1. Introduction

When the Goods and Services Tax (GST) came into effect, it replaced a messy network of indirect taxes with one unified system. The idea was simple — tax goods and services at the place where they’re consumed.

But what happens when goods don’t move at all?

This might sound unusual, but in reality, thousands of such transactions happen daily. Think about machinery sold where it already stands, or furniture attached to a property, or stock transfers that never leave the premises.

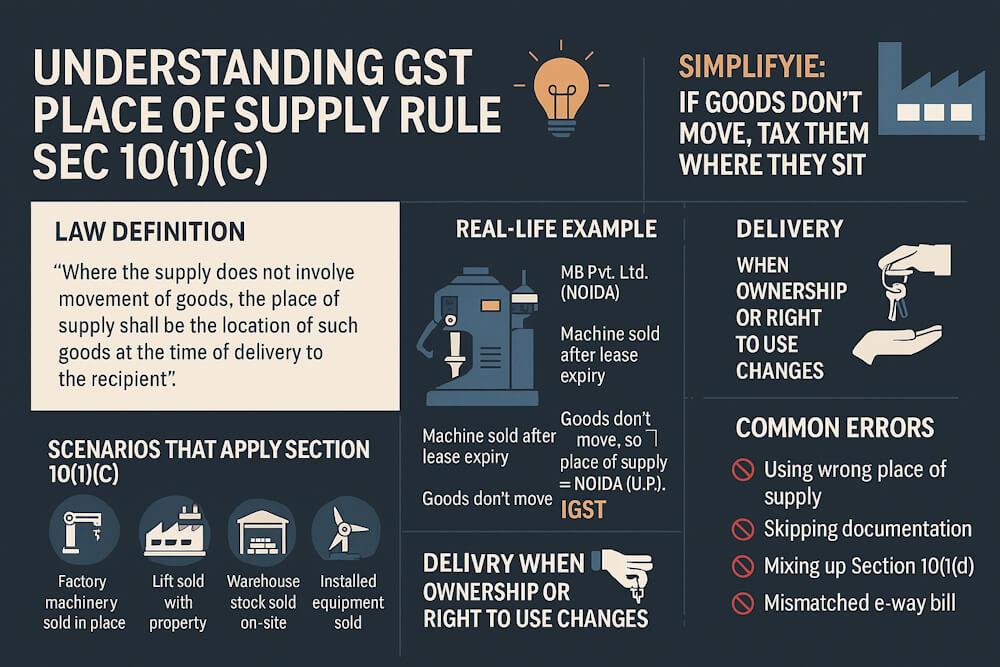

For such cases, Section 10(1)(c) of the Integrated Goods and Services Tax (IGST) Act, 2017 provides a special rule — it tells us how to determine the place of supply when there’s no movement of goods involved.

2. What Does Section 10(1)(c) Say?

The law states:

“Where the supply does not involve movement of goods, whether by the supplier or by the recipient, the place of supply shall be the location of such goods at the time of delivery to the recipient.”

Let’s simplify that.

If there’s no movement of goods — either because they’re fixed, stationary, or already lying where the buyer wants them — then GST considers the place where the goods exist at the time of delivery as the place of supply.

So, GST follows a simple logic:

👉 If goods don’t move, tax them where they sit.

3. Why This Rule Exists

GST is designed as a destination-based tax, meaning the tax should go to the State where goods are finally used or consumed.

However, when there’s no movement, the only logical “destination” is the current location of the goods.

Without Section 10(1)(c), there would be confusion about whether to treat such supplies as intra-State or inter-State, especially when the supplier and buyer are registered in different States.

This clause closes that gap — ensuring tax revenue flows correctly to the State where goods actually exist at the time of sale.

4. Key Characteristics of Section 10(1)(c)

Let’s list the main points in plain language:

- Applies only when goods do not move at all.

- Goods may remain in the supplier’s or buyer’s premises.

- The location of the goods at delivery decides the place of supply.

- Movement by a third party is irrelevant — if goods remain stationary, Sec 10(1)(c) applies.

