1. Introduction

When GST came into force in 2017, it completely changed how India collected indirect taxes. The goal was to simplify everything, but the government also knew that certain sectors — especially unorganized ones — couldn’t be tracked easily.

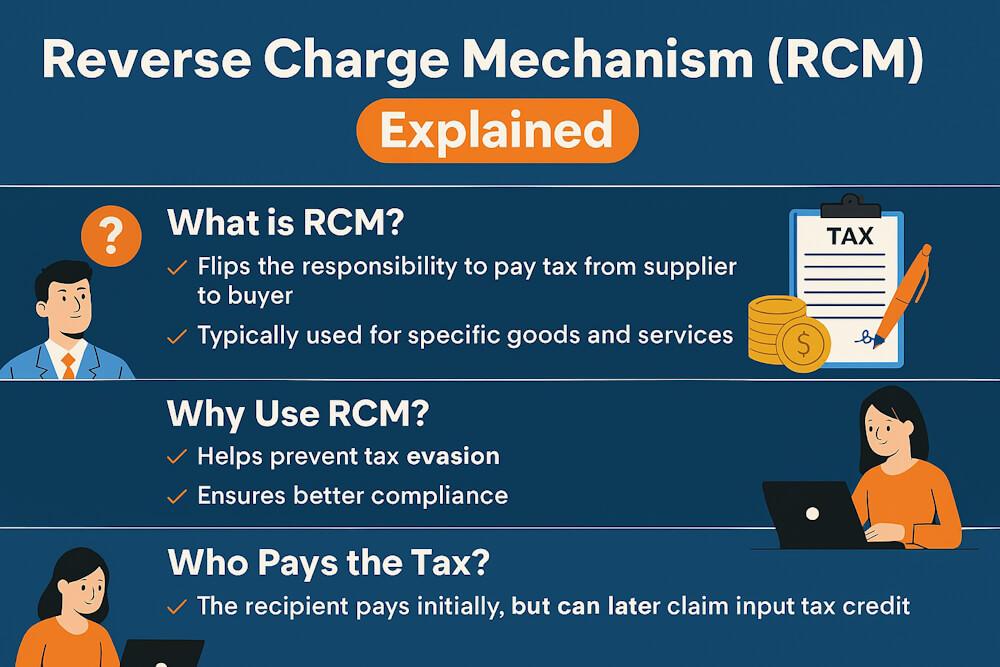

So, they introduced something called the Reverse Charge Mechanism (RCM).

Under this system, the responsibility to pay GST doesn’t lie with the supplier, but with the recipient.

To make things clear, the government issued Notification No. 13/2017 – Central Tax (Rate) on June 28, 2017, listing specific services where GST must be paid by the recipient instead of the supplier.

In this blog, we’ll go through that notification in detail — what it covers, how RCM works for services, and examples to make it easy to understand.

2. The Legal Background of RCM on Services

The Reverse Charge Mechanism for services is based on Section 9(3) of the CGST Act, 2017 and Section 5(3) of the IGST Act, 2017.

These sections empower the government to specify certain categories of services where the recipient shall pay the tax, instead of the supplier.

So, Notification No. 13/2017 was issued under these provisions. It clearly lists which services attract RCM, who the supplier is, and who the liable recipient is.

