In today’s business environment, financial information is not just about numbers. It is about trust, transparency, and comparability. Investors, lenders, regulators, and even employees rely heavily on financial statements to understand how a business is performing and where it stands financially. But imagine if every company followed its own rules while preparing financial statements. Comparisons would become meaningless, and financial data would lose credibility. This is exactly where Accounting Standards come into play.

Accounting Standards form the backbone of modern financial reporting. They ensure that financial statements are prepared using uniform principles, making them reliable and useful for decision-making. This blog explains the meaning of Accounting Standards, their objectives, and why they are so important in the accounting and business world.

“To understand how these rules improve transparency, comparability, and trust in financial reporting, read our detailed guide on the benefits of accounting standards in financial reporting.”

What Are Accounting Standards?

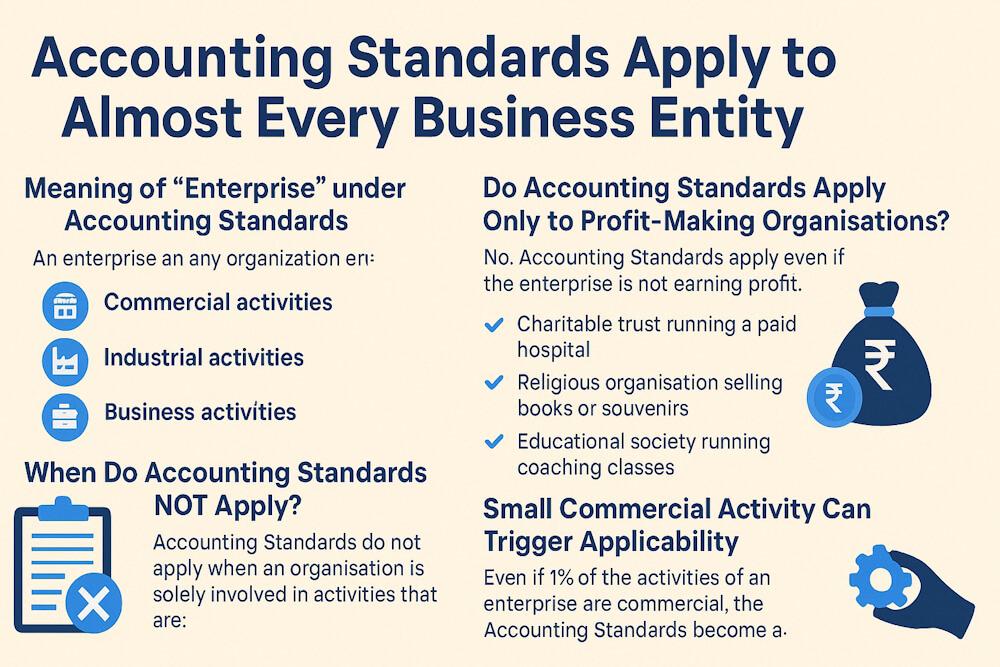

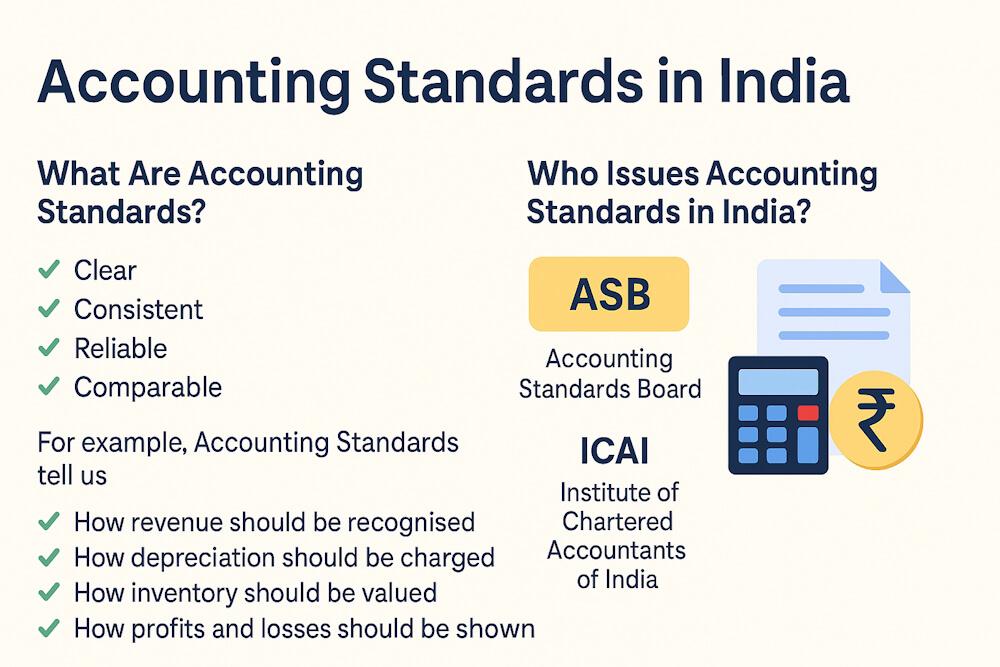

Accounting Standards are written guidelines and principles that prescribe how financial transactions and events should be recognized, measured, presented, and disclosed in financial statements. These standards are issued by authorized accounting bodies or regulators and are mandatory for businesses falling under their scope.

In simple words, Accounting Standards tell accountants what to record, how to record it, and how to present it in financial statements. They reduce confusion and prevent manipulation by setting clear rules for accounting treatment.

For example:

- When should revenue be recognized?

- How should inventory be valued?

- How should depreciation be calculated?

- What information must be disclosed in financial statements?

All these questions are answered through Accounting Standards.

Scope of Accounting Standards

Accounting Standards deal with four major aspects of financial reporting:

1. Recognition

Recognition refers to when a transaction or event should be recorded in the books of accounts. For instance, should revenue be recorded when an order is received, when goods are dispatched, or when payment is received? Accounting Standards provide clarity on such issues.

2. Measurement

