Accounting Standards play a very important role in India’s financial reporting system. They decide how companies, firms, and other business entities record their income, expenses, assets, and liabilities. Without proper Accounting Standards, every business would prepare its financial statements in its own way, making it difficult to compare, trust, or understand financial data.

This blog explains who makes Accounting Standards in India, how they get legal authority, and why they are mandatory for companies and other enterprises.

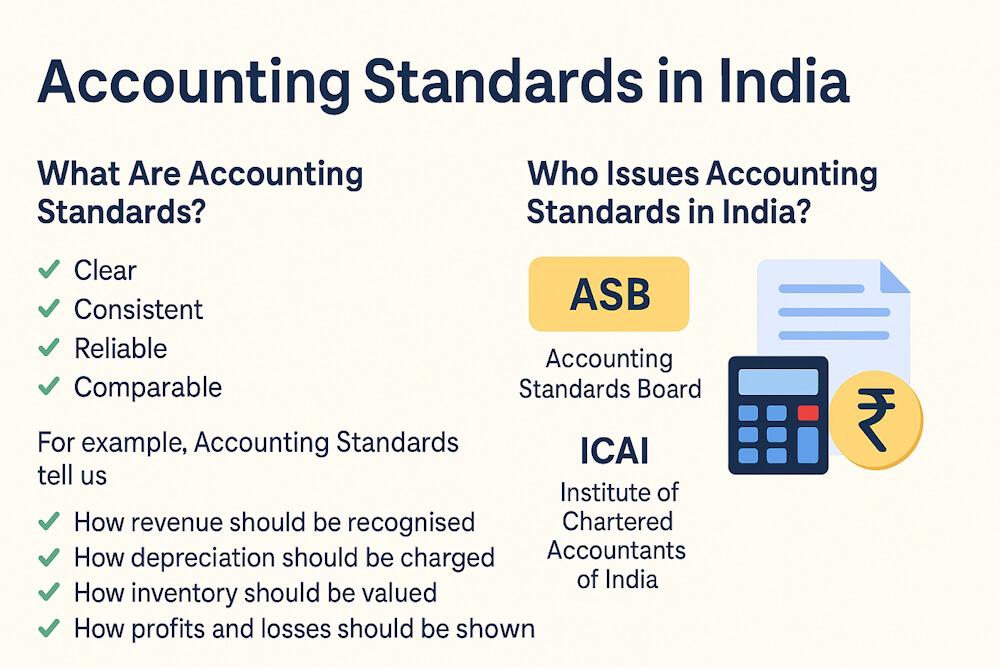

What Are Accounting Standards?

Accounting Standards are written rules that guide how financial transactions should be recorded, measured, presented, and disclosed in financial statements. They ensure that financial reports are:

- Clear

- Consistent

- Reliable

- Comparable

For example, Accounting Standards tell us:

- How revenue should be recognised

- How depreciation should be charged

- How inventory should be valued

- How profits and losses should be shown

Without these rules, financial statements would be confusing and misleading.

Who Issues Accounting Standards in India?

In India, Accounting Standards are developed by the Accounting Standards Board (ASB) of the Institute of Chartered Accountants of India (ICAI).

Role of ICAI

ICAI is the statutory body that regulates the accounting and auditing profession in India. It is responsible for:

- Setting accounting rules

- Issuing guidance on financial reporting

- Maintaining professional standards

The Accounting Standards Board (ASB) works under ICAI and prepares Accounting Standards after detailed study and discussion.

How Are Accounting Standards Created?

The process of making Accounting Standards is very systematic. It involves:

- Studying existing practices

- Identifying problems and inconsistencies

- Consulting experts, professionals, and regulators

- Drafting standards

- Getting feedback

- Final approval

After ICAI finalises a standard, it is forwarded to the Ministry of Corporate Affairs (MCA) for approval in case of companies.

Legal Authority of Accounting Standards

Accounting Standards do not become legally binding just because ICAI issues them. Their legal force comes from law.

For companies, Accounting Standards get legal authority from the Companies Act, 2013.

Section 133 of Companies Act, 2013

This section states that the Central Government may prescribe Accounting Standards recommended by ICAI in consultation with NFRA (National Financial Reporting Authority).

Once notified by MCA, these standards become mandatory for all companies.

Why Accounting Standards Are Mandatory

Accounting Standards are not optional. They are compulsory because:

- They ensure fairness in financial reporting

- They protect investors

- They improve transparency

- They prevent manipulation of profits

When standards are mandatory, companies cannot choose accounting methods just to show higher profits.

Auditor’s Responsibility

Under Section 143(3)(e) of Companies Act, 2013, auditors must report whether:

“Financial statements comply with Accounting Standards.”