3. What Does Notification No. 13/2017 Cover?

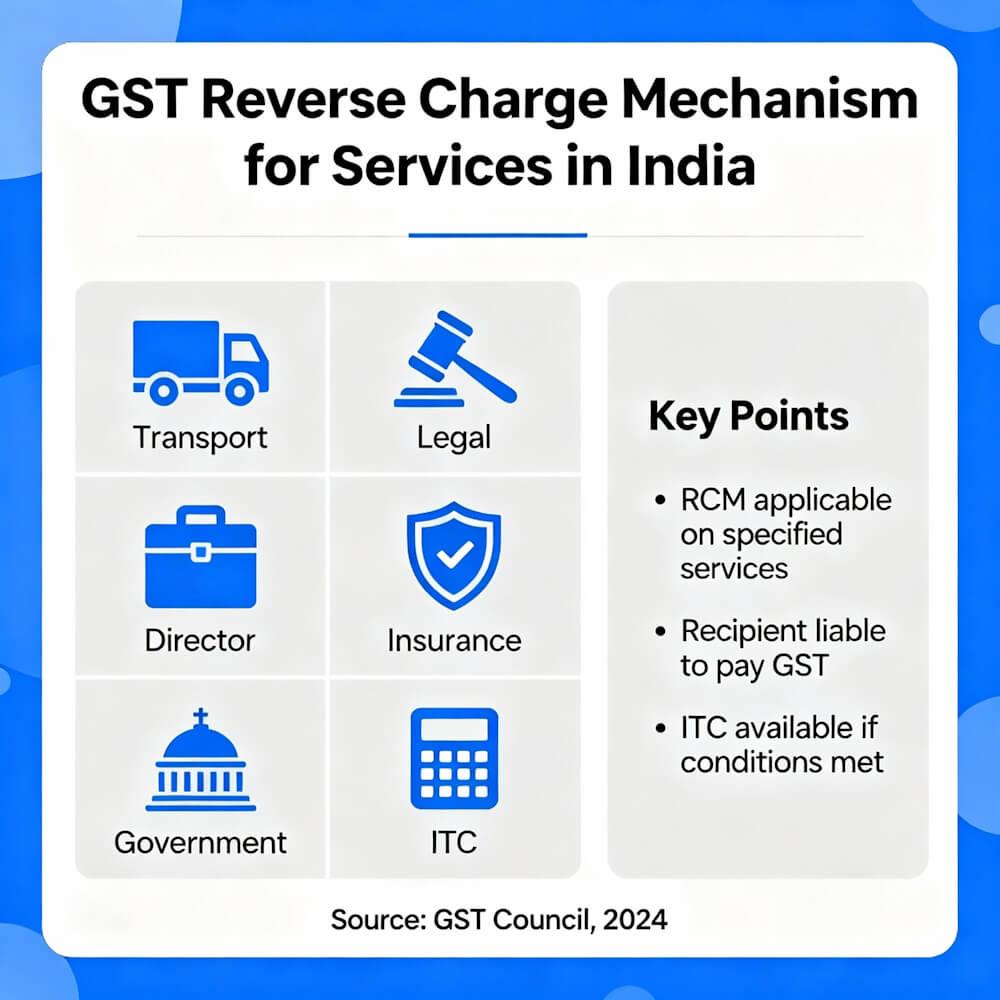

This notification specifies services, not goods, that fall under the Reverse Charge category.

The idea is to simplify tax collection from sectors where the service providers are small, scattered, or hard to monitor — like individual advocates, directors, transporters, and government departments.

4. Major Categories of Services Under RCM

Below is a simplified table that summarizes the main services covered under Notification 13/2017 (with later amendments):

| Sl. No. | Type of Service | Supplier of Service | Recipient Liable to Pay Tax (under RCM) |

| 1 | Goods Transport Agency (GTA) | GTA | Registered person (except few exempt categories) |

| 2 | Legal services | Advocate / Firm of advocates | Business entity |

| 3 | Services by an Arbitral Tribunal | Arbitral Tribunal | Business entity |

| 4 | Sponsorship services | Any person | Body corporate or partnership firm |

| 5 | Services by a Director to the company | Director | Company or body corporate |

| 6 | Services by an Insurance Agent | Insurance agent | Insurance company |

| 7 | Services by a Recovery Agent | Recovery agent | Bank, NBFC, or financial institution |

| 8 | Services by Author or Music Composer | Author / Music composer / Artist | Publisher / Producer / Music company |

| 9 | Renting of immovable property by Government | Central/State Government / Local authority | Registered person |

| 10 | Services supplied by the Government (excluding courts) | Government | Business entity |

| 11 | Transfer of development rights, FSI or long-term lease (real estate) | Landowner | Developer / Promoter |

| 12 | Services by an Agent to Business Correspondent | Agent of BC | Business Correspondent |

| 13 | Services by Business Correspondent to Bank | Business Correspondent | Bank / NBFC |

(Note: The list above is simplified and summarized for understanding; actual notification should always be referred for full legal text.)

