1. Introduction

When GST was introduced, one of its main goals was to make taxation uniform and transparent. But as the government soon realized, not every transaction could be tracked easily — especially when it came to small suppliers or farmers selling raw materials to registered businesses.

That’s where the Reverse Charge Mechanism (RCM) comes into play.

Under RCM, the buyer — not the seller — is responsible for paying GST directly to the government.

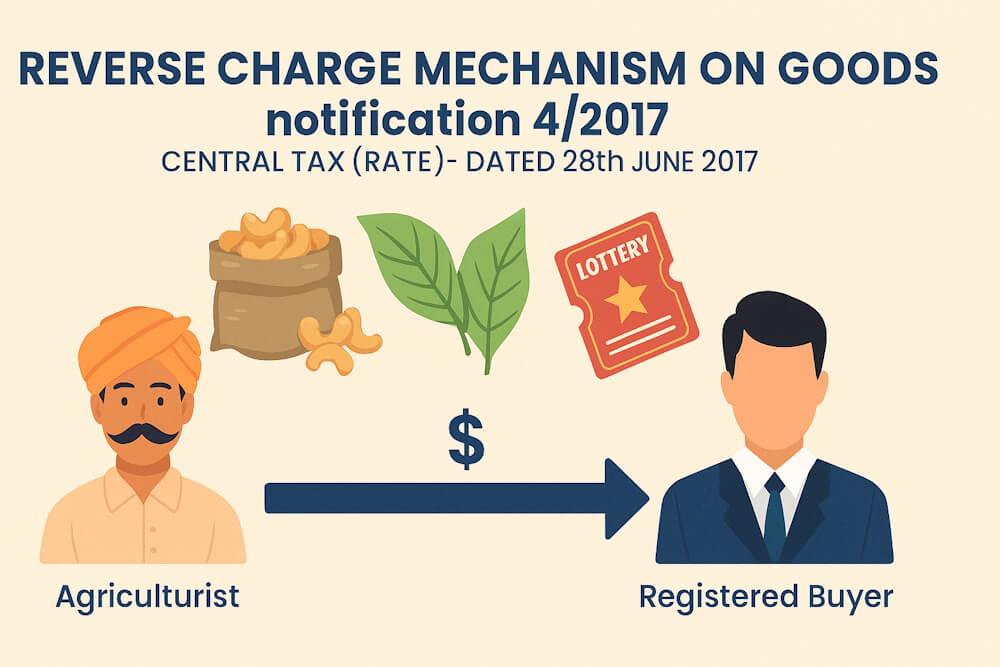

And one of the key legal documents that explains which goods fall under RCM is Notification No. 4/2017 – Central Tax (Rate), dated 28th June 2017.

In this blog, let’s go through what this notification says, which goods it covers, and how businesses should handle GST payments on such supplies.

2. What is Notification No. 4/2017?

The Notification No. 4/2017 – CGST (Rate) was issued under Section 9(3) of the CGST Act, 2017.

This section allows the government to specify categories of goods where the recipient (instead of the supplier) must pay tax under Reverse Charge Mechanism.

Simply put, this notification lists certain goods for which the buyer has to pay GST — not the seller.

This was mainly done because:

- Many of these goods are supplied by unregistered or small vendors (like farmers).

- Tracking GST collection from millions of small suppliers is impractical.

- The responsibility is shifted to registered buyers who can handle tax compliance properly.

3. Legal Basis for RCM on Goods

Here’s how the law supports this system:

- Section 9(3) of the CGST Act, 2017: “The Government may, on the recommendations of the GST Council, specify categories of supply of goods or services where the tax shall be paid by the recipient.”

- Section 5(3) of the IGST Act, 2017: Contains similar provisions for inter-State supplies.

Notification No. 4/2017 is issued using these powers.

4. Goods Covered Under Reverse Charge Mechanism

Let’s now look at the list of goods notified under RCM through Notification 4/2017 (and later amendments).

These are mainly agricultural or natural produce supplied by unregistered persons (often farmers) to registered buyers.

Here’s a complete table for better clarity:

| S. No. | Description of Goods | Supplier | Recipient Liable to Pay Tax (under RCM) |

| 1 | Cashew nuts (not shelled or peeled) | Agriculturist | Registered person |

| 2 | Bidi wrapper leaves (tendu leaves) | Agriculturist | Registered person |

| 3 | Tobacco leaves | Agriculturist | Manufacturer of tobacco products, registered buyer |

| 4 | Silk yarn | Any person (supplier of silk yarn) | Registered person (purchasing for business) |

| 5 | Raw cotton | Agriculturist | Registered person (buyer) |

| 6 | Supply of lottery tickets | State Government, Union Territory or authorized distributor | Lottery distributor or selling agent |

| 7 | Used vehicles, seized or confiscated goods, old and unserviceable goods, scrap | Central/State Government, Union Territory or local authority | Registered buyer purchasing such goods |

5. Understanding Each Item in Detail

Let’s go through each of these goods with examples — so it’s easier to understand how RCM works in practice.

