₹1,98,000 IGST can be claimed as input tax credit (ITC) in the company’s GST return.

4. GST on Import of Services

Imports aren’t limited to physical goods — services can also be imported.

Import of services is defined under Section 2(11) of the IGST Act. It means:

- The supplier is located outside India,

- The recipient is located in India, and

- The service is used for business or personal purposes in India.

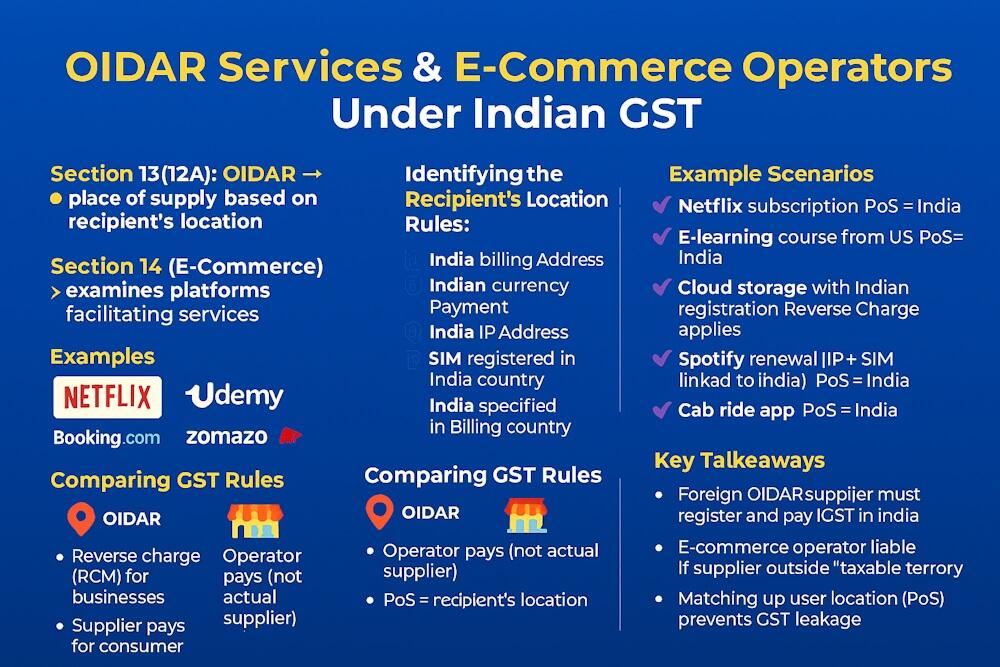

For such transactions, IGST is payable under the Reverse Charge Mechanism (RCM) by the recipient in India.

Example:

A firm in Mumbai hires a digital marketing consultant from the USA. The service is used in India, so IGST @18% is payable by the firm under reverse charge, even though the supplier is not registered in India.

5. Import Valuation for GST

To calculate IGST on imported goods, you need the assessable value determined under customs law.

The formula is usually:

“IGST = (Assessable Value + Customs Duty + Any other charges) × Applicable GST Rate”

This ensures that all duties and charges are part of the base value on which GST is calculated.

6. Input Tax Credit (ITC) on Imports

Businesses can claim the IGST paid on imports as input tax credit, provided the goods are used for business purposes.

The ITC can be used to offset output GST liability on domestic sales. However:

- BCD (Basic Customs Duty) is not available as ITC.

- Only IGST paid on imports can be claimed.

Example:

A furniture manufacturer imports wooden boards from Malaysia and pays ₹50,000 as IGST at customs. When it sells furniture in India, the manufacturer can use that ₹50,000 as credit to reduce its GST liability.

7. Import under Reverse Charge for Services

If a business in India receives services from a person located outside India, it has to pay GST under reverse charge.

This ensures that all imported services are taxed, even if the foreign supplier is not registered under Indian GST.

Example:

A company in Bengaluru subscribes to Canva Pro (Australia-based). It pays the subscription fee in dollars. The company must pay IGST @18% under RCM and later can claim it as input credit.

