Accounting Standards in India are not created or enforced by a single authority. Instead, they are the result of a structured, multi-layered regulatory framework designed to ensure transparency, consistency, and credibility in financial reporting. Three key institutions play a central role in this framework — ICAI, MCA, and NFRA.

Understanding how these bodies function and interact is essential for anyone studying accounting, working in finance, or relying on financial statements for decision-making. This blog explains the evolution of Accounting Standards in India, the roles of ICAI, MCA, and NFRA, and how they collectively shape financial reporting practices in the country.

Evolution of Accounting Standards in India

India’s accounting framework has evolved gradually in response to economic growth, globalization, and the need for reliable financial information. In the early years, accounting practices varied widely across businesses, leading to inconsistency and lack of comparability.

As Indian businesses expanded and capital markets developed, the need for uniform accounting rules became increasingly important. This led to the formal introduction of Accounting Standards and the creation of institutional bodies responsible for developing and enforcing them.

Over time, India has also aligned its accounting practices with global standards while ensuring compatibility with domestic laws and economic conditions.

Overview of Accounting Standards in India

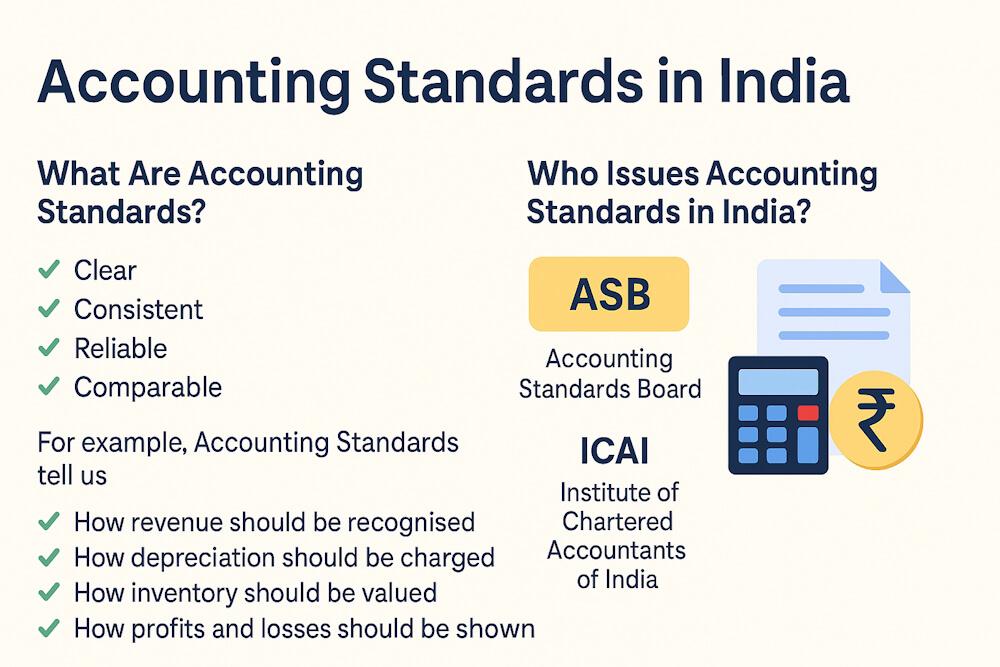

Accounting Standards in India aim to:

- Ensure uniform accounting practices

- Improve transparency in financial reporting

- Enhance comparability of financial statements

- Protect the interests of investors and stakeholders

These standards apply to different entities depending on their nature, size, and regulatory requirements. While traditional Accounting Standards (AS) continue to apply to certain entities, many companies now follow Indian Accounting Standards (Ind AS), which are largely converged with international standards.

The Institute of Chartered Accountants of India (ICAI)

Background and Authority

The Institute of Chartered Accountants of India (ICAI) is the primary professional accounting body in India. Established under the Chartered Accountants Act, 1949, ICAI plays a pivotal role in the development of accounting standards and the regulation of the accounting profession.

Although ICAI is not a legislative body, its influence on accounting practices in India is significant due to its expertise, professional authority, and statutory recognition.

