1. Introduction

Under GST, one of the most crucial things to figure out in any sale of goods is where the supply is deemed to happen. This matters because GST is a destination-based tax — meaning the tax goes to the state where goods are consumed, not where they are produced.

For goods sold within India, Section 10 of the Integrated Goods and Services Tax (IGST) Act, 2017 provides the framework for determining the place of supply of goods. Once we know this, we can easily decide whether the transaction is an intra-State supply (CGST + SGST) or an inter-State supply (IGST).

Let’s break down each situation covered under Section 10 with simple explanations, real-world examples, and a few latest clarifications notified by CBIC up to October 2024.

2. Understanding Section 10 – The Core Rule

Section 10 applies only to supplies of goods within India — i.e., where both supplier and recipient are located in India.

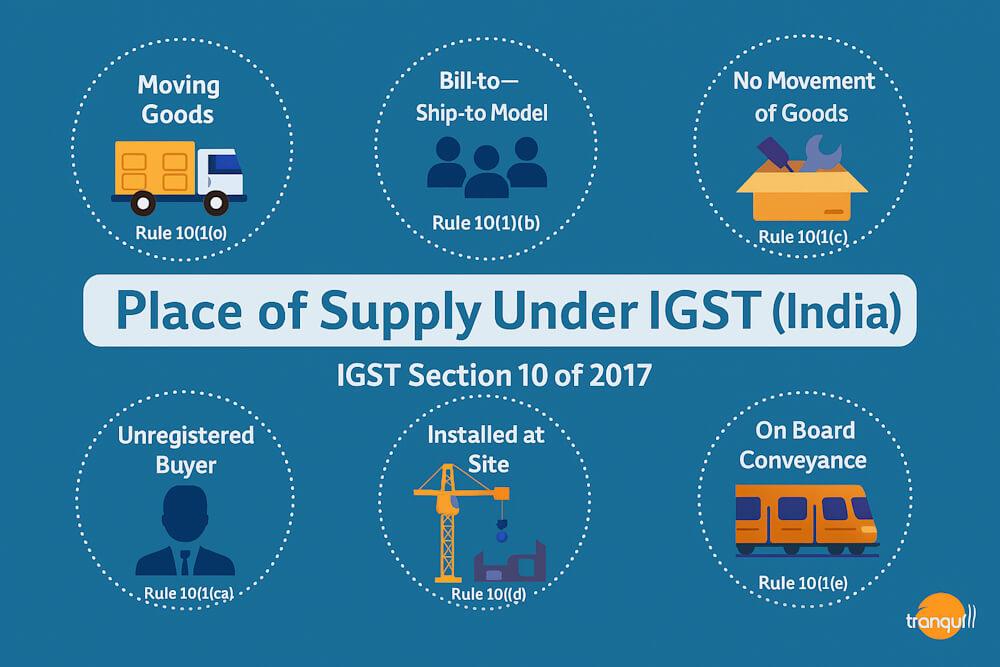

It provides five specific rules for determining the place of supply in various domestic situations:

- Supply involving movement of goods.

- Goods delivered to recipient on the direction of a third person (Bill-to–Ship-to model).

- Supply not involving movement of goods.

- Goods assembled or installed at site.

- Goods supplied on board a conveyance.

Additionally, a new clause ( ca ) was inserted via the Finance Act 2023 (effective July 2024), dealing with supplies made to unregistered persons — a significant change that businesses must be aware of.

3. Rule 1 – Supply Involving Movement of Goods [Section 10(1)(a)]

When goods move from one place to another for delivery (by the supplier, buyer, or any other person), the place of supply is where the movement of goods terminates for delivery to the recipient.

In simple words, the destination matters — not where the goods started from.

Example 1: MA Pvt. Ltd. of Nashik, Maharashtra sells 10 refrigerators to MB Pvt. Ltd. of Pune, Maharashtra, and delivers them to MB’s factory in Pune.

👉 Place of supply: Pune, Maharashtra (since goods are delivered there).

Example 2: MA Pvt. Ltd. (Nashik, Maharashtra) sells 20 refrigerators to MC Pvt. Ltd. of Ahmedabad, Gujarat for delivery in Ahmedabad.

👉 Place of supply: Ahmedabad, Gujarat.

