1. Introduction

Normally, in any GST transaction, the supplier of goods or services is the one who collects tax from the buyer and deposits it with the government.

But sometimes, this rule flips — and the buyer (or recipient) is made responsible for paying GST directly to the government. This flipped system is called the Reverse Charge Mechanism, or simply RCM.

In short, reverse charge means the liability to pay tax shifts from the seller to the buyer.

2. What is Reverse Charge Mechanism (RCM)?

Under Section 9(3) and 9(4) of the CGST Act, 2017 and Section 5(3) and 5(4) of the IGST Act, 2017, certain goods and services are notified by the government where the recipient, instead of the supplier, is liable to pay GST.

So, while in a normal situation:

“Supplier → Collects GST → Pays to Government”

In RCM:

“Recipient (buyer) → Pays GST directly → Can later claim Input Tax Credit (ITC)”

This mechanism helps bring unorganized sectors under the tax net and ensures tax compliance for specific services and goods where tracking every small supplier would be difficult.

3. Legal Provisions Governing RCM

Let’s quickly understand the legal background:

Under the CGST Act

- Section 9(3): The government may notify specific categories of goods or services for which the recipient shall pay tax under RCM.

- Section 9(4): RCM can also apply when a registered person receives taxable goods or services from an unregistered supplier, provided such supplies are notified by the government.

Under the IGST Act

- Section 5(3) & (4): Similar provisions apply to inter-State supplies, making the recipient liable to pay IGST instead of CGST/SGST.

4. Why RCM Exists — The Purpose Behind It

RCM was not created to make compliance harder; it’s there to plug revenue leakage and improve tax coverage.

Here’s why it’s important:

- Some service providers (like lawyers or transporters) are small or exempt; tracking their tax payments individually is tough.

- It ensures tax is still collected on such transactions.

- It shifts the burden to organized businesses, who are better equipped to handle compliance.

- It helps the government collect tax efficiently, without chasing small vendors.

5. Categories of Goods and Services Covered under RCM

The government has issued detailed notifications specifying which goods and services fall under RCM.

Let’s go through the major ones — simplified and grouped.

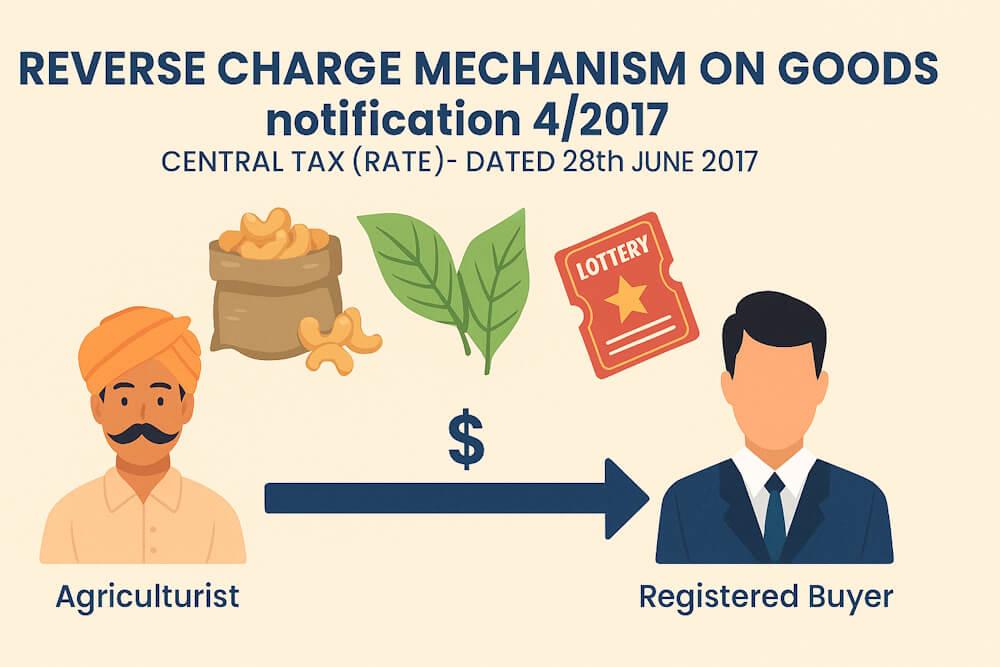

A. Goods under RCM (as per Notification No. 4/2017–CGST dated 28.06.2017)

| Sl. No. | Goods | Supplier | Recipient (who pays GST) |

| 1 | Cashew nuts (not shelled or peeled) | Agriculturist | Registered person |

| 2 | Bidi wrapper leaves (tendu leaves) | Agriculturist | Registered person |

| 3 | Tobacco leaves | Agriculturist | Manufacturer or registered buyer |

| 4 | Silk yarn | Any person | Registered buyer |

| 5 | Raw cotton | Agriculturist | Registered person |

| 6 | Supply of lottery tickets | State Govt., Union Territory, or authorized distributor | Registered distributor or agent |

So, whenever a registered dealer buys these goods from an unregistered or exempt supplier (like a farmer), the buyer must pay GST under RCM.