5. Let’s Understand Each RCM Service with Examples

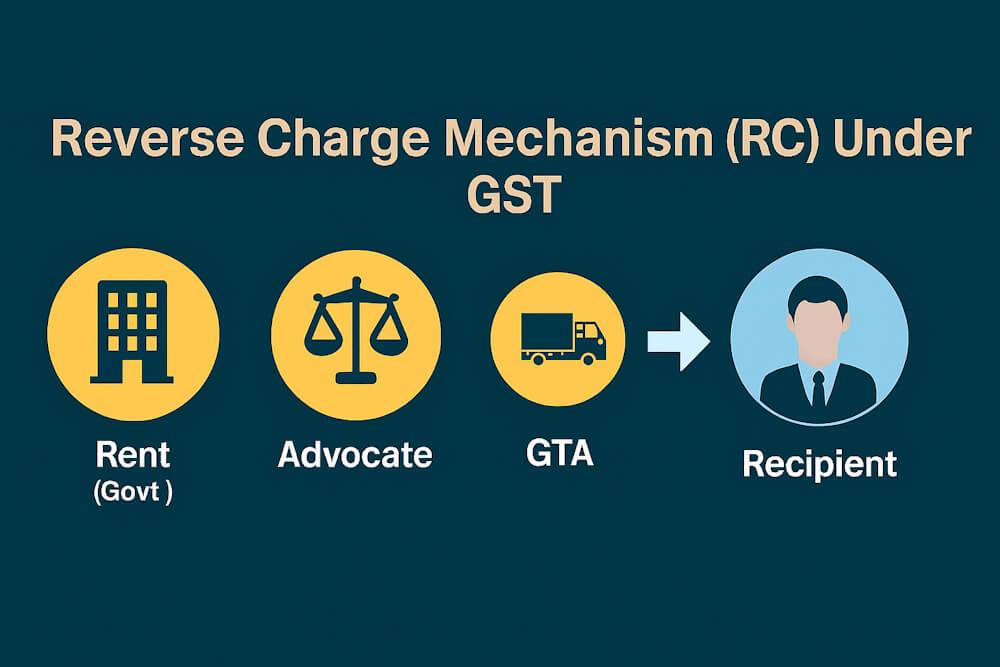

(1) Goods Transport Agency (GTA)

When a Goods Transport Agency provides transportation services for goods, and the recipient is a registered person, the recipient pays GST under RCM.

Example: A factory in Pune hires a GTA to transport goods to Mumbai. The GTA issues a consignment note, but doesn’t charge GST. The factory pays 5% GST under RCM and later claims it as input tax credit (ITC).

(2) Legal Services

Legal professionals and law firms are covered under RCM when they provide services to business entities.

Example: A company in Delhi hires a law firm for corporate legal advice. The law firm doesn’t charge GST. The company pays 18% GST under RCM and can claim ITC on it.

(3) Services by an Arbitral Tribunal

If an arbitral tribunal provides services to a business entity, the tax liability shifts to the recipient.

Example: A dispute between two companies is handled by an arbitral tribunal. GST on the tribunal’s fees is paid by the company under reverse charge.

(4) Sponsorship Services

When a company sponsors an event, sports tournament, or media program, GST is paid by the sponsoring entity, not by the event organizer.

Example: A soft drink company sponsors a cricket tournament organized by a local club. The company (sponsor) pays GST under RCM.

(5) Services by a Director

Directors providing services to their company are covered under RCM. This includes sitting fees, commission, or any payment for attending board meetings.

Example: A company pays ₹2,00,000 as director remuneration (not treated as salary). GST @18% is payable under RCM by the company, not the director.

(6) Services by an Insurance Agent

When an insurance agent earns commission from an insurance company, the tax liability shifts to the insurance company.

Example: An agent sells LIC policies and earns ₹50,000 commission. LIC pays 18% GST under RCM and can claim ITC on it.

(7) Services by a Recovery Agent

Banks, financial institutions, and NBFCs often hire recovery agents to collect overdue payments.

In such cases, GST is payable under RCM by the bank or NBFC, not the agent.

Example: HDFC Bank hires a recovery agent to follow up on loan defaulters. The bank pays 18% GST under reverse charge.

