1. Introduction

When we talk about GST, one question that comes up very often is — “Who collects it and how is it charged?”

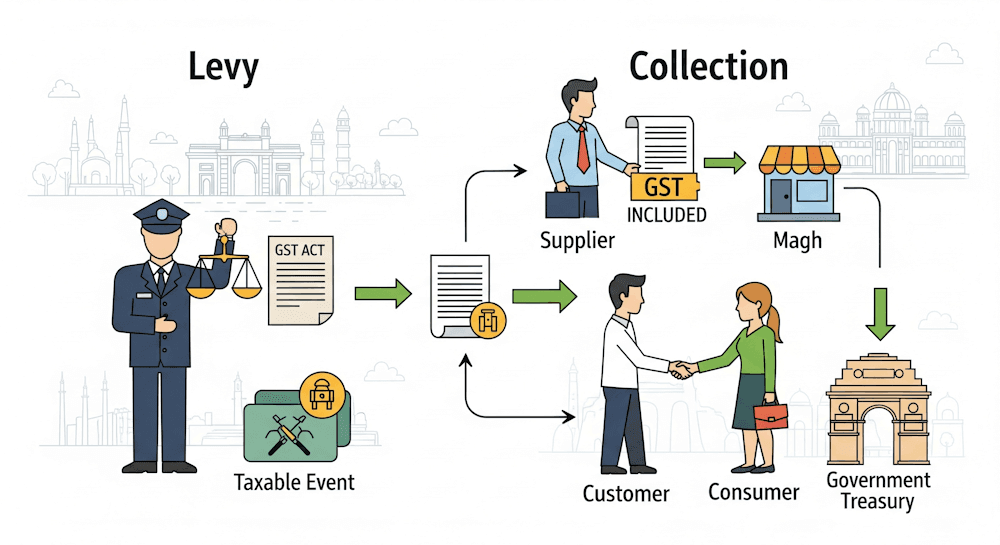

That’s exactly what the concept of levy and collection answers. Every tax needs two basic things —

- Levy, meaning the right to impose it, and

- Collection, meaning how and from whom it’s actually received.

In simple words, “levy” is the legal power to charge a tax, while “collection” is the practical act of taking it from the taxpayer.

Under GST, both these powers are laid down clearly in Section 9 of the CGST Act, 2017 and Section 5 of the IGST Act, 2017. Let’s break them down in plain English.

2. What Does ‘Levy of GST’ Mean?

The word levy may sound complicated, but it just means imposing or charging a tax on a specific transaction.

In GST, the tax is levied when a “supply” of goods or services takes place. So, the taxable event (the event that triggers the tax) under GST is not “manufacture” or “sale” anymore — it is supply.

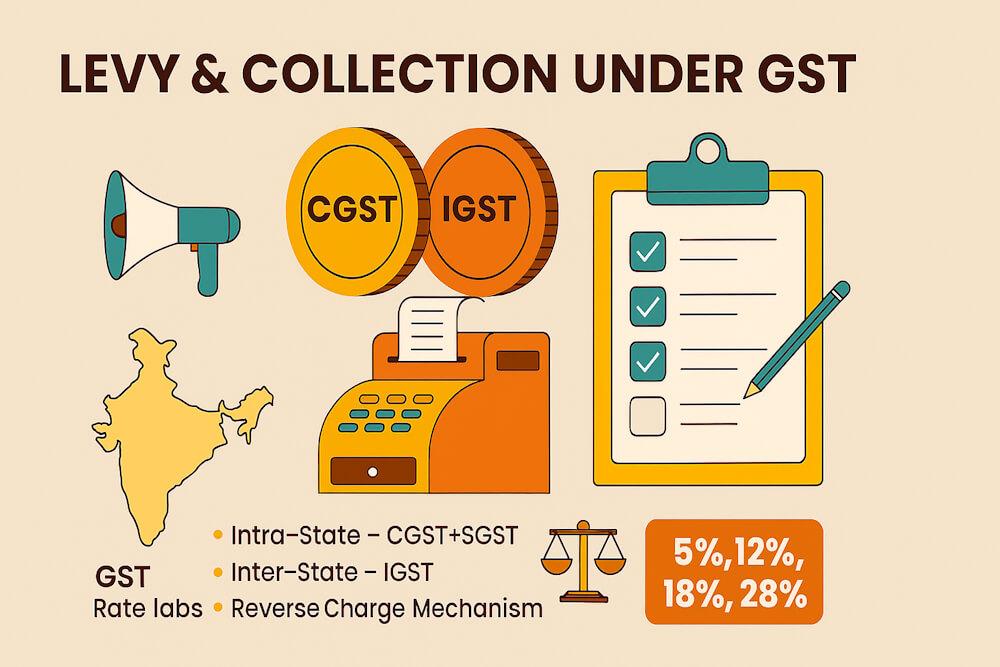

Once a supply happens, the law determines:

- What kind of tax applies (CGST, SGST, or IGST),

- Who should pay it, and

- At what rate it should be charged.