(1) Cashew Nuts (Not Shelled or Peeled)

Farmers or local traders often sell raw cashew nuts to processing factories. Since most of these farmers are unregistered, collecting GST from them is not feasible.

So, when a registered buyer purchases cashew nuts from an agriculturist, the buyer must pay GST under RCM.

Example: A cashew processing company in Kerala buys unshelled cashews from a local farmer. The company pays GST on the purchase directly to the government under reverse charge.

(2) Bidi Wrapper Leaves (Tendu Leaves)

Tendu leaves are used in making bidis (traditional cigarettes). They are usually collected by forest workers and sold to bidi manufacturers.

Under RCM, the manufacturer or registered buyer purchasing tendu leaves pays GST directly to the government.

Example: A bidi company in Madhya Pradesh buys tendu leaves from forest contractors. Since the supplier (contractor) may not be registered, the bidi manufacturer pays GST under RCM.

(3) Tobacco Leaves

Tobacco leaves are one of the key agricultural inputs used by cigarette manufacturers.

Here again, the supplier (farmer or local trader) might be unregistered. So, the manufacturer purchasing tobacco leaves has to pay GST under reverse charge.

Example: A cigarette company in Andhra Pradesh buys raw tobacco leaves from local growers. GST is payable by the manufacturer under RCM.

(4) Silk Yarn

Silk yarn often changes hands between small producers and textile manufacturers. Since many silk farmers are unregistered, the buyer must pay GST under RCM.

Example: A textile unit in Karnataka purchases silk yarn from a local silk reelers’ cooperative. GST is paid by the textile unit under RCM.

(5) Raw Cotton

Raw cotton is another agricultural product commonly sold by farmers to textile mills. As per this notification, when an agriculturist sells raw cotton to a registered buyer, the buyer must pay GST under RCM.

Example: A spinning mill in Gujarat purchases cotton from local farmers. The mill is liable to pay GST on the purchase under reverse charge.

(6) Supply of Lottery Tickets

The supply of lottery tickets by State Governments or authorized distributors is also covered under RCM.

Example: A lottery distributor purchases tickets from the Kerala State Government. The distributor, being registered, pays GST under reverse charge.

(7) Used or Scrap Goods from Government Departments

When Central or State Governments (or local bodies) sell old, confiscated, or scrap goods, the registered buyer is responsible for paying GST under RCM.

Example: A government department auctions used vehicles to a registered scrap dealer. The dealer pays GST under RCM for the purchase.

6. Why These Goods Are Under RCM

There’s a common pattern here — most of these goods are supplied by small or unorganized sectors, like farmers, artisans, or local sellers.

The government chose RCM for these items because:

- The suppliers are usually not registered under GST.

- Tracking individual small sellers would be difficult.

- Registered buyers can handle compliance more easily.

- It ensures no loss of tax revenue to the government.

7. How RCM on Goods Works Step-by-Step

Here’s a simple flow to understand how RCM operates for these goods:

- Supplier sells goods without charging GST (since they’re unregistered).

- Recipient (buyer) calculates the applicable GST rate and pays it directly to the government through their GST portal.

- The buyer then issues a self-invoice for the transaction (since the supplier didn’t issue a GST invoice).

- The buyer can claim input tax credit (ITC) for the tax paid, provided the goods are used for business.

Example Flow:

- Raw cotton purchased → ₹1,00,000

- GST rate → 5%

- Buyer pays ₹5,000 under RCM

- Buyer claims ₹5,000 as ITC in GSTR-3B return

8. Tax Rates for Goods under RCM

| Goods | Applicable GST Rate |

| Cashew nuts (not shelled) | 5% |

| Tendu leaves | 18% |

| Tobacco leaves | 5% |

| Silk yarn | 5% |

| Raw cotton | 5% |

| Lottery tickets | As per relevant schedule (usually 12% or 28%) |

| Used/scrap goods sold by government | 18% |

Note: Always check the latest GST rate notifications, as rates are subject to change.

9. Documentation Required Under RCM

When paying GST under RCM for these goods, the recipient must prepare the following documents:

- Self-Invoice under Rule 46 (since supplier didn’t issue one)

- Payment Voucher under Rule 52

- Proper accounting entries in purchase and GST ledgers

- Declaration of RCM liability in GSTR-3B and GSTR-2

These documents are essential for claiming input tax credit later.

