When a business is sold, merged, or split into two entities, one big question always pops up:

“What happens to the Input Tax Credit lying in the electronic credit ledger?”

- Some people think the credit just expires.

- Others think it moves automatically.

- And many don’t know that GST has a very specific mechanism for transferring ITC from one entity to another.

This mechanism is governed by:

- Section 18(3) of CGST Act, and

- Rule 41 of CGST Rules

And practically, the work happens through a single form: Form GST ITC-02

Let’s break this down in an extremely simple, everyday-business way.

1. Why Does ITC Transfer Matter?

Whenever a business undergoes:

- Sale / transfer of business

- Merger / amalgamation

- Demerger / split / division

- Transfer of ownership

- Change in constitution of business

…the assets, liabilities, and operations shift to a new entity.

And ITC is also considered an “asset”.

So the government allows ITC to be shifted from the old GSTIN (transferor) to the new GSTIN (transferee).

Example

- Company A is merging into Company B.

- Company A has ₹18,50,000 ITC sitting in its ledger.

- Once the merger takes effect → this ITC must be moved to Company B.

2. Legal Foundation: Section 18(3) of CGST Act

Section 18(3) says:

“When business is transferred as a going concern, the ITC shall also be transferred to the transferee.”

This applies to:

- sale

- merger

- amalgamation

- demerger

- lease

- transfer of business

- assignment of business

The only condition is:

✔ the business must be transferred with its liabilities.

If only assets are transferred (without liabilities) → ITC cannot be transferred.

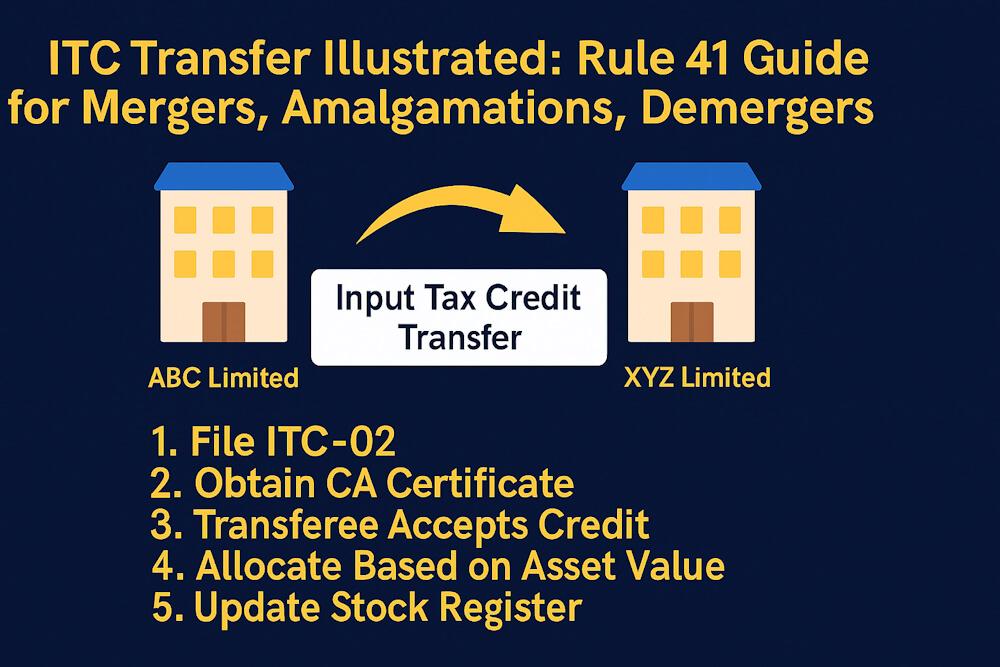

3. Rule 41 – The Core ITC Transfer Rule

Rule 41 describes how ITC can be transferred.

It requires three important things:

3.1 Filing of ITC-02 by Transferor

The old entity files Form ITC-02. This is basically a declaration:

- “I am transferring my ITC to the new GSTIN.”

The form contains:

- name of the transferee

- GSTIN of transferee

- amount of ITC to be transferred (by tax head)

- details of business transfer

- CA certificate

3.2 Acceptance by Transferee

Once the old entity files ITC-02, the new entity must:

- log in

- go to the portal

- accept the credit transfer

Only after acceptance does ITC shift to the new ledger.