(8) Services by Author, Music Composer, or Artist

Creative professionals like authors or musicians who license their work to a publisher or producer are also under RCM.

Example: A book author licenses publishing rights to a publishing house. The publisher pays GST under RCM on royalties.

(9) Renting of Immovable Property by Government

If the Government rents out property to a registered business, the business pays GST under RCM.

Example: A government office rents a warehouse to a logistics company. The logistics company pays GST under RCM.

(10) Services by Government to Business Entities

Other services provided by the Government — like licensing, permits, or business approvals — are taxable under RCM, except for judicial or sovereign functions.

Example: A company pays a license fee to a State Government for operating a liquor shop. The company pays GST under RCM.

(11) Real Estate Transactions – Transfer of Development Rights (TDR)

If a landowner gives development rights or Floor Space Index (FSI) to a builder, GST is payable by the developer under reverse charge.

Example: A developer constructs apartments on land owned by another person. GST on the TDR portion is paid by the developer under RCM.

(12) Business Correspondents (BCs) and Their Agents

Business Correspondents (BCs) and their sub-agents work for banks to handle rural transactions. GST on these services is paid under RCM.

Example: A BC agent collects cash deposits for a bank. The bank pays GST under RCM.

6. Why Reverse Charge for Services Was Needed

Here’s the logic behind RCM on services:

- Many service providers (like advocates, agents, and directors) are not registered under GST.

- Collecting tax from each small provider is impractical.

- Registered businesses are already compliant, so it’s easier for them to pay and file taxes.

- It ensures no revenue leakage for the government.

In short, RCM keeps the GST system balanced and efficient.

7. Time of Supply for Services under RCM

The time of supply decides when GST becomes payable under reverse charge.

As per Section 13(3) of the CGST Act, it’s the earlier of:

- The date of payment, or

- 60 days from the date of invoice.

If none can be determined, it’s the date of entry in the recipient’s books.

Example: If an advocate issues an invoice on 1st April and the company pays on 20th May, the time of supply is 20th May (since payment came before 60 days).

8. Input Tax Credit (ITC) on RCM Payments

Even though the recipient pays GST under RCM, they can still claim ITC, provided:

- The service is used for business purposes, and

- Proper self-invoice and documentation are maintained.

Example: A company pays ₹18,000 GST under RCM for legal services. It can claim ₹18,000 ITC in its GSTR-3B, offsetting its output tax liability.

9. Documents Required Under RCM

When you pay GST under reverse charge, the supplier usually doesn’t issue a GST invoice. So, the recipient must generate:

- A self-invoice (Rule 46 of CGST Rules)

- A payment voucher (Rule 52 of CGST Rules)

These are essential for recordkeeping and claiming ITC.

10. Filing and Reporting RCM in Returns

All RCM payments must be reported in:

- GSTR-3B → under “Tax on reverse charge” section

- GSTR-2 (when applicable) → for inward supplies liable to RCM

Even if there are no RCM transactions, taxpayers must mark “No” in the RCM column to confirm compliance.

11. Common Mistakes to Avoid

- Forgetting to issue a self-invoice for RCM services

- Missing RCM reporting in GSTR-3B

- Not claiming ITC on time

- Paying RCM on exempt or non-notified services

Always cross-check the latest GST notifications because new categories are sometimes added or modified.

12. Key Takeaways

- RCM on services is notified under Notification 13/2017 – CGST (Rate).

- The recipient, not the supplier, pays GST.

- Applies to services like GTA, legal, director, sponsorship, insurance, and government rentals.

- Recipients can claim input tax credit (ITC) for taxes paid under RCM.

- Self-invoice and proper record maintenance are mandatory.

13. Final Thoughts

The Reverse Charge Mechanism for services ensures that GST doesn’t leak from unorganized or exempt sectors.

By shifting tax liability to registered recipients, the government made compliance smoother and collection more efficient.

If you’re running a business, always check whether any of your service expenses fall under Notification 13/2017, pay the GST accordingly, and claim the credit to stay fully compliant.

Remember — RCM isn’t an extra tax; it’s just a different route for the same tax to reach the government.