If both supplier and buyer are in Maharashtra, the transaction is intra-State (CGST + SGST). But if one is in Maharashtra and the other in Gujarat, it’s inter-State (IGST).

This rule does not depend on who owns the goods during movement; the key factor is the place where delivery ends.

4. Rule 2 – “Bill-to – Ship-to” Model [Section 10(1)(b)]

Now let’s look at a common business scenario — where a supplier delivers goods to someone else at the direction of a third party (often called bill-to ship-to model).

Here, the law deems that the third person (who gives the instruction) is the recipient of the goods.

👉 Therefore, the place of supply is the principal place of business of that third person.

This provision applies when:

- There is a tripartite arrangement.

- The goods are delivered to a person other than the one billed.

- Delivery happens before or during movement (not after).

Example 3: X & Co. (registered in Noida, U.P.) instructs Y & Co. of Ahmedabad, Gujarat to deliver 50 washing machines to Z & Co. at Jaipur, Rajasthan.

Here are the two supplies:

- Supply 1: Y → X (deemed to be received by X in Noida).

- Supply 2: X → Z (actual delivery in Jaipur).

For the first supply (Y → X), the place of supply = principal place of business of X, i.e. Noida, U.P.

For the second (X → Z), the place of supply = Jaipur, Rajasthan (where movement ends).

Visual summary:

| Transaction | Supplier | Recipient | Delivery to | Place of Supply | Type |

| Supply 1 | Y & Co. (Gujarat) | X & Co. (U.P.) | Z & Co. (Rajasthan) | Noida, U.P. | Inter-State |

| Supply 2 | X & Co. (U.P.) | Z & Co. (Rajasthan) | Z & Co. (Rajasthan) | Jaipur, Rajasthan | Inter-State |

This rule ensures that the chain of supplies is taxed correctly, without double taxation or mismatch between States.

5. Rule 3 – Supply Not Involving Movement of Goods [Section 10(1)(c)]

Sometimes goods don’t move at all — for instance, when sold on an “as-is-where-is” basis. In that case, the place of supply is the location of goods at the time of delivery.

Example 4: MA Pvt. Ltd. (New Delhi) leases a machine to MB Pvt. Ltd. (Noida, U.P.) for production. After 14 months, MB decides to buy the same machine in place, without any further movement.

👉 Place of supply = Noida (U.P.), where the machine is located when sold.

Example 5: XZ Ltd. (Mumbai) buys a building in Gurugram, Haryana from KTS Builders, along with pre-installed furniture and fixtures. Sale of building itself isn’t taxable (Schedule III), but sale of furniture is.

👉 Place of supply = Gurugram, where the furniture exists.

This rule is particularly relevant for heavy machinery, real estate components, or goods that cannot be physically shifted before sale.

6. Rule 4 – Supply to an Unregistered Person [Section 10(1)(ca)]

This clause was newly inserted by the Finance Act 2023 (effective 1 July 2024, via Notification No. 09/2024–IGST).

It provides that when goods are supplied to a person other than a registered person (B2C transactions), the place of supply shall be:

- The address of the unregistered person recorded in the invoice, or

- If no such address is recorded, the location of the supplier.

👉 Even mentioning only the State name of the buyer is deemed sufficient as an address.

Purpose of this change:

To avoid ambiguity in determining tax for B2C sales where consumers often buy goods across states (e.g., tourists, migrant workers, or vehicle buyers purchasing from another state).

Examples:

- A tourist from Bihar buys electronics in Goa and takes them home. Since address isn’t on invoice → place of supply = Goa.

- If seller records Bihar as address → place of supply = Bihar.

This amendment replaced confusing older practices and simplified compliance for retailers, e-commerce sellers, and automobile dealers.

7. Rule 5 – Goods Installed or Assembled at Site [Section 10(1)(d)]

If the supply involves installation or assembly of goods at a particular site, the place of supply is the site of installation or assembly itself.

These are cases of composite supplies, where installation service is incidental to the supply of goods.

Example 6: MA Pvt. Ltd. (New Delhi) sells a machine to MB Pvt. Ltd. for installation in its Noida factory.

👉 Place of supply: Noida (U.P.).

Example 7: Pure Refineries (Mumbai) gives a contract to PQ Ltd. (Ranchi) to supply and assemble a machine at its refinery in Kutch, Gujarat.