3.3 Mandatory CA or CMA Certificate

A Chartered Accountant (CA) or Cost Accountant (CMA) must certify that:

- the transfer is legitimate

- the transfer includes liabilities

- the ITC transferred is in accordance with Rule 41

This avoids fraudulent transfers.

4. Special Rule for Demergers — Allocation Based on Assets

In demerger, the business splits into two or more units.

In this case:

✔ ITC must be transferred based on the ratio of the value of assets transferred.

- Not turnover.

- Not capital goods.

- Not nature of business.

Only asset value matters.

Example – Demerger Allocation

- Company A has total assets worth ₹10 crore.

- Assets transferred to NewCo = ₹4 crore (40%).

- Total ITC in A = ₹50 lakh.

- ITC eligible to transfer = ₹50 lakh × 40% = ₹20 lakh.

This is a mandatory rule.

5. Types of ITC That Can Be Transferred

Under Rule 41:

✔ All accumulated ITC can be transferred:

- IGST

- CGST

- SGST/UTGST

- Compensation Cess

✔ ITC on capital goods can also be transferred.

No proportionate reduction needed, because credit is attached to the business—not to the asset alone.

6. Step-by-Step Process to Transfer ITC

Step 1: Prepare Documents

You need:

- merger/demerger agreement

- CA certificate

- asset valuation statement

- board resolution

- list of ITC balances (IGST/CGST/SGST)

Step 2: Transferor Files ITC-02

Path: Services → Returns → ITC Forms → GST ITC-02

Fill:

- transferee GSTIN

- reason for transfer

- business transfer details

- ITC amounts (per tax head)

- upload CA Certificate

Submit → File with DSC/EVC.

Step 3: Transferee Accepts ITC

The new entity logs in and accepts the request.

Credit immediately appears in their Electronic Credit Ledger.

Step 4: Update Stock Register

Both entities must update:

- stock

- fixed assets

- liabilities

The law requires maintaining records for minimum 72 months.

7. When ITC Transfer Is NOT Allowed

ITC cannot be transferred if:

- the business is sold PARTIALLY, without liabilities

- only assets are transferred (not a going concern)

- only a product line is sold (unless entire undertaking is transferred)

- registration is cancelled

- individual assets like machinery or trucks are sold

- no CA certificate is furnished

8. Practical Examples

Example 1 – Business Sale

ABC Traders sells its business to XYZ Traders.

ABC ITC balance:

- IGST: 2,50,000

- CGST: 1,20,000

- SGST: 1,20,000

ABC files ITC-02 → transfers ₹4,90,000.

XYZ accepts → credit moves instantly.

Example 2 – Amalgamation

A Ltd. and B Ltd. merge into C Ltd.

Both A & B transfer ITC to C through separate ITC-02 filings.

Example 3 – Demerger (Asset Ratio)

- Total assets of A Ltd.: ₹12 crore

- Assets transferred to A1 Ltd.: ₹3 crore

- Asset ratio = 25%

- Total ITC of A Ltd.: ₹80 lakh

- Eligible transfer = 80 lakh × 25% = ₹20 lakh

Example 4 – Branch Transfer (Not Allowed)

One GSTIN in Karnataka cannot transfer ITC to another GSTIN of the same company in Maharashtra through ITC-02.

Because interstate branch transfer is not a business transfer.

Example 5 – Fraud Prevention Case

- A company wants to transfer unused ITC before shutting down.

- But shutdown is not a business transfer.

- ITC-02 filing → rejected.

9. Common Mistakes Made by Taxpayers

- Confusing slump sale (valid) with asset sale (not valid)

- Incorrect asset ratio in demerger

- Filing ITC-02 without CA certificate

- Forgetting transferee acceptance

- Not updating book value of transferred assets

- Trying to transfer ITC between two GSTINs of same company

10. Records to Maintain for Audit

Both entities must preserve:

- business transfer agreement

- ITC-02 copy

- acceptance proof

- CA certificate

- asset allocation statement

- stock transfer records

- copy of scheme of arrangement (in mergers/demergers)

These must be kept for 6 years.

11. Final Human-Friendly Summary

ITC transfer under business restructuring looks complex, but the logic is simple:

- When business moves → ITC also moves

- When business splits → ITC splits based on asset value

- When business merges → ITC joins the new entity

- ITC-02 is the only way to shift credit

- CA certificate is mandatory

- ITC cannot move unless liabilities also move

Done right, Rule 41 ensures that ITC never gets wasted during corporate restructuring.