- Both supplier and recipient could be in different States, but place of supply remains fixed where goods are physically located.

5. Real-Life Scenarios Where It Applies

This rule covers a wide variety of transactions, including:

- Sale of factory machinery that remains installed on site.

- Sale of immovable or attached goods, like lift systems or generators.

- Sale of goods stored in a warehouse where buyer takes possession on-site.

- Sale of furniture, fittings, or capital goods along with a building.

- Sale of goods lying in customs-bonded warehouses before movement.

6. Example 1 – Goods Sold as They Stand

Scenario:

MA Pvt. Ltd., located in New Delhi, leases a large packaging machine to MB Pvt. Ltd. in Noida, U.P. for one year. After 12 months, MB decides to buy the same machine in place, without moving it anywhere.

Here:

- No movement of goods occurs at the time of sale.

- Machine already sits in MB’s Noida factory.

Place of Supply = Noida (U.P.) - because that’s where the machine exists when ownership changes.

Tax Type: Supplier in Delhi → goods in U.P. → Inter-State → IGST applicable.

7. Example 2 – Furniture Sold Along with Property

Scenario: XZ Ltd. (Mumbai) sells a fully furnished office in Gurugram, Haryana to KTS Builders. The building itself isn’t taxable under GST (sale of building = neither goods nor services as per Schedule III), but furniture and fixtures are treated as goods.

- Place of Supply = Gurugram, Haryana, where the furniture exists.

- Tax Type: Inter-State (Mumbai → Haryana) → IGST.

Even though ownership transfer documents might be executed elsewhere, GST looks at where the furniture physically exists, not where the agreement is signed.

8. Example 3 – Stock Sale Inside Warehouse

Scenario: A trader in Rajasthan sells iron rods that are already stored in a Gujarat warehouse to another buyer who also takes delivery from that warehouse.

Here:

- Goods never move between States.

- Buyer takes possession at Gujarat warehouse.

Place of Supply = Gujarat Tax

Type: Inter-State (if supplier’s registration in Rajasthan).

This example shows how location of goods overrides supplier’s registration place.

9. Example 4 – Sale of Equipment Installed on Site

Scenario: MecPower Ltd. (Hyderabad) installs heavy turbines in a factory at Nagpur, Maharashtra. Later, ownership of those turbines is transferred to another company, ABC Energy Ltd. — but the turbines remain fixed on site.

- Place of Supply = Nagpur, Maharashtra

- Tax Type: Inter-State (Hyderabad → Nagpur) → IGST.

Even though the buyer is registered elsewhere, GST is due to the State where turbines are installed.

10. Understanding “Location of Goods”

The location of goods under GST refers to the physical place where the goods exist at the time ownership passes or delivery is made.

It does not depend on:

- Location of supplier’s registered office, or

- Place where the sale agreement is signed, or

- Buyer’s place of business.

If the goods remain fixed or are not moved as part of the sale, the tax jurisdiction will always be the place where they physically sit.

11. When Does Delivery Happen in Such Cases?

Delivery in Section 10(1)(c) means the point when ownership or possession of goods is transferred — not when they are physically handed over or transported.

So, even if the goods remain in the same warehouse or site, once the buyer has the right to use or own them, the delivery is complete, and GST liability arises.

12. Documentation & Compliance

Whenever Section 10(1)(c) applies, suppliers must ensure proper documentation to prove there was no movement of goods.

Essential documents:

- Invoice stating “Sale of goods without movement – Section 10(1)(c) IGST Act”.

- Delivery challan / handover certificate showing the place of goods.

- Ownership transfer record (if applicable).

- E-way bill (if generated for record) should still show the physical location of goods.

This helps avoid disputes during departmental audits.