👉 Place of supply: Kutch, Gujarat (installation site).

This provision ensures that tax goes to the State where goods are finally consumed or fixed.

8. Rule 6 – Goods Supplied on Board a Conveyance [Section 10(1)(e)]

This applies when goods are supplied during a journey — for example, food or items sold on a train, aircraft, or vessel.

Here, the place of supply = location where the goods are taken on board.

Example 8: Mr. X boards a New Delhi–Kota train and sells goods on the train after departure from New Delhi.

👉 Place of supply: New Delhi, because that’s where the goods were taken on board — not where they were sold.

This prevents confusion about which State should get the tax when a moving conveyance crosses multiple States.

9. What if the Place of Supply Cannot Be Determined? [Section 10(2)]

If none of the above situations clearly apply, the Government may prescribe other methods. So far, no separate rules are notified under this clause — meaning almost all cases are covered by Section 10(1).

10. Practical Importance of Correctly Determining the Place of Supply

Getting the place of supply right is not just academic — it has real compliance consequences.

| Mistake | Possible Impact |

| Treating inter-State supply as intra-State | Wrong tax type paid → need to pay IGST, claim refund of CGST/SGST. |

| Wrong place of supply on invoice | Mismatch in GSTR-1 and 3B, issues during audit or refund claims. |

| Missing address for unregistered buyers | System may auto-assign supplier’s State → wrong tax reporting. |

Because refunds for wrongly paid tax take time, it’s better to determine the place correctly before invoicing.

11. Key 2024–25 Updates & Clarifications

Here’s a quick look at recent changes relevant to Section 10 of IGST Act:

| Amendment / Clarification | Date / Notification | Summary |

| Insertion of Clause ( ca ) – Supplies to Unregistered Persons | Finance Act 2023, effective 01-07-2024 via Notification 09/2024-IGST | Specifies that for B2C supplies, place of supply = address of unregistered person on invoice; if none, supplier’s location. |

| Clarification via Circular No. 209/3/2024-GST (13 July 2024) | CBIC Circular | Clarifies that merely recording the State name of buyer in invoice is sufficient to determine place of supply for B2C sales. |

| Digital invoicing compliance | From 1 Aug 2024 (extended e-invoicing threshold ₹ 5 Cr) | Businesses must mention buyer’s State code correctly — auto-linked to place of supply in GSTN portal. |

| Cross-border “Bill-to Ship-to” transactions | Clarified through FAQs (Oct 2024) | When one leg is domestic and other is export/import, Section 10 and 11 read together decide PoS. |

These updates show that the government is tightening compliance and reducing disputes among States over revenue allocation.

12. Quick Recap Table

| Scenario | Section | Place of Supply | Example |

| Movement of goods | 10(1)(a) | Where movement ends → delivery location | Goods sent from Nashik to Ahmedabad → Ahmedabad |

| Bill-to–Ship-to model | 10(1)(b) | Principal place of third person (who gives instruction) | X in U.P. instructs Y in Gujarat to ship to Z in Rajasthan → Noida |

| No movement of goods | 10(1)(c) | Location of goods at delivery time | Machine sold as-is in Noida |

| Goods to unregistered person | 10(1)(ca) | Buyer’s address on invoice / supplier location | Retail sale to tourist → Goa |

| Goods installed at site | 10(1)(d) | Place of installation / assembly | Machine installed in Noida |

| Goods on board a conveyance | 10(1)(e) | Place where goods taken on board | Train boarding at New Delhi → Delhi |

| Residual cases | 10(2) | As prescribed by Govt. (so far none) | — |

13. Final Thoughts

The concept of Place of Supply might seem like a legal technicality, but it forms the backbone of how GST revenue gets distributed among States.

For domestic transactions of goods, Section 10 provides a clear and logical framework — linking tax to the point of delivery, consumption, or installation.

With the 2024 amendments, especially clause ( ca ), the system is more transparent for B2C sales. Yet, businesses must stay vigilant: capturing the buyer’s correct state on invoices, updating ERP systems, and verifying GST registration details before shipping are now non-negotiable steps.

If a business can master these simple rules, it won’t just stay compliant — it’ll also build smoother, error-free GST operations and reduce the risk of refund or penalty headaches later.