3. Section 9 – Levy and Collection of CGST

Section 9 of the Central Goods and Services Tax (CGST) Act, 2017 explains how GST is imposed on transactions within a State.

Here’s what it basically says (in simple terms):

“A tax called the Central Goods and Services Tax (CGST) shall be levied on all intra-State supplies of goods or services or both (except alcoholic liquor for human consumption), and shall be collected in such manner as prescribed, at rates not exceeding 20%.”

So, for any supply within the same State, the tax is divided into two parts:

- CGST — collected by the Central Government

- SGST (or UTGST) — collected by the State or Union Territory

The taxpayer (the person making the supply) is responsible for paying this tax to the government.

Example:

If a seller in Delhi supplies goods worth ₹1,00,000 to a buyer in Delhi, and the GST rate is 18%, then:

- CGST = ₹9,000

- SGST = ₹9,000

Both are charged on the same value but go to different governments.

4. Section 5 – Levy and Collection of IGST

Section 5 of the Integrated Goods and Services Tax (IGST) Act, 2017 talks about the tax charged on inter-State supplies (i.e., supplies between two States or between a State and a Union Territory).

It says:

“A tax called the Integrated Goods and Services Tax (IGST) shall be levied on all inter-State supplies of goods or services or both (except alcoholic liquor for human consumption), and shall be collected in such manner as prescribed, at rates not exceeding 40%.”

So, when goods or services move from one State to another, instead of charging CGST + SGST separately, only IGST is applied.

Example:

A trader in Maharashtra sells machinery worth ₹1,00,000 to a buyer in Karnataka. Since it’s an inter-State transaction, the applicable tax is IGST @18% = ₹18,000. The Central Government collects IGST and later shares a part of it with the destination State (Karnataka).

5. Why Are There Two Separate Laws (CGST & IGST)?

You might be wondering why we have two different laws — one for CGST and one for IGST — when it’s all under “GST.”

Here’s why:

India follows a federal system, meaning both the Centre and States have the authority to collect taxes. So, for intra-State transactions, both governments share the tax — that’s why we have CGST + SGST. But for inter-State transactions, only one tax (IGST) is collected to avoid confusion and ensure seamless credit flow.

This dual model keeps India’s federal structure intact while maintaining the “One Nation, One Tax” philosophy.

6. The Scope of Levy — What’s Included

GST applies broadly to all supplies of goods and/or services made for consideration in the course of business.

But some items are specifically kept out of its scope, like:

- Alcoholic liquor for human consumption

- Petroleum crude

- Motor spirit (petrol)

- High-speed diesel

- Natural gas

- Aviation turbine fuel (ATF)

These items will be brought under GST only when the government notifies them in the future.

