1. Introduction

When GST came into force in July 2017, it completely changed how India taxed goods and services. But the government also knew that some sectors — like transport, legal, and renting — weren’t always easy to monitor. Many service providers in these areas were small, unregistered, or part of unorganized markets.

To ensure proper tax collection, the government introduced the Reverse Charge Mechanism (RCM).

Normally, the supplier pays GST to the government. But under RCM, the recipient (buyer of the service) is responsible for paying GST directly.

In this blog, we’ll break down how RCM applies to three important service categories:

- Renting of immovable property,

- Advocate (legal) services, and

- Goods Transport Agency (GTA) services.

We’ll also look at the latest updates — including the 2022 and 2024 notifications that changed how residential and commercial rent are taxed.

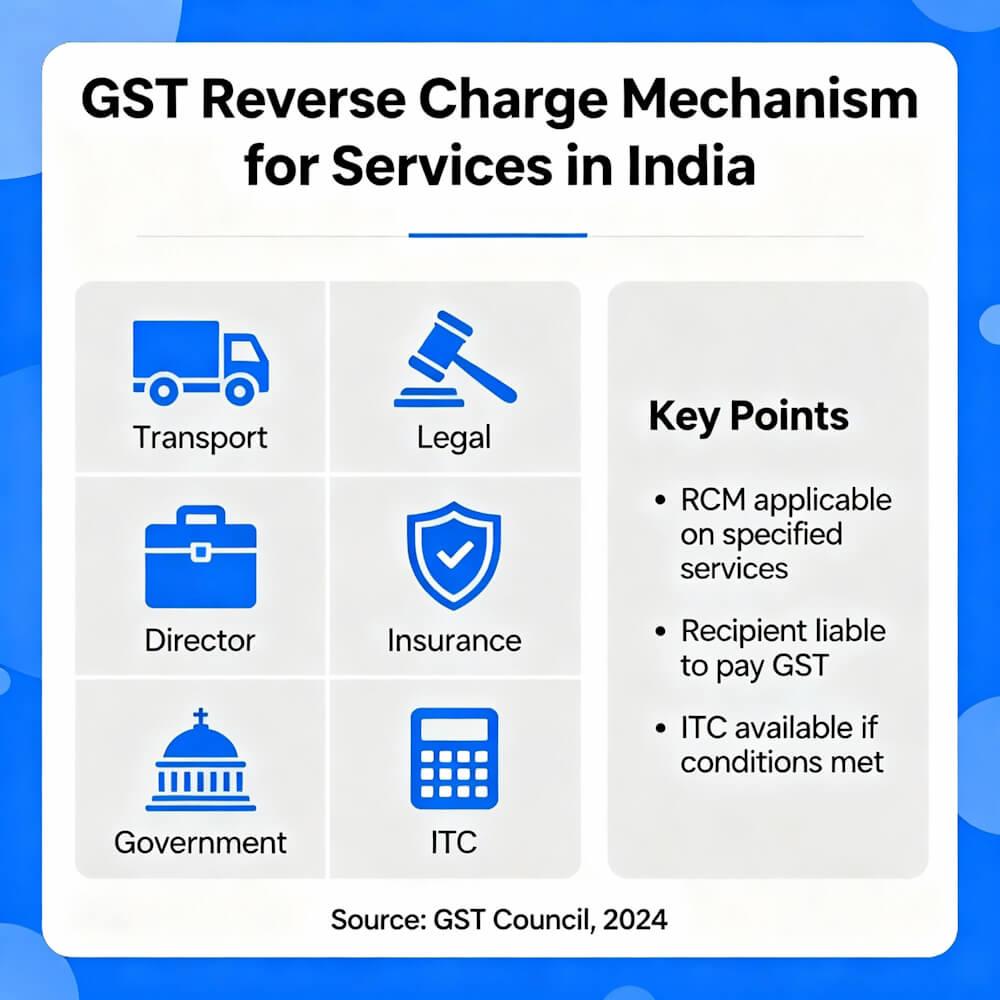

2. What is Reverse Charge Mechanism (RCM)?

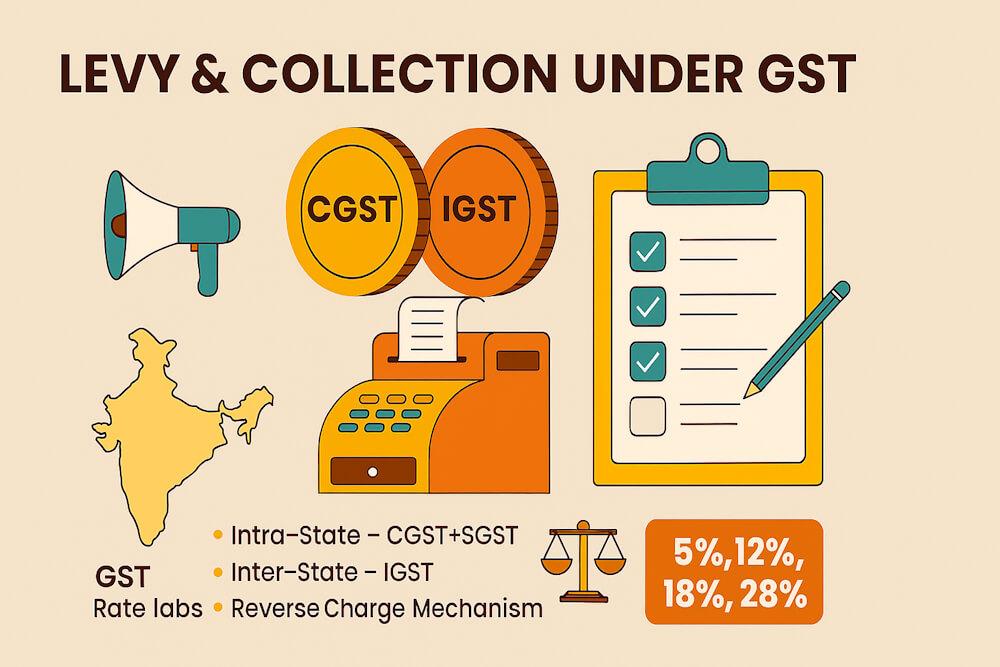

RCM is defined under Section 9(3) and Section 9(4) of the CGST Act, 2017.

- Section 9(3): Applies to specific goods and services notified by the government where the recipient pays GST.

- Section 9(4): Applies to transactions between registered recipients and unregistered suppliers (only in limited notified cases now).

The government notifies these services through Notification No. 13/2017 – Central Tax (Rate), dated 28 June 2017, and issues later amendments — including Notification 04/2022 and 09/2024, which specifically impact renting services.

3. Why Reverse Charge Exists in These Services

The main reasons for RCM are:

- Compliance ease: Easier to collect tax from registered businesses than small or unregistered suppliers.

- Revenue protection: Prevents leakage in sectors where suppliers are hard to track.

- Legal simplicity: The recipient is often better equipped to handle GST filings.

For example:

- Most advocates are not GST-registered.

- Many truck owners or landlords fall below GST thresholds.

- So, instead of chasing hundreds of small suppliers, the tax liability is moved to the registered business receiving their services.

4. Renting of Immovable Property under RCM

Initially, RCM on renting only applied to commercial properties rented out by the Government or local authorities.

But two key notifications — 04/2022 and 09/2024 — have expanded and clarified these rules.

(A) Notification No. 04/2022 – Central Tax (Rate) (dated 13 July 2022)

This notification changed the game for residential property rentals.

Before July 2022:

