If there’s one area of GST that still confuses businesses, accountants, and even some consultants, it’s the Time of Supply (TOS). You may know all the theory under Sections 12, 13, and 14, but the moment things get messy — delayed invoices, advance payments, milestone billing, RCM, imports of services, mixed timelines — it becomes a headache.

In real life, GST doesn’t happen in neat textbook examples. It happens in half-done projects, late payments, missing invoices, advances, purchase returns, partial deposits, debit-credit notes, etc.

This blog focuses on realistic, practical GST situations that actually occur in day-to-day business, and explains:

- What GST law expects

- Why certain mistakes happen

- And how to avoid interest, penalties, and notices

Let’s go straight into the field-level examples.

Scenario 1: Invoice Issued Late Beyond the Allowed Time

Goods:

- Supplier dispatches goods on 10 April

- Invoice issued on 20 April (allowed as per Sec 31)

- Payment received on 5 May

- TOS = 10 April (date of removal)

But…

If invoice was issued on 30 April:

- Delayed beyond permissible time

- TOS = 10 April (still the date of removal)

- Interest applicable from April.

This is one of the most common mistakes in audits.

Scenario 2: Advance Received Before Supply (Goods)

- Advance received on 2 June

- Goods dispatched on 20 June

- Invoice issued on 20 June

Unlike services, advances for goods do NOT attract GST (after the 2017 amendment).

- TOS = 20 June

- No GST on 2 June.

Many businesses still wrongly pay GST on advances for goods.

Scenario 3: Advance Received for Services

- Advance received: 10 March

- Invoice issued: 28 March

- Service completed: 28 March

Services follow the advance rule.

- TOS = 10 March (date of advance)

GST auditors frequently raise queries where advances are not taxed.

Scenario 4: Service Completed, Invoice Delayed Beyond 30 Days

- Service completed: 5 June

- Invoice issued: 20 July

- Payment received: 25 July

Invoice delayed beyond allowed time (30 days for services)

- TOS = 5 June

- Interest payable from June.

Most late-fee demands arise from this exact error.

Scenario 5: RCM on Services – Payment Before 60 Days

- Invoice: 1 September

- Entry in books: 20 September

- Bank debit: 22 September

- 60 days from invoice = 31 October

Earlier of payment OR 60 days:

- TOS = 20 September

- Even though 60 days not completed.

Scenario 6: RCM on Services – No Payment Made Even After 60 Days

- Invoice issued: 3 March

- Payment not made

- 60 days ends: 2 May

- TOS = 3 Mar

- GST due even without payment.

Businesses often think “no payment → no GST under RCM”, which is WRONG.

Scenario 7: Import of Services (Not Associated Enterprise)

- Invoice issued: 1 July

- Payment made: 10 September

- 60-day limit ends: 30 August

Earlier of payment or 60 days:

- TOS = 30 August

Scenario 8: Import of Services From Associated Enterprise

- Entry in books: 25 April

- Payment: 10 July

Earlier of the two:

- TOS = 25 April

Invoice date is completely irrelevant here.

Many companies wrongly take TOS as invoice date — audits pick this instantly.

Scenario 9: Continuous Services – Milestone Billing

- Milestone achieved: 12 February

- Invoice issued: 18 February

- Payment received: 28 February

Section 31(5) says: invoice must be issued on completion of event.

Invoice is late.

- TOS = 12 February

Scenario 10: Rent Paid Before Due Date

- Contract says rent due on 5th of every month

- Rent paid on 1st of the month

Invoice must be issued on or before due date (not payment date).

So TOS = 5th.

Even if tenant pays earlier, GST liability is tied to the due date.

Scenario 11: Mixed Transactions – Part Advance, Part After Supply

- Advance for services: 15 May

- Service delivered: 30 May

- Invoice: 30 May

- Balance payment: 10 June

- TOS for advance portion → 15 May

- TOS for remaining amount → 30 May

Two different TOS for one contract — very normal in real life.

Scenario 12: Recipient Records Invoice Late (Common Accounting Error)

- Invoice date: 5 Nov

- Company records invoice on: 20 Dec

- Payment: 25 Jan

Companies often think TOS = 20 Dec (book entry). Wrong for FORWARD charge.

- Invoice date prevails for forward charge.

Book entry rule applies only under RCM.

Scenario 13: Credit Note Issued After Year-End

- Original invoice: December 2023

- Credit note issued: May 2024

Credit notes for the previous year cannot adjust GST after September of next year (or Annual Return due date).

TOS doesn't change — but many try forcing it.

Scenario 14: Goods Sent on Approval

Goods sent on approval: 5 April Customer accepts: 30 May Invoice issued: 30 May

As per Sec 31, invoice must be issued:

- On or before acceptance, or

- After 6 months from removal (whichever earlier)

- TOS = 30 May

Scenario 15: Wrongly Treating Delivery Date as Supply Date

- Goods are dispatched on 28 June (from warehouse)

- Reached buyer on 3 July

Supply date is 28 June → the removal date. Not the delivery date.

Businesses often mistake this and apply wrong GST rate in rate-change situations.