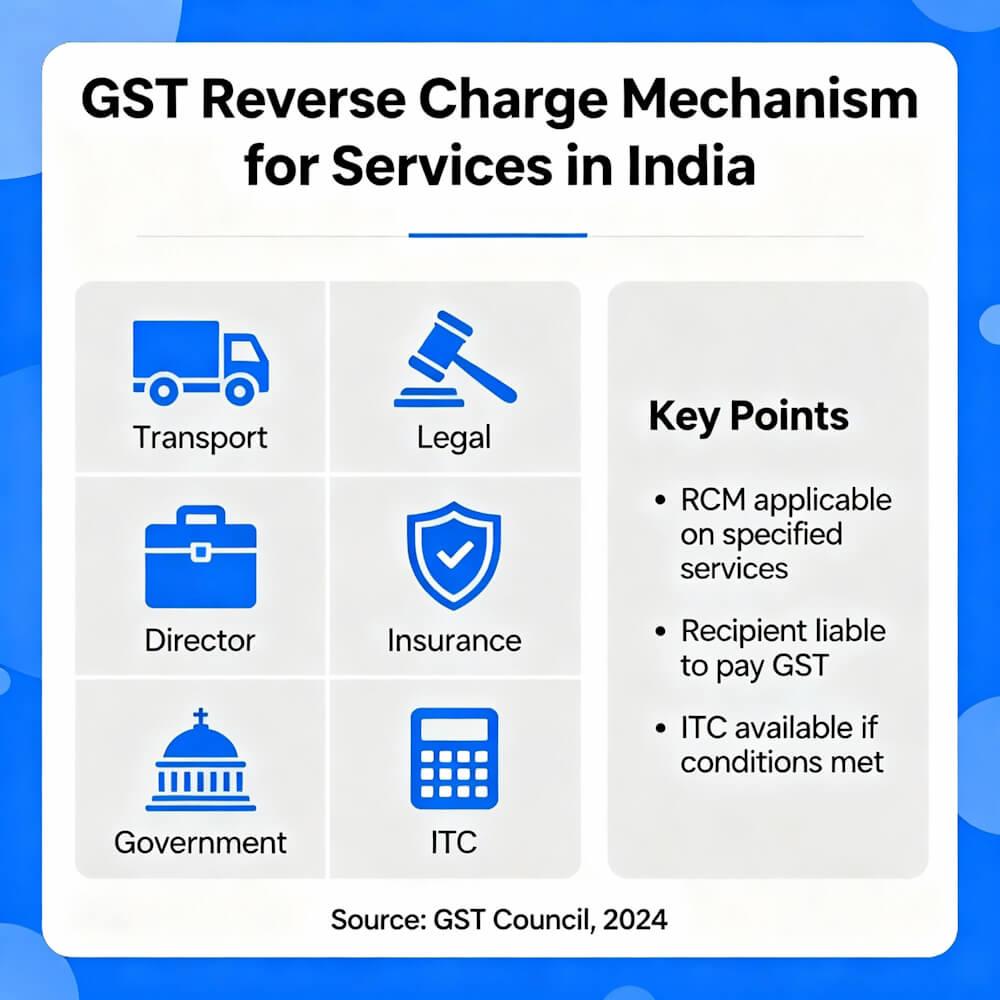

B. Services under RCM (as per Notification No. 13/2017–CGST dated 28.06.2017)

This is where RCM is more commonly seen. Some important examples:

| Sl. No. | Type of Service | Supplier | Person Liable to Pay Tax |

| 1 | Goods Transport Agency (GTA) | GTA | Recipient (if registered) |

| 2 | Legal services | Advocate or firm | Business entity |

| 3 | Services supplied by a Director to a company | Director | Company or body corporate |

| 4 | Services by an Insurance Agent | Insurance agent | Insurance company |

| 5 | Services by a Recovery Agent | Recovery agent | Bank or NBFC |

| 6 | Sponsorship services | Any person | Body corporate or partnership firm |

| 7 | Services by Central/State Government (like renting of immovable property) | Govt. | Business entity |

| 8 | Services by a Transporter (individual truck owner) | Transporter | Registered business receiving service |

These are the most common RCM cases businesses deal with.