If a company does not follow Accounting Standards, the auditor must mention this in the audit report.

What If a Company Does Not Follow Accounting Standards?

If financial statements do not follow Accounting Standards, the company must:

- Disclose the deviation

- Explain the reason

- Show the financial impact

However, this does not automatically mean the statements are wrong — but full transparency is required.

Accounting Standards and Other Laws

Accounting Standards cannot override:

- Companies Act

- Income Tax Act

- Banking Regulation Act

- Insurance Act

- Electricity Act

For example:

- Banks follow Banking Regulation Act

- Insurance companies follow IRDA rules

Accounting Standards apply only to the extent they do not conflict with these laws.

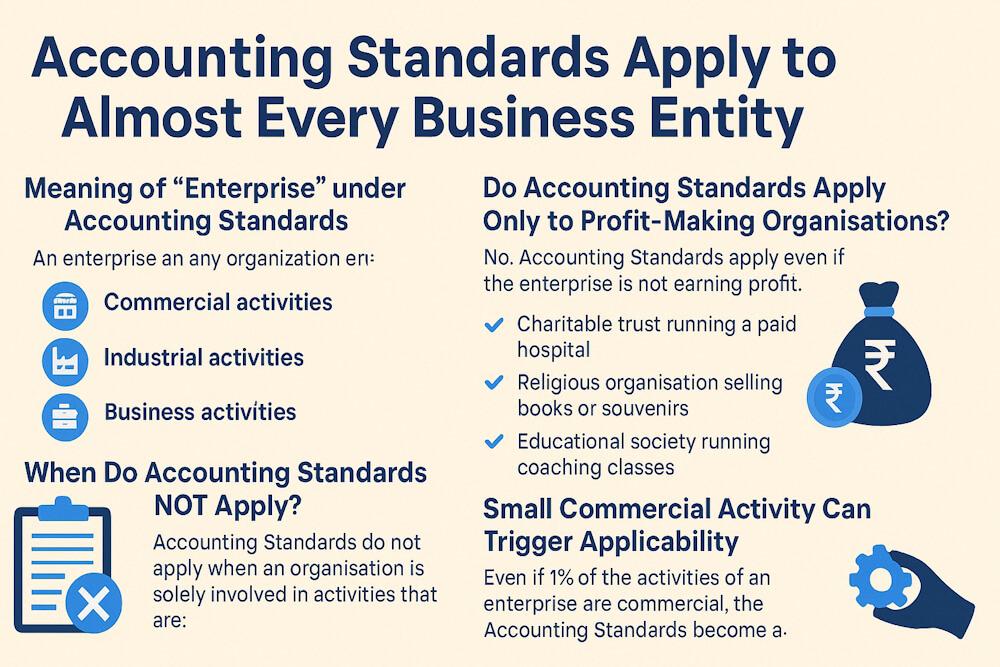

Applicability Depends on Three Questions

Before applying any Accounting Standard, we must check:

- Does it apply to the enterprise?

- Does it apply to the financial statement?

- Does it apply to the financial item?

This avoids unnecessary compliance where the standard is not relevant.

Why This Topic Is Important for Exams and Practice

Understanding the status and legal authority of Accounting Standards helps you:

- Answer theory questions

- Handle case studies

- Understand auditor’s responsibility

- Know when compliance is mandatory

It also helps businesses avoid legal and financial problems.

What’s Next?

Now that you understand who makes Accounting Standards and why they are legally binding, the next step is to learn:

This is explained in the next chapter.

FAQs

1. Who issues Accounting Standards in India?

Accounting Standards in India are prepared by the Accounting Standards Board (ASB) of the Institute of Chartered Accountants of India (ICAI) and notified by the Ministry of Corporate Affairs for companies.

2. Are Accounting Standards legally binding in India?

Yes. Accounting Standards become legally binding when they are notified by the Central Government under Section 133 of the Companies Act, 2013.

3. What gives Accounting Standards legal authority?

Their legal authority comes from the Companies Act, 2013, especially Section 133, which empowers the government to notify standards recommended by ICAI and NFRA.

4. What is the role of MCA in Accounting Standards?

The Ministry of Corporate Affairs (MCA) approves and notifies Accounting Standards for companies, making them mandatory.

5. Can a company ignore Accounting Standards?

No. If a company does not follow Accounting Standards, it must disclose the deviation, reason, and financial impact in its financial statements.

6. What is the auditor’s role regarding Accounting Standards?

The auditor must report whether the company’s financial statements comply with Accounting Standards as required under Section 143 of the Companies Act, 2013.

7. Do Accounting Standards override other laws?

No. Accounting Standards cannot override laws such as the Income Tax Act, Banking Regulation Act, or Insurance Act.