Measurement refers to how much value should be assigned to a transaction or asset. Should assets be recorded at historical cost, fair value, or net realizable value? Standards guide the measurement base to be used.

3. Presentation

Presentation focuses on how financial information is shown in financial statements. It ensures that balance sheets, profit and loss statements, and cash flow statements follow a uniform structure so users can easily understand and compare them.

4. Disclosure

Disclosure ensures that relevant information is not hidden. Accounting Standards specify what additional notes, explanations, and policies must be disclosed so users can correctly interpret the financial data.

Why Do We Need Accounting Standards?

Before the introduction of Accounting Standards, companies had significant freedom in choosing accounting methods. While flexibility sounds good, it often led to inconsistent reporting, lack of transparency, and sometimes intentional manipulation of profits.

Some companies would:

- Overstate profits to attract investors

- Understate liabilities to appear financially strong

- Change accounting policies frequently to suit management interests

Accounting Standards were introduced to bring discipline and consistency to financial reporting.

Objectives of Accounting Standards

The main objectives of Accounting Standards are not limited to compliance alone. They serve a much broader purpose.

1. Uniformity in Accounting Practices

One of the key objectives is to reduce diversity in accounting treatments. While complete uniformity is not always possible, Accounting Standards narrow down the choices and ensure consistency across organizations.

2. Reliability of Financial Statements

Financial statements prepared in accordance with Accounting Standards are more trustworthy and credible. Users can rely on the information for decision-making without fear of manipulation.

3. Comparability

Accounting Standards make it possible to compare:

- Financial statements of the same company over different years

- Financial statements of different companies within the same industry

This comparability is extremely important for investors, analysts, and lenders.

4. Transparency and Disclosure

Standards promote transparency by requiring proper disclosures. This ensures that users are aware of:

- Accounting policies followed

- Assumptions made

- Significant judgments applied

5. Protection of Stakeholders

By preventing misleading accounting practices, Accounting Standards protect the interests of shareholders, creditors, employees, and the general public.