Scenario 16: Time of Supply During GST Rate Change

- Old rate: 12%

- New rate: 18%

- Rate change date: 1 Aug

- Supply: 28 July

- Invoice: 5 Aug

- Payment: 2 Aug

- Supply before R

- Earlier of invoice/payment = 2 Aug → after R

- New rate applies (18%)

Rate-change calculations are among the MOST frequent TOS disputes.

Scenario 17: Debit Note for Price Increase After Supply

- Original invoice: 10 April

- Price updated: 15 May

Debit note issued: 15 May

TOS for debit note = date of debit note.

Price-increase debit notes create additional GST liability on issue date.

Scenario 18: Late Fee / Penalty Collected

- Customer pays penalty for late payment: 10 December

- Invoice was from October.

Sec 13(6) says interest/penalty is taxed on the date it is received.

Even though principal supply happened earlier, TOS for penalty = 10 December.

Common Errors Businesses Make (and How to Avoid Them)

1. Delayed Invoicing Creates Wrong TOS

Always issue invoices within:

- 30 days for services

- On removal for goods

- Event completion for continuous supply

2. Not Updating Books Quickly

Especially under RCM, book entry timing determines TOS.

3. Ignoring Advance Payments

For services → advances attract GST.

4. Confusing RCM with Forward Charge

Book entry rule applies only to RCM.

5. Wrongly calculating TOS during rate changes

Section 14 must be applied strictly.

6. Not tracking email-based invoices

If vendor sends invoice by email but accountant records late → TOS remains invoice date.

7. Not maintaining proof of supply date

Especially in construction, AMC, and milestone-based work.

8. Believing payment date decides everything

Only true for RCM and imports — not forward charge.

Checklist for Perfect Time-of-Supply Compliance

- Track invoice date, supply date, payment date separately

- Avoid delayed invoicing

- Maintain delivery challans + e-way bill for supply date proof

- For services, track milestone achievement

- For RCM, track 60-day rule

- For AE imports, track book entry date

- For rate changes, apply Section 14 matrix

- For advances, always calculate partial TOS

- Train staff on invoice discipline

A small mistake in any of these can cause:

- Interest for late GST

- Penalty

- Notices under Sec 73/74

- Scrutiny under ASMT

- ITC mismatches

Final Summary

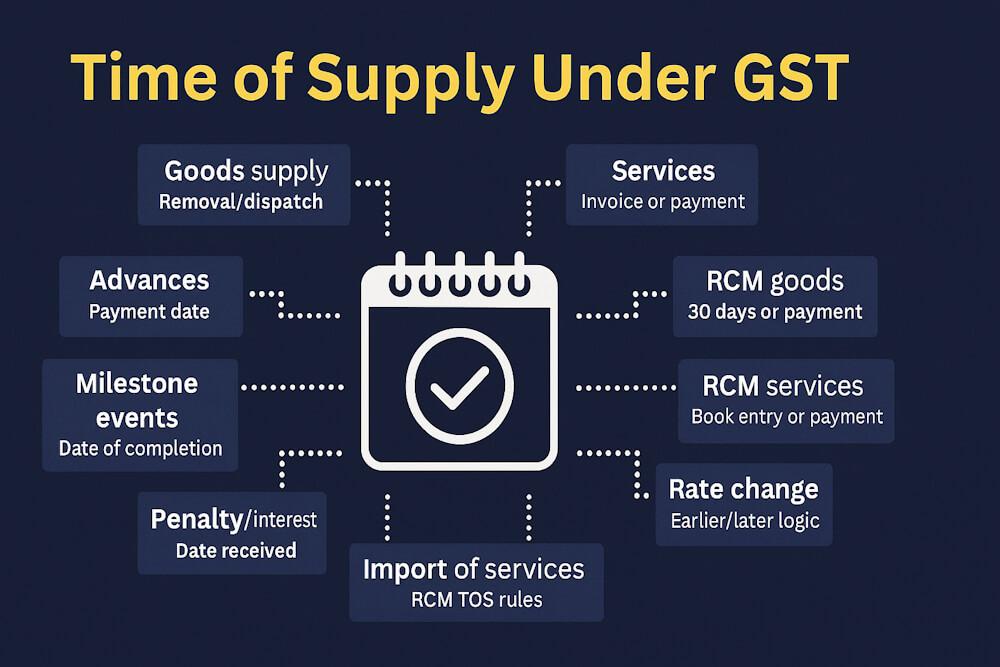

Real-life GST isn’t clean or linear. Time of Supply shifts depending on multiple moving pieces:

| Transaction Type | Key Trigger |

| Goods supply | Removal/dispatch |

| Services | Invoice or payment |

| RCM goods | 30 days or payment |

| RCM services | 60 days or payment |

| AE services | Book entry or payment |

| Rate change | Earlier/later logic |

| Advances | Payment date |

| Milestone events | Date of completion |

| Penalty/interest | Date received |

| Import of services | RCM TOS rules |

Understanding these real-world scenarios makes you better prepared for GST audits, compliance, and day-to-day accounting.