8. Who Pays GST on Imports?

For goods – the importer of record (the person in whose name the Bill of Entry is filed). For services – the recipient located in India.

In both cases, the person receiving the goods or service bears the GST liability.

9. Exemptions and Special Cases

Some imports are exempt from IGST, for example:

- Goods imported under Advance Authorization Scheme for export purposes.

- Goods imported for diplomatic missions.

- Certain defense-related imports.

Apart from these, almost every import attracts IGST to ensure tax parity between imported and domestic products.

Part 2 – Petroleum Products under GST

Now let’s talk about the other half of our topic — petroleum products.

10. Why Are Petroleum Products Outside GST?

When GST was introduced, the idea was to include everything under one tax. However, some politically and economically sensitive products — like petroleum crude, petrol, diesel, aviation turbine fuel (ATF), and natural gas — were kept outside GST’s scope temporarily.

The reason was simple: These fuels are a major source of revenue for both the Centre and the States through excise duty and VAT.

If GST replaced these, States would lose a big chunk of their income — and they weren’t ready for that shift yet.

11. Constitutional Basis

The 101st Constitutional Amendment Act, 2016, which introduced GST, included a special clause for petroleum products.

Article 279A(5) states that the GST Council will decide when petroleum products should be brought under GST.

So legally, they can be included in GST — but only when the GST Council recommends it.

12. Current Tax Structure on Petroleum Products

Here’s how taxation currently works for major fuels:

| Product | Tax under GST? | Present Taxes |

| Petrol | ❌ Not under GST | Central Excise + State VAT |

| Diesel | ❌ Not under GST | Central Excise + State VAT |

| Crude Oil | ❌ Not under GST | Central Excise + VAT |

| Natural Gas | ❌ Not under GST | Excise + VAT |

| Aviation Turbine Fuel (ATF) | ❌ Not under GST | Excise + VAT |

So, even though GST covers almost every other item, fuel prices still vary from state to state, because each State levies different VAT rates.

13. How This Affects Businesses

Since petroleum products are outside GST:

- Businesses cannot claim input tax credit (ITC) for taxes paid on petrol or diesel used in operations.

- Transport and logistics costs remain higher because fuel is taxed separately.

- Fuel prices differ widely across States due to varying VAT rates.

This is one of the few areas where GST hasn’t yet created a truly unified market.

14. Why Petroleum Should Be Included in GST

There’s been ongoing debate about bringing fuels under GST. Here’s why many experts support it:

- It would reduce the overall fuel price by removing cascading of taxes.

- Businesses could claim ITC on fuel, reducing logistics and transport costs.

- It would create uniform pricing across States.

- It would simplify compliance — one tax system for everything.

However, governments fear that bringing fuels under GST might lead to temporary revenue loss, especially for States.

15. Future Possibility – Will Fuels Ever Come Under GST?

Yes, eventually. The GST Council has discussed it multiple times, and many policymakers agree it’s necessary.

The most likely first candidate will be natural gas, since it’s used in manufacturing and industries. Petrol and diesel might take longer because of their huge revenue contribution.

Once included, fuel prices could stabilize and tax credits will become smoother for businesses.

16. Key Differences: Imports vs Petroleum Products

| Aspect | Imports | Petroleum Products |

| Status under GST | Fully covered | Temporarily excluded |

| Applicable Tax | IGST | Excise Duty + VAT |

| Who Pays | Importer / recipient | Dealers and consumers |

| Input Tax Credit | Allowed | Not allowed |

| Legal Basis | Section 7 & 5 of IGST Act | Article 279A(5) of Constitution |

| Administered By | Customs + GST | Centre + State Revenue Departments |

17. Final Thoughts

GST has successfully unified most of India’s indirect taxes, but imports and petroleum remain two areas that operate with special rules.

For imports, GST ensures tax parity between foreign and domestic goods — thanks to IGST and input credit provisions. For petroleum, the old system still continues, mainly because States rely heavily on the revenue it generates.

In the future, once petroleum products are brought under GST, India will truly achieve “One Nation, One Tax” in every sense.