Importance of Accounting Standards

The importance of Accounting Standards goes far beyond accounting departments. Their impact is felt across the entire economy.

1. Enhances Investor Confidence

Investors prefer companies that follow standardized accounting practices. When financial statements are prepared according to recognized standards, investors feel confident that the numbers reflect the true financial position of the company.

2. Facilitates Decision-Making

Banks, financial institutions, and analysts use financial statements to make lending and investment decisions. Accounting Standards ensure that the information used for these decisions is consistent and reliable.

3. Reduces Scope for Creative Accounting

Creative accounting refers to the manipulation of accounting policies to present a desired financial result. Accounting Standards restrict such practices by defining clear rules and acceptable treatments.

4. Improves Corporate Governance

Transparent financial reporting strengthens corporate governance. It holds management accountable and ensures that financial performance is reported honestly.

5. Supports Regulatory Oversight

Regulators rely on standardized financial reporting to monitor compliance, detect fraud, and enforce laws effectively.

Accounting Standards and GAAP

Accounting Standards form a crucial part of Generally Accepted Accounting Principles (GAAP). GAAP represents the complete framework of accounting rules, including standards, conventions, and practices followed in a country.

While GAAP provides the overall philosophy, Accounting Standards provide specific guidance on individual accounting issues.

Accounting Standards in the Indian Context

In India, Accounting Standards are issued to ensure that financial reporting aligns with national laws and global practices. These standards apply to various entities depending on their nature, size, and regulatory requirements.

Over time, India has also moved towards global alignment through Indian Accounting Standards (Ind AS), which are largely converged with international standards. This shift has strengthened the quality and global acceptance of Indian financial statements.

Accounting Standards vs Accounting Policies

It is important to understand that Accounting Standards and Accounting Policies are not the same.

- Accounting Standards are mandatory rules issued by regulatory bodies.

- Accounting Policies are specific methods chosen by a company within the framework allowed by Accounting Standards.

For example, a standard may allow multiple inventory valuation methods, but the company must clearly disclose which method it has chosen.

Limitations of Accounting Standards

While Accounting Standards are essential, they are not without limitations:

- They involve professional judgment in complex transactions

- They may not cover every unique business situation

- They must be read along with applicable laws

However, these limitations do not reduce their importance. Instead, they highlight the need for skilled professionals and ethical judgment.

Conclusion

Accounting Standards play a critical role in shaping the credibility of financial reporting. They bring structure, consistency, and transparency to accounting practices, ensuring that financial statements serve their true purpose — providing reliable information to users.

In a world where businesses are increasingly global and financial decisions are made across borders, Accounting Standards act as a common language of finance. They protect stakeholders, enhance investor confidence, and strengthen the overall financial system.

Understanding Accounting Standards is not just important for accountants and auditors, but for anyone who relies on financial information to make informed decisions.

FAQs -

F1: What are Accounting Standards in simple words?

Accounting Standards are rules that explain how financial transactions should be recorded and reported. They help ensure that financial statements are prepared in a consistent and reliable way.

2: Why are Accounting Standards important?

Accounting Standards are important because they improve transparency, reduce manipulation, and make financial statements comparable across different companies and time periods.

3: Who issues Accounting Standards in India?

In India, Accounting Standards are issued under the guidance of the Institute of Chartered Accountants of India (ICAI) and notified by the Ministry of Corporate Affairs (MCA).

4: What is the difference between Accounting Standards and Accounting Policies?

Accounting Standards are mandatory rules, while accounting policies are the methods chosen by a company within the options allowed by those standards.

5: How do Accounting Standards help investors?

Accounting Standards help investors by ensuring that financial statements are reliable, transparent, and comparable, which supports better investment decisions.

6: Are Accounting Standards mandatory for all businesses?

Yes, Accounting Standards are mandatory for businesses depending on their type and regulatory requirements. Some small entities may have limited or simplified compliance rules.

7: Can Accounting Standards prevent financial fraud?

While they cannot completely eliminate fraud, Accounting Standards significantly reduce the chances of manipulation by setting clear accounting rules and disclosure requirements.