Accounting Standards Board (ASB)

To formalize the standard-setting process, ICAI constituted the Accounting Standards Board (ASB). The ASB is responsible for:

- Identifying areas requiring accounting standards

- Drafting Accounting Standards

- Considering international developments

- Consulting with stakeholders

The ASB includes representatives from industry, regulators, academicians, and government bodies, ensuring that standards are developed through a consultative and transparent process.

Role of ICAI in Standard Setting

ICAI performs several critical functions in the accounting standard framework:

- Drafting Accounting Standards and Ind AS

- Issuing guidance notes and interpretations

- Aligning Indian standards with global practices

- Recommending standards to the government

For non-corporate entities, ICAI directly issues Accounting Standards. For corporate entities, ICAI plays an advisory role by recommending standards to the government.

Ministry of Corporate Affairs (MCA)

Regulatory Authority of MCA

The Ministry of Corporate Affairs (MCA) is the central government authority responsible for regulating corporate entities in India. It holds the statutory power to notify Accounting Standards applicable to companies.

While ICAI drafts and recommends standards, MCA gives them legal enforceability through notifications under the Companies Act.

MCA’s Role in Accounting Standards

MCA is responsible for:

- Notifying Accounting Standards and Ind AS

- Specifying their applicability and effective dates

- Issuing amendments and clarifications

- Ensuring alignment with corporate laws

Once notified by MCA, compliance with Accounting Standards becomes mandatory for companies falling under their scope.

Legal Framework

Accounting Standards in India derive legal authority primarily from:

- The Companies Act

- Rules notified by MCA

- Regulatory requirements of other authorities

If there is any conflict between Accounting Standards and statutory law, the law prevails. This ensures legal consistency while maintaining accounting discipline.

National Financial Reporting Authority (NFRA)

Introduction to NFRA

The National Financial Reporting Authority (NFRA) was established to strengthen oversight of financial reporting and auditing standards in India. NFRA operates as an independent regulatory body with enhanced powers.

Its creation marked a significant shift toward stronger regulatory supervision and improved accountability in financial reporting.

Functions of NFRA

NFRA performs multiple functions, including:

- Recommending Accounting Standards to MCA

- Monitoring compliance with Accounting Standards

- Overseeing audit quality

- Investigating professional misconduct

NFRA’s role ensures that Accounting Standards are not only issued but also effectively implemented and enforced.

NFRA and Corporate Governance

By monitoring compliance and enforcing accountability, NFRA strengthens corporate governance. It acts as a safeguard against:

- Financial misstatements

- Audit failures

- Manipulation of financial information

This oversight enhances investor confidence and trust in financial reporting.

Interaction Between ICAI, MCA, and NFRA

The Indian accounting framework operates through a collaborative model:

- ICAI drafts and recommends standards based on professional expertise

- NFRA examines and recommends standards from a regulatory perspective

- MCA notifies and enforces standards through legal authority

This division of roles ensures that Accounting Standards are technically sound, legally enforceable, and effectively monitored.