13. Comparison with Other Clauses of Section 10

| Clause | Situation | Place of Supply | Example |

| 10(1)(a) | Supply involves movement | Where movement ends | Goods sent Nashik → Ahmedabad |

| 10(1)(b) | Bill-to Ship-to model | Principal place of Bill-to | Y in Gujarat ships to Z in Rajasthan on X’s instruction |

| 10(1)(c) | No movement of goods | Location of goods at delivery | Machine sold as-is in Noida |

| 10(1)(d) | Installed/assembled at site | Place of installation | Turbine installed in Nagpur |

| 10(1)(e) | On board conveyance | Place where goods taken on board | Food sold on train from Delhi |

As you can see, Section 10(1)(c) acts as the “stationary goods” rule — a fallback when there’s zero movement.

14. CBIC Clarifications and 2024-25 Updates

While this section hasn’t changed much since 2017, recent CBIC circulars and FAQs have clarified certain aspects:

| Circular / Notification | Date | Key Clarification |

| Circular No. 209/3/2024-GST | 13 July 2024 | Clarifies that for unregistered buyers, if there’s no recorded address, supplier’s location becomes PoS — affects stationary goods sold to consumers. |

| Notification No. 09/2024-IGST | 8 Oct 2024 | Introduced Clause ( ca ) for unregistered buyers — though it mainly affects movable goods, it ensures B2C cases don’t default incorrectly under Sec 10(1)(c). |

| E-invoicing update (Aug 2024) | — | Mandatory State-code field ensures correct PoS even in non-movement cases. |

In short, CBIC wants taxpayers to clearly mention the State where goods are located in the invoice and GST return, especially in warehouse sales and real-estate-linked supplies.

15. Common Errors to Avoid

- Using wrong place of supply — taxpayers sometimes use the supplier’s location instead of goods’ location.

- Skipping documentation — no proof that goods didn’t move.

- Mixing up with installation cases — if assembly occurs later, Sec 10(1)(d) may apply instead.

- Ignoring e-way bill details — even if optional, mismatched details trigger notices.

16. Practical Tips for Businesses

- Mention “Place of supply – [State] (Goods located at delivery site)” clearly on invoice.

- Keep photographic or site records of stationary goods if value is high.

- Check customer’s GSTIN state to ensure correct IGST/SGST type.

- For warehouse sales, link the warehouse address to GST registration records.

- Update ERP systems to auto-populate PoS based on goods’ physical location.

17. Case Study Example

Let’s say Global Chem Ltd. (Gujarat) maintains a tank farm at Kandla Port. It sells 50,000 litres of chemical to Ocean Exports Pvt. Ltd., who already stores chemicals in the same tank.

- No movement happens — goods remain in the same tank.

- Ownership passes through a simple agreement.

✅ Place of Supply = Kandla, Gujarat.

✅ Tax Type = Intra-State (since supplier and goods in same State) → CGST + SGST.

If the buyer were registered in Maharashtra, it still remains Gujarat as place of supply → IGST. This is one of the most frequent real-world examples under Section 10(1)(c).

18. Why This Rule Matters

Businesses dealing in warehouses, construction materials, or heavy industrial equipment often sell goods without physically moving them.

Understanding Section 10(1)(c) prevents:

- Wrong classification of supply,

- Misreporting in GSTR-1/3B, and

- Costly re-deposits of IGST/SGST.

It also ensures fair allocation of GST revenue to the State actually hosting the goods.

19. Quick Recap Table

| Rule | Description | Place of Supply | Example | Tax Type |

| 10(1)(c) | Supply without movement | Location of goods at delivery | Machine sold on site in Noida | IGST |

| — | Furniture sold with property | Where furniture exists | Office in Gurugram | IGST |

| — | Warehouse stock sold in same State | Warehouse location | Goods sold in Gujarat warehouse | CGST + SGST |

20. Final Thoughts

The rule for goods without movement might seem simple at first glance, but it’s one of the most misunderstood clauses under the IGST Act.

Businesses must remember:

“If goods don’t move, the tax doesn’t move either — it belongs to the State where the goods stand.”

By keeping invoices clear, recording the physical location of goods, and understanding how Section 10(1)(c) fits within the broader GST structure, companies can avoid compliance headaches and stay audit-ready.

In the GST world, precision matters — and knowing the exact place of supply ensures that your tax goes exactly where it should.