6. Reverse Charge on Imports

RCM also applies when goods or services are imported into India.

For imports:

- IGST is levied on the value of goods at the time of customs clearance.

- The importer (recipient) pays IGST under RCM and can later claim it as input tax credit.

Example: A company in Chennai imports medical devices from Germany worth ₹10 lakh.

- IGST @18% = ₹1.8 lakh

- Paid under reverse charge

- The company can claim ₹1.8 lakh as ITC in its GST return.

7. Reverse Charge under Section 9(4) – Unregistered to Registered Supplies

Under Section 9(4), RCM applies when a registered person purchases from an unregistered supplier — but only if the government notifies that category of supply.

Earlier, this used to apply to all unregistered purchases, but now it’s restricted to specific situations (like certain real estate transactions).

Example: A developer purchases cement from a local unregistered dealer for a construction project. Since cement is a notified item, the developer must pay GST under RCM.

8. Time of Supply under RCM

The time of supply determines when GST becomes payable under RCM.

For Goods (Section 12(3)):

Whichever is earlier:

- Date of receipt of goods, or

- Date of payment, or

- 30 days from invoice date

For Services (Section 13(3)):

Whichever is earlier:

- Date of payment, or

- 60 days from invoice date

If none of these can be determined, the date of entry in the recipient’s books is considered.

9. Input Tax Credit (ITC) on RCM

The good news is — even though the recipient pays GST under RCM, they can still claim ITC on that tax, provided:

- The goods or services are used for business purposes, and

- The recipient is registered under GST.

However, the credit can only be claimed after the tax has been paid to the government.

Example: A company pays ₹10,000 GST under RCM for legal services. In its GSTR-3B filing, it can claim ₹10,000 as input tax credit, which can be adjusted against output GST liability.

10. Accounting Treatment for RCM

RCM entries in books of accounts are slightly different. Here’s a simple view:

| Transaction | Journal Entry |

| At the time of booking expense | Expense A/c Dr. ₹1000 Input RCM GST A/c Dr. ₹180 To Supplier A/c ₹1000 To Output RCM GST A/c ₹180 |

| At the time of payment | Output RCM GST A/c Dr. ₹180 To Cash/Bank A/c ₹180 |

This ensures transparency — GST is both paid and claimed properly.

11. RCM and E-Invoicing

Under GST, even though the supplier doesn’t charge tax under RCM, the recipient must issue a self-invoice and payment voucher under Rule 46 and Rule 52 of CGST Rules.

Documents required:

- Self-Invoice (since supplier doesn’t issue a GST invoice)

- Payment Voucher (when paying the supplier)

This ensures the transaction is recorded and traceable in the GST system.

12. Common Examples of RCM in Daily Business

Here are a few real-world cases most businesses face:

| Scenario | GST Treatment |

| Company avails legal advice from a lawyer | RCM – Company pays GST |

| Factory hires a truck from a GTA | RCM – Factory pays GST |

| Company pays commission to a director | RCM – Company pays GST |

| Bank hires a recovery agent | RCM – Bank pays GST |

| Registered business imports goods | RCM – IGST under import |

13. Compliance and Return Filing under RCM

All taxes paid under RCM must be reported in GSTR-3B under the “Tax on Reverse Charge” column.

Even if no RCM transactions happen in a month, registered taxpayers must tick “No” under RCM section to confirm no liability.

Failure to comply may lead to:

- Penalties for underpayment

- Blocking of input credit

- Interest on delayed payment

So it’s important to track all RCM transactions carefully and reconcile them monthly.

14. Key Takeaways

- RCM shifts tax payment responsibility from supplier to buyer.

- It applies only on notified goods and services or imports.

- The recipient must self-invoice and pay tax, then claim ITC.

- RCM improves compliance and prevents revenue leakage.

- Always verify the latest RCM notifications, as the government updates them frequently.

15. Final Thoughts

The Reverse Charge Mechanism (RCM) may look like an extra burden at first, but it’s actually a smart move to make the tax system more accountable.

It ensures that even when small or exempt suppliers are involved, tax still reaches the government safely. For businesses, the key is to identify RCM transactions early, maintain proper documentation, and claim ITC correctly.

If handled carefully, RCM won’t hurt your cash flow — it just changes who pays the tax first.