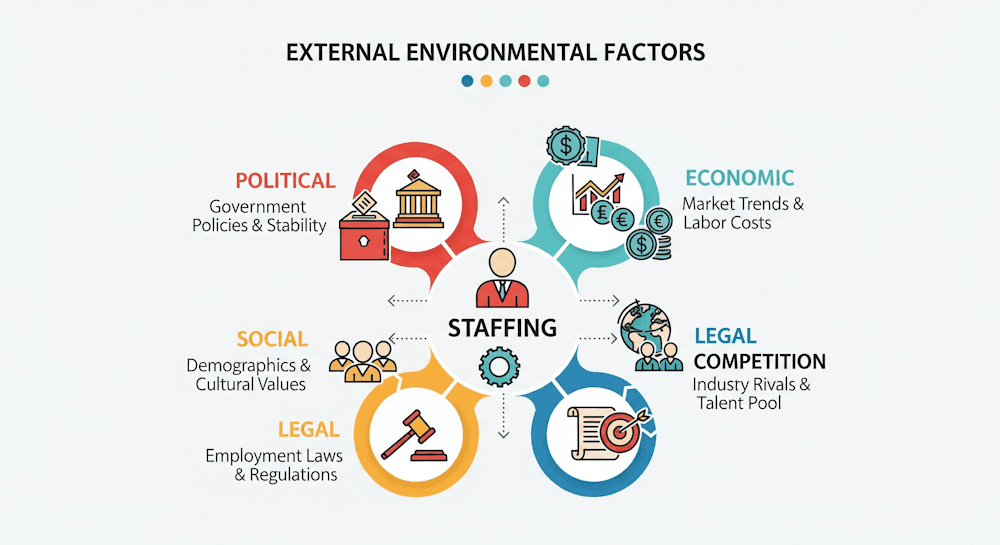

External Environmental Factors Affecting Staffing

Various external factors influence the staffing process — and the truth is, organizations have no control over them. Let’s break them down one by one.

1. Political Factors

Political stability, the role of political parties, and their strategies can have a big impact on staffing. For example, the formation of new political parties, or splits in trade unions, can make staffing more complicated. Trade union changes can directly affect how and who you hire. On top of that, organizations sometimes face political pressure to employ local people, or even pressure from business connections to hire specific candidates.

2. Economic Factors

Economic conditions play a major role in staffing. Things like the overall economic system, national income, per capita income, and how income and wealth are distributed across society all influence how staffing decisions are made.

3. Social Factors

The social environment is another big player here. It includes social roles, values, caste systems, occupational structures, cultural backgrounds, religious beliefs, and the division between forward and backward social sections. Sometimes, socio-cultural norms mean certain jobs end up being given to specific categories of people. This makes the staffing process more complex and sensitive.

4. Competition

These days, the race for good talent is tough. Companies aren’t just looking for any employee — they’re after the smartest fresh graduates, sharp-minded managers, and tech experts who know their stuff. And guess what? Everyone else is chasing them too. To win them over, businesses have to think beyond just salaries. They might throw in flexible work setups, career growth paths, a friendly work atmosphere, or perks that make employees feel valued enough to stick around instead of jumping ship to a competitor.

5. Legal Factors

The law doesn’t just sit on the sidelines when it comes to staffing — it sets clear rules that companies have to follow. Think about things like:

- No child labour, no exceptions.

- Certain positions reserved for women or minority groups.

- Strict safety measures to keep employees protected at work. Ignoring these isn’t an option. Breaking the rules can cost a company more than just money — it can damage its reputation and disrupt operations.

6. Customers

No matter how big or small a company is, its heartbeat is the customers. If people aren’t happy with what you’re offering, it’s only a matter of time before they look elsewhere. And when customers walk away, it often means fewer sales, less growth, and eventually fewer jobs. On the flip side, happy customers create more demand — and more demand usually means more hiring. So, in a way, keeping customers satisfied is also part of keeping staff employed.

Read the related article -