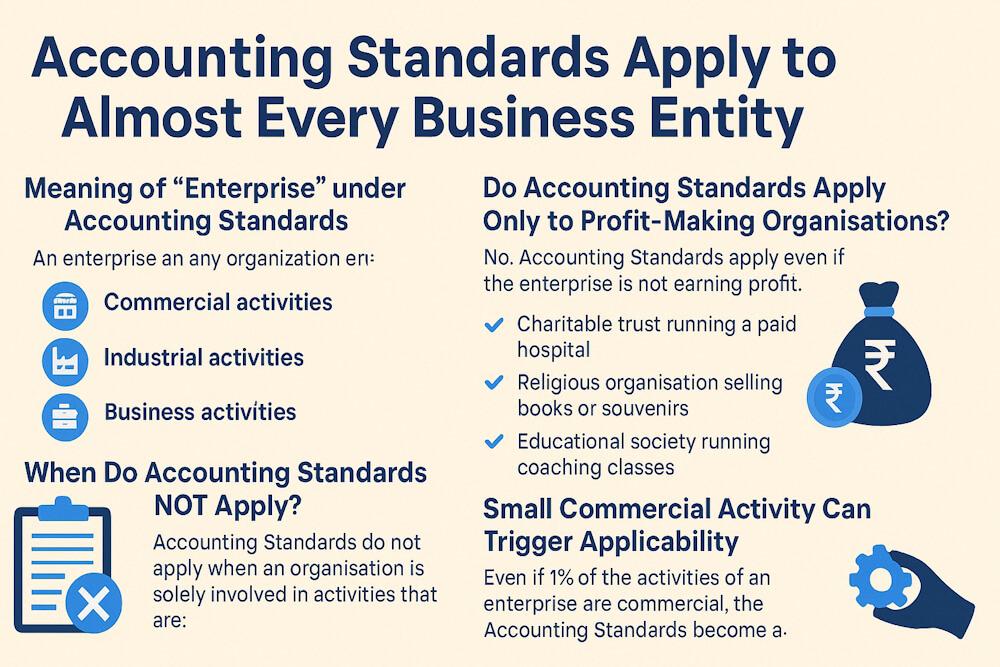

Applicability of Accounting Standards in India

Accounting Standards in India apply differently depending on the type of entity:

- Corporate entities follow standards notified by MCA

- Non-corporate entities follow standards issued by ICAI

- Certain companies follow Ind AS based on prescribed criteria

The applicability framework ensures proportional compliance while maintaining overall consistency.

Transition to Indian Accounting Standards (Ind AS)

As part of global convergence, India introduced Indian Accounting Standards (Ind AS). These standards are largely aligned with international standards but adapted to Indian conditions.

The transition to Ind AS reflects India’s commitment to:

- Global best practices

- Improved transparency

- Enhanced comparability with international companies

ICAI, MCA, and NFRA jointly play critical roles in this transition process.

Challenges in the Indian Accounting Framework

Despite a robust structure, challenges remain:

- Complexity in applying standards

- Need for professional judgment

- Frequent regulatory changes

- Training and awareness requirements

However, continuous updates and institutional coordination help address these challenges over time.

Importance of Institutional Framework

The presence of ICAI, MCA, and NFRA ensures that accounting standards in India are:

- Professionally developed

- Legally enforced

- Properly monitored

This framework protects stakeholders and strengthens the credibility of Indian financial reporting.

Conclusion

Accounting Standards in India are the result of a well-defined institutional collaboration between ICAI, MCA, and NFRA. Each body plays a distinct yet interconnected role in shaping financial reporting practices.

ICAI brings professional expertise, MCA provides statutory authority, and NFRA ensures oversight and accountability. Together, they create a balanced system that promotes transparency, consistency, and trust in financial reporting.

Understanding this framework is essential for students, professionals, and stakeholders who rely on financial information to make informed decisions in an increasingly complex business environment.

“To understand the basics, refer to our explanation of the meaning and importance of accounting standards.”

“For a deeper understanding of their practical impact, explore the benefits of accounting standards in financial reporting.”

FAQs

1: Who is responsible for issuing Accounting Standards in India?

Accounting Standards in India are drafted by ICAI, reviewed and recommended by NFRA, and officially notified and enforced by the Ministry of Corporate Affairs (MCA).

2: What is the role of ICAI in Accounting Standards?

ICAI develops and drafts Accounting Standards through its Accounting Standards Board and recommends them to the government for implementation.

3: What role does the Ministry of Corporate Affairs play?

The MCA gives legal authority to Accounting Standards by notifying them under the Companies Act and specifying their applicability to companies.

4: What is NFRA and why was it created?

NFRA is an independent regulatory body created to monitor compliance with accounting and auditing standards and to strengthen financial reporting oversight.

5: Are Accounting Standards mandatory in India?

Yes, Accounting Standards are mandatory for entities covered under the Companies Act and other regulatory frameworks, subject to applicability rules.

6: How do Accounting Standards in India align with global standards?

India aligns its accounting framework with global standards through Ind AS, which are largely converged with international financial reporting standards.

7: What happens if Accounting Standards conflict with law?

In case of any conflict, the provisions of the applicable law prevail over Accounting Standards.