1. Introduction

When we talk about GST, one term you’ll keep coming across is “supply.”

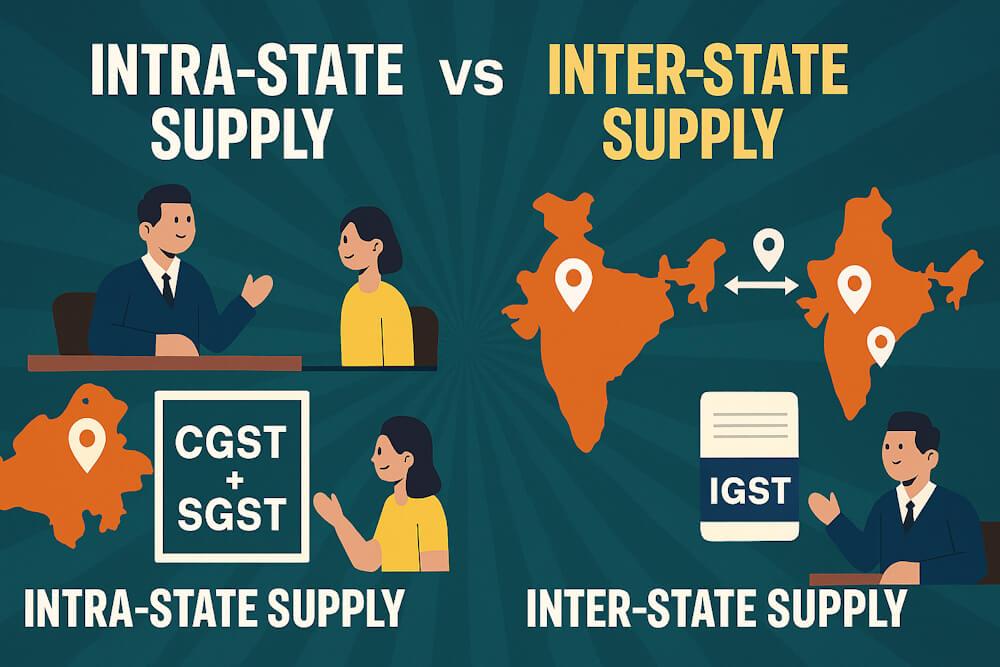

In simple words, GST is a tax on the supply of goods or services. But to know what kind of GST applies — CGST + SGST or IGST — you must first figure out whether the supply is intra-State or inter-State.

This distinction (Difference or clear separation) decides who collects the tax, how much tax is paid, and where the revenue goes.

Let’s understand these two types of supplies in plain, everyday language — with simple examples that make it crystal clear.

2. The Legal Backbone

Under the Central Goods and Services Tax (CGST) Act, 2017 and the Integrated Goods and Services Tax (IGST) Act, 2017, the nature of supply is what determines the type of tax.

- Section 8 of the IGST Act defines intra-State supply.

- Section 7 of the IGST Act defines inter-State supply.

These two sections form the foundation for deciding which GST applies.

3. Meaning of Intra-State Supply

An intra-State supply means that the location of the supplier and the place of supply are in the same State or Union Territory.

In simpler terms — if both the buyer and seller are in the same State, it’s an intra-State supply.

In such cases:

- CGST (Central GST) is collected by the Central Government.

- SGST (State GST) or UTGST (Union Territory GST) is collected by the respective State or UT Government.

Example 1:

A trader in Maharashtra sells mobile phones to a retailer in Pune, Maharashtra. Since both are in the same State, this is an intra-State supply. The invoice will include CGST + SGST.

Example 2:

A beauty salon in Delhi provides services to a customer in Delhi itself. The transaction happens within the same State — so CGST + SGST applies.

4. Meaning of Inter-State Supply

An inter-State supply happens when the location of the supplier and the place of supply are in different States or Union Territories, or between a State and a Union Territory.

In such cases:

- Only IGST (Integrated GST) is charged and collected by the Central Government.

Later, the revenue from IGST is shared between the Centre and the destination State (where goods or services are consumed).

Example 1:

A manufacturer in Gujarat sells machinery to a company in Rajasthan. The location of the supplier (Gujarat) and the place of supply (Rajasthan) are in different States. So, this is an inter-State supply, and IGST applies.

Example 2:

An online tutor in Delhi provides training to a student in Karnataka. Since the supplier and recipient are in different States, it’s an inter-State supply, and IGST is charged.

5. The Role of “Place of Supply”

The phrase “place of supply” keeps coming up, right? That’s because it’s the key to identifying whether a supply is intra-State or inter-State.

In simple words, place of supply means the place where goods or services are considered to be supplied under GST law.

- For goods, the place of supply depends on where the goods are delivered.

- For services, it depends on where the service is actually performed or where the recipient is located.

Let’s understand this better with examples.