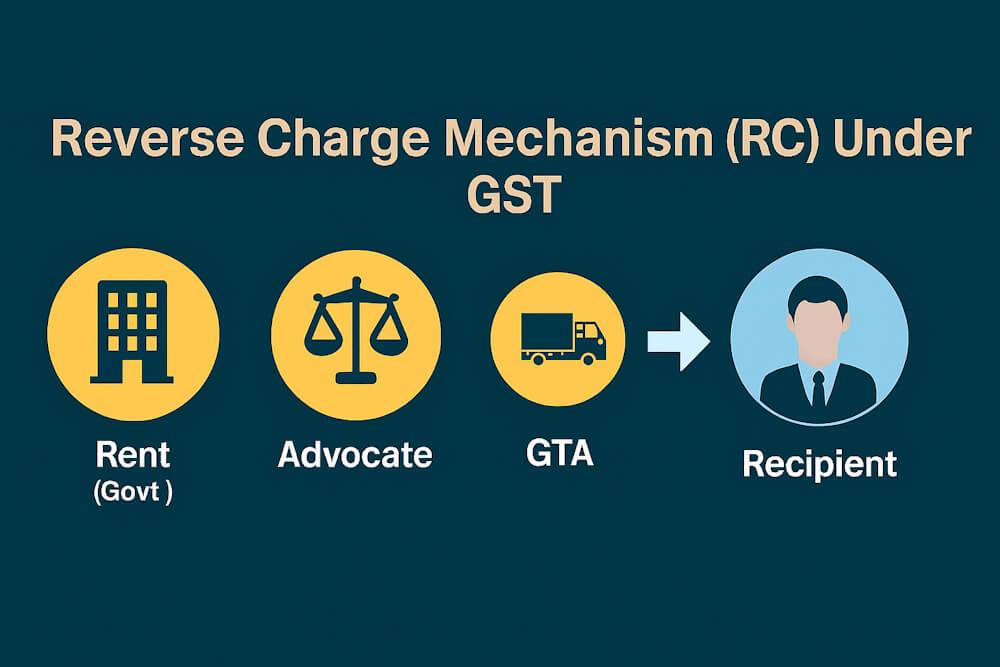

7. Reverse Charge Mechanism (RCM)

Under normal circumstances, the supplier pays GST to the government. But in some special cases, the recipient (the buyer) is made liable to pay — this is called the Reverse Charge Mechanism (RCM).

RCM applies in two main cases:

- When the government notifies certain categories of goods or services on which the recipient must pay GST.

- When a registered person receives goods or services from an unregistered supplier, and the government notifies such cases.

Example:

If a registered company avails legal services from an advocate, GST is payable under reverse charge by the company, not the advocate.

This helps bring certain unorganized sectors into the tax net and ensures that tax is collected efficiently.

8. Import and IGST – How It Works

Whenever goods are imported into India, IGST is also levied in addition to customs duties. This ensures that imported goods and locally produced goods are taxed at the same rate.

The value for IGST on imports is the same value determined for customs purposes (CIF value + customs duties).

Example:

A company in Mumbai imports medical equipment from Germany worth ₹10,00,000. Let’s assume:

- Basic Customs Duty (BCD) = 10% → ₹1,00,000

- IGST = 18% → ₹1,98,000 (calculated on ₹11,00,000)

This IGST can be claimed as input tax credit (ITC) when the importer uses those goods for business.

9. The Maximum Rate of Tax Under GST

The law specifies upper limits to prevent excessive taxation:

- CGST rate: cannot exceed 20%

- IGST rate: cannot exceed 40%

In practice, GST rates are much lower and fall under slabs like 5%, 18%, and 40%, depending on the type of goods or services.

10. Understanding “Collection” Under GST

Once the tax is levied, the next step is collection, which means actually receiving it from the taxpayer.

The supplier collects GST from the buyer at the time of supply and then deposits it with the government while filing returns.

So the flow goes like this:

- Supplier charges GST on invoice

- Buyer pays invoice amount (including GST)

- Supplier remits GST to the government through GSTR-3B filing

- Buyer can claim Input Tax Credit (ITC) for the GST paid

This ITC mechanism ensures that tax is levied only on value addition, not repeatedly on the same amount.

11. Comparison Between CGST and IGST

Let’s simplify it with a quick comparison table:

| Particulars | CGST | IGST |

| Applicable On | Intra-State supplies | Inter-State supplies and imports |

| Law Governing | CGST Act, 2017 | IGST Act, 2017 |

| Maximum Rate | 20% | 40% |

| Collected By | Central Government | Central Government (shared with States) |

| Tax Sharing | Equally between Centre & State (CGST + SGST) | Shared later between Centre & destination State |

| Input Credit Usage | Can be used against CGST & IGST | Can be used against IGST, CGST, SGST in that order |

| Example | Seller and buyer both in Delhi | Seller in Delhi, buyer in Punjab |

12. Levy on Specific Sectors – A Few Highlights

Certain sectors have special rules for levy and collection:

- Real Estate: Builders pay GST on construction but get exemptions on affordable housing at 1% and others at 5% without ITC.

- E-commerce: Platforms like Amazon or Swiggy may be liable to collect GST on behalf of suppliers under specific notifications.

- Online Gaming: From 2023, online money gaming has been notified under IGST, ensuring tax on virtual transactions.

These targeted rules make sure new-age sectors and services don’t escape the tax net.

13. Why Levy and Collection Are Important

Levy and collection form the legal and practical foundation of GST. Without these, the entire system would collapse.

They ensure that:

- Tax is applied correctly on all taxable supplies

- The right authority gets the right share

- Businesses know their liabilities

- Revenue is distributed fairly between Centre and States

In short, it’s the backbone that keeps the GST mechanism functional and balanced.

14. Final Thoughts

Understanding how GST is levied and collected helps you see the big picture behind every invoice and every return you file.

The CGST Act and IGST Act may sound technical, but at their core, they simply ensure that:

- The tax follows the movement of goods and services, and

- The revenue follows the point of consumption.

Whether you’re a small trader or a large enterprise, grasping this concept helps you stay compliant, avoid errors, and plan your taxes better.