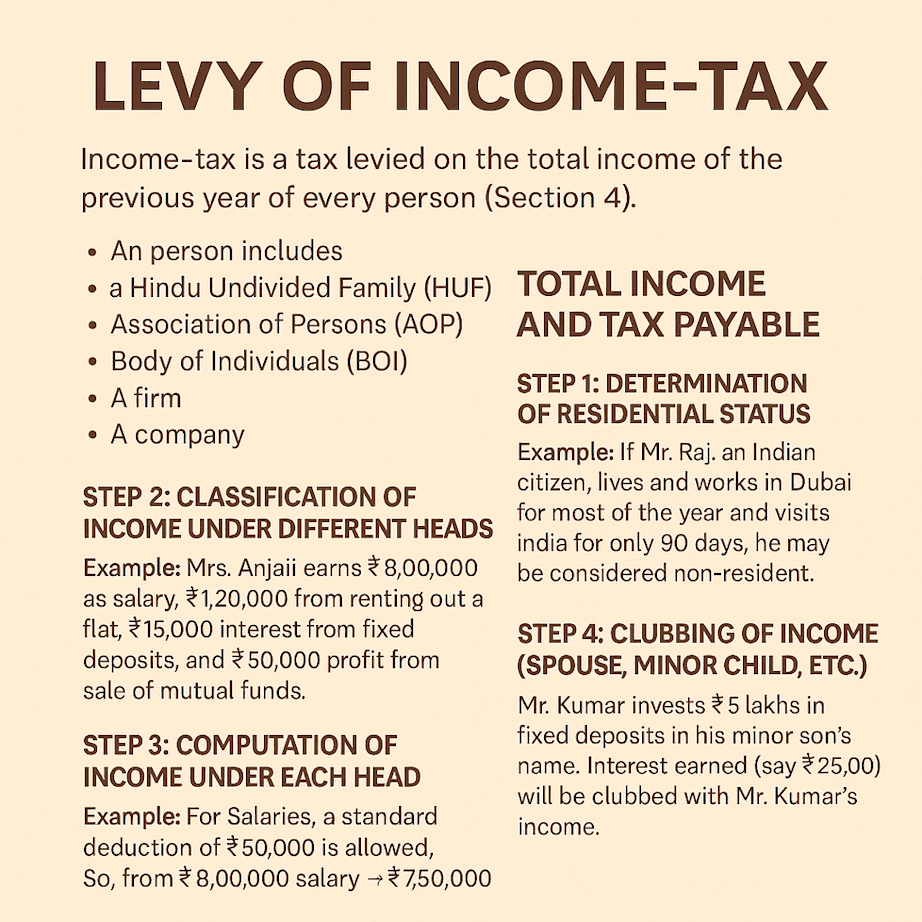

Income-tax is a tax levied on the total income of the previous year of every person (Section 4).

A person includes:

- An individual

- Hindu Undivided Family (HUF)

- Association of Persons (AOP)

- Body of Individuals (BOI)

- A firm

- A company

- Etc.

(1) Total Income and Tax Payable

Income-tax is levied on a person's total income. This has to be computed as per the rules laid down in the Income-tax Act, 1961.

Let’s go through the steps to compute the total income of an individual — with examples included.

Step 1 – Determination of Residential Status

Your residential status determines how much of your income is taxable in India.

Example: If Mr. Raj, an Indian citizen, lives and works in Dubai for most of the year and visits India for only 90 days, he may be considered non-resident. Only his income earned or received in India would be taxable in India.

Step 2 – Classification of Income Under Different Heads

Income is grouped into 5 categories:

- Salaries

- Income from House Property

- Profits and Gains from Business or Profession

- Capital Gains

- Income from Other Sources

Example: Mrs. Anjali earns ₹8,00,000 as salary, ₹1,20,000 from renting out a flat, ₹15,000 interest from fixed deposits, and ₹50,000 profit from sale of mutual funds.

Her income is divided like this:

- Salaries: ₹8,00,000

- House Property: ₹1,20,000

- Capital Gains: ₹50,000

- Other Sources: ₹15,000

Step 3 – Computation of Income Under Each Head

Each head has specific rules. Standard deductions, allowances, or expenses may be allowed.

Example: For Salaries, a standard deduction of ₹50,000 is allowed. So, from ₹8,00,000 salary → ₹7,50,000 is taxable.

Step 4 – Clubbing of Income (Spouse, Minor Child, etc.)

If you divert income to close relatives to reduce tax, some of that income may be “clubbed” back with your own.

Example: Mr. Kumar invests ₹5 lakhs in fixed deposits in his minor son’s name. Interest earned (say ₹25,000) will be clubbed with Mr. Kumar’s income.

Step 5 – Set-off or Carry Forward of Losses

Losses from one source can be adjusted against gains from another, subject to rules.

Example: Mr. Ravi has a ₹1,00,000 profit from shares (Capital Gain) and a ₹60,000 loss from a second property (House Property Loss). His net taxable income = ₹1,00,000 - ₹60,000 = ₹40,000

Step 6 – Computation of Gross Total Income

Add up income from all heads after adjustments:

- Salaries: ₹7,50,000

- House Property: ₹1,20,000

- Capital Gains: ₹50,000

- Other Sources: ₹15,000 Gross Total Income = ₹9,35,000

Step 7 – Deductions from Gross Total Income

You can claim deductions under sections like 80C, 80D, 80G etc.

Example: Mrs. Anjali invested ₹1,50,000 in PPF (80C) and paid ₹20,000 towards health insurance premium (80D). Total deductions = ₹1,70,000

Step 8 – Total Income

Subtract deductions from Gross Total Income:

₹9,35,000 – ₹1,70,000 = ₹7,65,000

Rounded off to nearest ₹10 → ₹7,65,000

Step 9 – Apply Tax Rates

Now apply slab-wise tax rates. For individuals under 60 (FY 2025-26 – old regime):

- Up to ₹2,50,000: Nil

- ₹2,50,001–₹5,00,000: 5% = ₹12,500

- ₹5,00,001–₹10,00,000: 20% of ₹2,65,000 = ₹53,000 Total = ₹65,500

Step 10 – Surcharge and Rebate (Section 87A)

Surcharge:

Applicable only if total income exceeds ₹50 lakhs.

Rebate u/s 87A:

Available if income is ≤ ₹5,00,000. In our example (₹7,65,000) – Not eligible.

Step 11 – Health and Education Cess

Cess @4% on ₹65,500 = ₹2,620 Total Tax Payable = ₹68,120

Step 12 – Advance Tax & TDS

If total tax exceeds ₹10,000 in a year, advance tax applies.

Example: If Mr. Ramesh earns ₹10,00,000 annually, he must pay advance tax in 4 installments. His employer may deduct TDS from salary to cover this.

Step 13 – Tax Payable or Refundable

Finally, subtract TDS or advance tax already paid.

Example: Mrs. Anjali’s TDS from salary = ₹65,000

Her total tax = ₹68,120

Tax Payable = ₹3,120

She must pay this as self-assessment tax before filing her return.

If she had already paid more than required, she would get a refund.