- Residential rent was fully exempt from GST.

- Only commercial property rent was taxable.

After Notification 04/2022, if a residential dwelling is rented to a registered person for business use, then the tenant (recipient) must pay GST under RCM @18%.

Example: A company rents a flat for employee accommodation or as a guesthouse. The landlord is an individual (unregistered). The company (registered person) must now pay 18% GST under RCM, even though the landlord is not registered.

However, if the property is rented to an individual for personal use, it remains exempt.

(B) Notification No. 09/2024 – Central Tax (Rate) (dated 8 October 2024)

This later notification cleared up the confusion about commercial rent after the 2022 change.

It confirmed that:

- Commercial property rent continues to be taxable under forward charge when the landlord is registered.

- But if the landlord is unregistered, and the tenant is registered, then GST must be paid by the tenant under RCM.

Purpose: Many taxpayers misunderstood the 2022 update and started applying RCM even to commercial properties.

This 2024 clarification restored balance — only residential rent to registered businesses and commercial rent from unregistered landlords fall under RCM.

(C) Updated RCM Matrix for Renting (Post–Notification 09/2024)

| Type of Property | Supplier (Landlord) | Recipient (Tenant) | Charge Type | Who Pays GST | GST Rate |

| Residential dwelling for personal use | Any | Individual (unregistered) | Exempt | None | — |

| Residential dwelling for business use | Any | Registered person | RCM | Tenant | 18% |

| Commercial property | Registered | Registered | Forward charge | Landlord | 18% |

| Commercial property | Unregistered | Registered | RCM | Tenant | 18% |

| Property rented by Govt./Local Authority | Govt. / Local Body | Registered person | RCM | Tenant | 18% |

Quick Summary:

- Residential rent → RCM (if tenant is registered).

- Commercial rent → Forward charge (unless landlord is unregistered).

- Government property rent → Still RCM (as per original Notification 13/2017).

Input Tax Credit (ITC)

The tenant (recipient) who pays GST under RCM can claim ITC on that tax amount, as long as the rented property is used for business.

5. Advocate (Legal) Services under RCM

Legal services are another classic example where RCM applies — because most advocates or law firms are individuals or partnerships that may not be registered under GST.

What is covered?

- Services by an individual advocate,

- Senior Advocate, or

- Firm of advocates, provided directly or indirectly to a business entity.