Example (for Goods):

A seller in Kolkata (West Bengal) sends goods to a buyer in Bhubaneswar (Odisha). The goods are delivered to Odisha, so the place of supply is Odisha. Hence, it’s an inter-State supply and IGST applies.

Example (for Services):

A marketing agency in Mumbai designs an ad campaign for a company based in Delhi. Since the service recipient is located in Delhi, the place of supply is Delhi. That makes it an inter-State service under GST.

6. Intra-State vs Inter-State: The Basic Difference

Here’s a simple table to make it easy to understand the difference at a glance:

| Basis | Intra-State Supply | Inter-State Supply |

| Definition | Supplier and place of supply are in the same State/UT | Supplier and place of supply are in different States/UTs |

| Applicable Law | CGST Act + SGST/UTGST Act | IGST Act |

| Type of Tax | CGST + SGST/UTGST | IGST |

| Collected By | Both Centre and State | Central Government |

| Example | Seller in Delhi sells to buyer in Delhi | Seller in Delhi sells to buyer in Haryana |

| Invoice Type | Two taxes – CGST & SGST | One tax – IGST |

| ITC Credit Flow | Credit available within the same State | Credit flows across States via IGST mechanism |

7. Special Cases Under Inter-State Supply

There are some unique situations where a supply is treated as inter-State even if it appears to be intra-State.. Here are a few:

(a) Supply to or by an SEZ (Special Economic Zone)

All supplies to or by an SEZ unit or SEZ developer are treated as inter-State supplies, even if the SEZ is in the same State.

Example:

A company in Gurugram sells goods to an SEZ in Noida (U.P.) — clearly inter-State. But even if that SEZ was in Gurugram itself, it would still be considered inter-State because SEZs are treated separately for tax purposes.

(b) Supply to or by a Registered Person Located Outside India

If goods or services are supplied to or received from a person outside India, it becomes an inter-State supply (import or export).

Example:

A firm in Chennai exports garments to a buyer in France. This is an inter-State supply treated as zero-rated under GST.

(c) Imports

Whenever goods or services are imported into India, IGST is levied in addition to customs duties. This ensures that imported goods are taxed in the same way as domestic supplies.

Example:

A company in Delhi imports machinery from Germany. The import is treated as inter-State, and IGST is payable at the time of customs clearance.

8. When Supply Is Not Considered Inter-State

The following cases are not treated as inter-State supplies under the law:

- Supplies within the same State or Union Territory (obviously intra-State).

- Supplies to job workers located in another State (special provision under Section 143 of CGST Act).

- Supplies where the place of supply and supplier location are both in non-taxable territory.

Example:

If a company in Kerala sends goods to its own warehouse in Kerala, it’s not an inter-State supply — it’s still within the same State.

9. How Taxes Are Split Between Centre and State

In intra-State transactions, both the Centre and State get their share directly:

- CGST goes to the Central Government.

- SGST goes to the respective State Government.

But in inter-State transactions, only IGST is collected — and later, it’s divided and distributed among different parties between the Centre and the destination State (where goods are finally consumed).

This ensures that tax revenue follows consumption, not production — one of the core principles of GST.

10. Practical Example to Understand Both

Let’s take a full example to tie it all together.

Scenario 1 (Intra-State):

A supplier in Bengaluru, Karnataka sells air conditioners to a customer in Mysuru, Karnataka worth ₹1,00,000.

- CGST @9% = ₹9,000

- SGST @9% = ₹9,000

- Total GST = ₹18,000

So, ₹9,000 goes to the Centre and ₹9,000 to Karnataka State.

Scenario 2 (Inter-State):

The same supplier sells the same goods to a customer in Chennai, Tamil Nadu for ₹1,00,000.

- IGST @18% = ₹18,000

- Total GST = ₹18,000

Here, the Centre collects IGST and later passes the State’s share to Tamil Nadu (where the goods are consumed).

11. Key Takeaways

- If supplier and buyer are in the same State, it’s intra-State — CGST + SGST apply.

- If supplier and buyer are in different States, it’s inter-State — IGST applies.

- The place of supply determines the nature of the transaction.

- Supplies to SEZs, imports, and exports are always treated as inter-State.

- Intra-State taxes are shared between Centre and State immediately, while IGST is later apportioned (divided and distributed among different parties).

Understanding this difference is crucial for filing correct GST returns, issuing proper invoices, and avoiding compliance errors.

12. Final Thoughts

The distinction (Difference or clear separation) between intra-State and inter-State supply may seem small, but it’s one of the most important aspects of the GST system.

It affects your tax rate, invoice format, ITC claims, and even how your tax payments are distributed between governments.

So the next time you issue a GST invoice, remember — the place of supply decides everything. Whether you charge CGST + SGST or IGST depends entirely on where the goods or services end up being used.