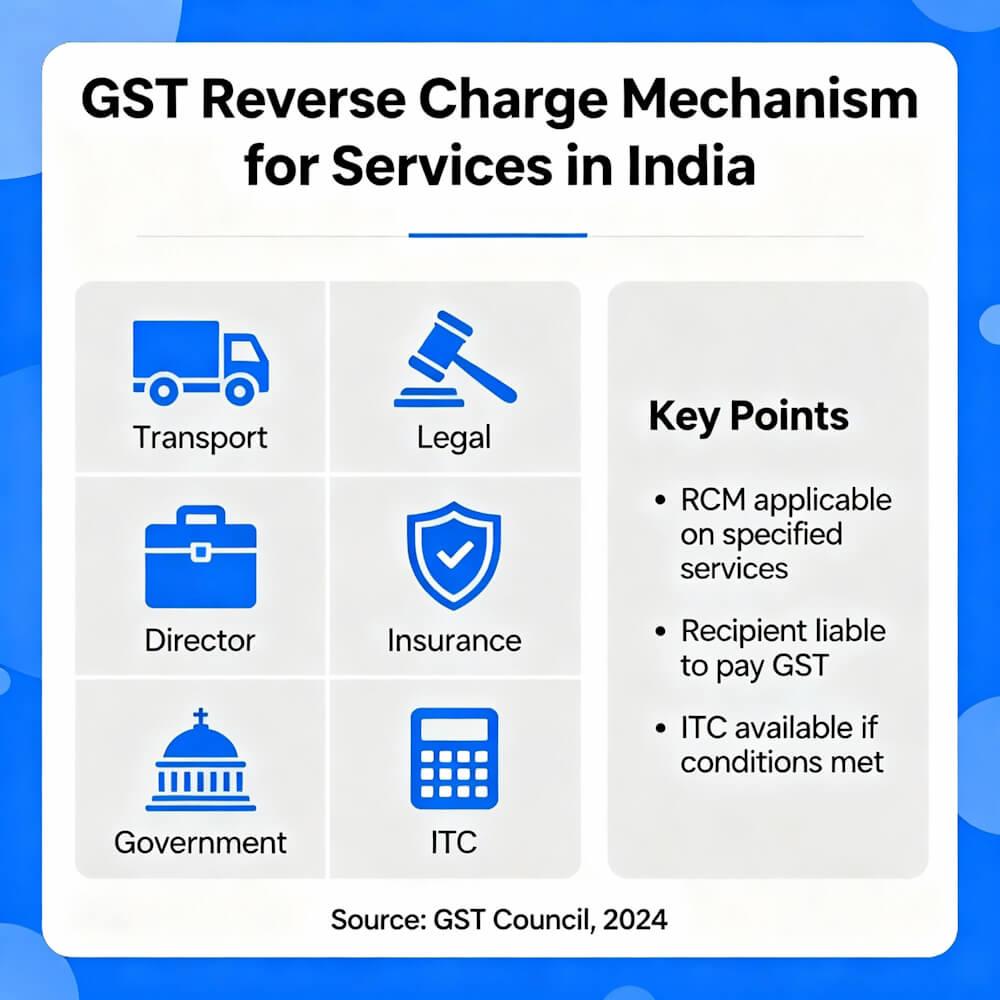

10. Input Tax Credit (ITC) under RCM

One of the best parts of paying GST under RCM is that it’s creditable. The buyer who pays tax can claim ITC in the same month — provided:

- They are a registered person.

- The goods are used for business or taxable supply.

Example: If a textile company pays ₹5,000 GST on silk yarn under RCM, it can claim ₹5,000 ITC and adjust it against future output GST.

11. Common Mistakes Businesses Make

Some businesses still get RCM wrong. Here are common issues:

- Forgetting to issue a self-invoice.

- Paying tax but not reporting it in GSTR-3B.

- Failing to claim ITC properly.

- Paying RCM for non-notified goods (not required).

To stay compliant, always refer to the latest RCM notifications and keep clear documentation.

12. Key Takeaways

- Notification 4/2017 lists specific goods under RCM.

- It mainly covers agricultural commodities and government disposals.

- The recipient (registered buyer) pays GST instead of the supplier.

- The buyer can claim ITC for tax paid under RCM.

- Self-invoice and payment vouchers are mandatory for compliance.

In short, RCM ensures that even when goods come from unregistered suppliers, tax still reaches the government — without complicating things for small sellers.

13. Final Thoughts

The Reverse Charge Mechanism on goods under Notification 4/2017 is a smart way to make sure GST is collected smoothly from sectors that are otherwise hard to monitor.

It balances the system — protecting small farmers and artisans from compliance burdens while keeping businesses responsible for tax payment.

If you’re a manufacturer or trader buying any of these goods, make sure you understand the RCM rules, keep records tidy, and claim your credits correctly. Handled properly, RCM won’t hurt your business — it’ll just keep you compliant.