Notification Reference:

Notification No. 13/2017 – Central Tax (Rate), Sr. No. 2.

Who is liable to pay GST?

The business entity (recipient) receiving the legal service.

Rate of GST:

18% (9% CGST + 9% SGST)

Who is exempt?

If legal services are provided to:

- A non-business entity, or

- A small business (turnover below ₹20 lakh), then RCM does not apply (since the recipient is unregistered).

Example: A law firm provides consultation worth ₹50,000 to a registered company. The company must pay GST @18% = ₹9,000 under RCM.

The advocate or law firm will issue an invoice without GST, and the company (recipient) pays ₹9,000 directly to the government while claiming it later as ITC.

ITC Treatment:

The company can claim the ₹9,000 RCM tax paid as input tax credit, reducing its net tax liability.

6. Goods Transport Agency (GTA) Services under RCM

Transport services are one of the largest unorganized sectors in India. That’s why GST law makes special provisions for GTA services under RCM.

Definition (as per Notification 11/2017):

A Goods Transport Agency (GTA) means any person who provides transport services by road and issues a consignment note.

If no consignment note is issued, it’s not a GTA — and RCM won’t apply.

Notification Reference:

Notification No. 13/2017 – Central Tax (Rate), Sr. No. 1.

Who is liable to pay GST under RCM?

The recipient of services, if they fall in any of the following categories:

| Recipient Type (liable to pay under RCM) | Examples |

| A registered factory | Manufacturing unit |

| A registered society | Cooperative / welfare society |

| A registered person | Any GST-registered business |

| A body corporate | Company or LLP |

| A partnership firm | Including AOP |

| Casual taxable person | Temporary business setup |

So, if any of these entities hire a truck from a GTA, the recipient must pay GST under RCM.

Rate of GST:

- 5% (without ITC) — if paid under RCM

- 12% (with ITC) — if the GTA opts to pay GST themselves

However, in most cases, GTAs choose the 5% RCM option, and the recipient pays GST directly.

Example:

A registered company hires a transporter to deliver goods from Mumbai to Delhi. Freight = ₹50,000.

✅ GST @5% under RCM = ₹2,500.

The company pays ₹2,500 to the government under RCM and can claim ITC on the same.

If the transporter (GTA) is unregistered or opts out of GST, the recipient still needs to pay under RCM as long as a consignment note is issued.

7. Summary Table – RCM on Key Services

| Service Type | Supplier | Recipient Liable under RCM | GST Rate | ITC Available? |

| Renting of immovable property | Govt. / Individual / Unregistered | Registered person | 18% | ✅ Yes |

| Legal services | Advocate / Law firm / Senior Advocate | Business entity | 18% | ✅ Yes |

| Goods Transport Agency (GTA) | GTA issuing consignment note | Registered business, firm, or company | 5% | ✅ Yes |

8. Key Compliance Points for Businesses under RCM

- Self-invoice: - When paying under RCM, the recipient must issue a self-invoice since the supplier doesn’t charge GST.

- Payment Voucher: - Must also issue a payment voucher at the time of payment to the supplier.

- Record in GSTR-3B: - RCM liability must be shown under Table 3.1(d) in GSTR-3B return.

- Claim ITC: - RCM tax paid can be claimed as ITC in the next month (provided the expense is for business use).

- Timing of Payment: - RCM must be paid in cash only, not through ITC balance.

9. Common Mistakes to Avoid

- Treating RCM invoices as zero-rated — they are taxable.

- Forgetting to issue self-invoices for unregistered suppliers.

- Paying RCM from ITC balance — it must be paid in cash.

- Claiming ITC without actually paying RCM liability.

A small oversight here can cause mismatches and interest during audit.

11. Example – All Three Services Together

Let’s say ABC Pvt. Ltd.:

- Rents office space from a local municipal body – ₹1,00,000/month

- Hires a lawyer – ₹50,000

- Uses GTA services – ₹70,000

GST payable under RCM:

- Rent: 18% of ₹1,00,000 = ₹18,000

- Legal services: 18% of ₹50,000 = ₹9,000

- GTA: 5% of ₹70,000 = ₹3,500

Total RCM liability = ₹30,500

ABC Pvt. Ltd. pays ₹30,500 in cash to the government, claims it later as ITC, and uses that credit against future GST output tax.

12. Final Thoughts

The Reverse Charge Mechanism (RCM) under GST is not a penalty — it’s a compliance tool to bring unorganized sectors like renting, legal, and transport into the tax network.

With the 2022 and 2024 updates, even residential rent to registered businesses now attracts GST under RCM, while commercial property remains under forward charge — unless rented by unregistered persons.

Understanding these small but crucial updates helps avoid notices and ensures smooth ITC flow.

In short:

- RCM = recipient pays,

- ITC = claimable,

- Compliance = mandatory.

Stay updated with Notification No. 13/2017, 04/2022, and 09/2024, and you’ll never go wrong with RCM on rent, advocates, or GTA services again.