Accounting Standards in India provide the foundation for preparing reliable, consistent, and transparent financial statements. While many people are aware that such standards exist, fewer understand how many Accounting Standards are applicable in India, what they cover, and how they are grouped for practical use.

This blog presents a complete and easy-to-understand list of Accounting Standards in India (AS 1 to AS 29), along with their objectives and classification. Whether you are a student, accounting professional, or business owner, this guide will help you understand the scope and structure of Indian Accounting Standards.

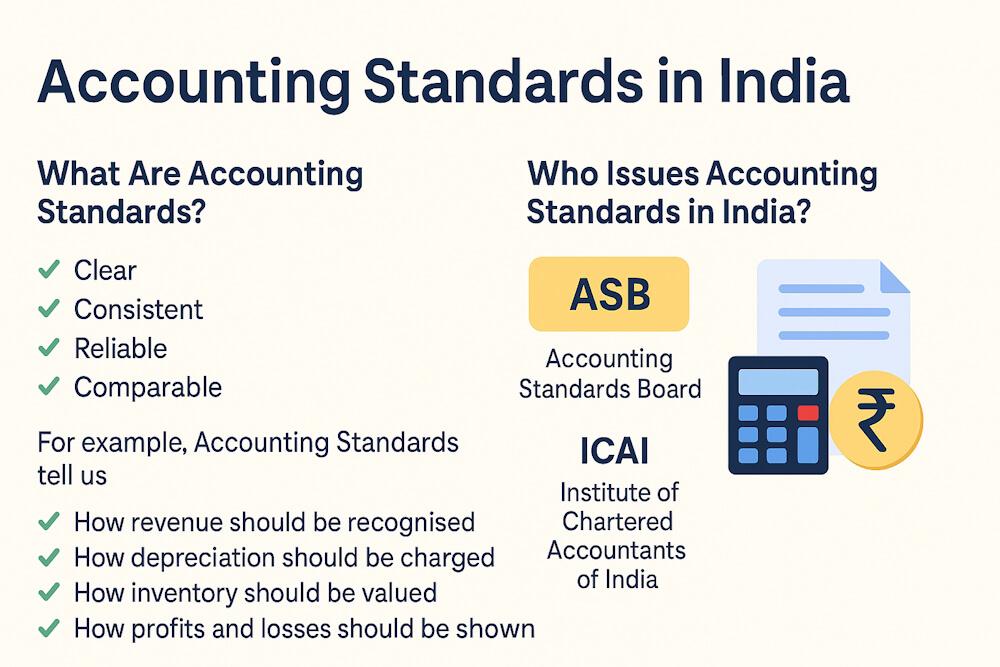

What Are Accounting Standards in India?

Accounting Standards in India are authoritative guidelines that prescribe the recognition, measurement, presentation, and disclosure of financial transactions and events. These standards are framed by the Institute of Chartered Accountants of India (ICAI) and notified by the Ministry of Corporate Affairs (MCA) for corporate entities.

Although 29 Accounting Standards were originally issued, two standards have been withdrawn, making 27 Accounting Standards currently applicable in India.

How Many Accounting Standards Are Applicable in India?

Originally issued: 29 Accounting Standards

Withdrawn:

- AS 6 – Depreciation Accounting (withdrawn and merged into AS 10)

- AS 8 – Accounting for Research and Development (withdrawn due to AS 26)

“Effective Accounting Standards in India today: 27”

These standards collectively form the backbone of financial reporting under Indian GAAP.

Why Are Accounting Standards Grouped?

Accounting Standards are often grouped based on their nature and the type of financial information they govern. This grouping makes them easier to understand and apply in practice.

The major groupings include:

- Presentation and Disclosure Standards

- Asset-based Standards

- Liability-based Standards

- Income and Expense-related Standards

- Consolidation Standards

Complete List of Accounting Standards in India (AS 1 to AS 29)

Below is a structured explanation of each Accounting Standard currently applicable in India.

1. Presentation and Disclosure-Based Accounting Standards

These standards focus on how financial information is presented and disclosed in financial statements.

AS 1 – Disclosure of Accounting Policies

Specifies the requirement to disclose significant accounting policies used in preparing financial statements to ensure transparency and comparability.

AS 3 – Cash Flow Statements

Prescribes the preparation and presentation of cash flow statements, classifying cash flows into operating, investing, and financing activities.

AS 17 – Segment Reporting

Requires disclosure of financial information for different business or geographical segments to help users evaluate performance.

AS 18 – Related Party Disclosures

Mandates disclosure of transactions with related parties to prevent misuse of influence or manipulation.

AS 20 – Earnings Per Share

Provides guidance on calculating and presenting basic and diluted earnings per share.

AS 24 – Discontinuing Operations

Ensures proper disclosure of operations that are being discontinued or disposed of.

AS 25 – Interim Financial Reporting

Prescribes minimum content and principles for interim financial reports.

2. Asset-Based Accounting Standards

These standards deal with accounting for assets owned or controlled by an enterprise.

AS 2 – Valuation of Inventories

Guides inventory valuation at the lower of cost or net realizable value and prescribes acceptable cost formulas.

AS 10 – Property, Plant and Equipment

Covers recognition, measurement, depreciation, and derecognition of tangible fixed assets.

AS 13 – Accounting for Investments

Deals with classification, valuation, and disclosure of investments.

AS 16 – Borrowing Costs

Prescribes the treatment of borrowing costs, including capitalization and expensing.

AS 19 – Leases

Provides accounting guidance for operating and finance leases from the lessee and lessor perspectives.

AS 26 – Intangible Assets

Covers recognition and measurement of intangible assets such as goodwill, patents, and trademarks.

AS 28 – Impairment of Assets

Requires assessment and recognition of impairment losses when asset values decline.

3. Liability-Based Accounting Standards

These standards focus on obligations and liabilities of an enterprise.

AS 15 – Employee Benefits

Prescribes accounting treatment for employee benefits such as gratuity, pension, and leave encashment.

AS 29 – Provisions, Contingent Liabilities and Contingent Assets

Provides guidance on recognizing provisions and disclosing contingent liabilities and assets.

4. Accounting Standards Affecting Profit and Loss

These standards influence income, expenses, and financial results.

AS 4 – Contingencies and Events Occurring After the Balance Sheet Date

Deals with events occurring after the balance sheet date that may affect financial statements.

AS 5 – Net Profit or Loss for the Period, Prior Period Items and Changes in Accounting Policies

Prescribes classification and disclosure of extraordinary items and prior period adjustments.

AS 11 – The Effects of Changes in Foreign Exchange Rates

Provides accounting treatment for foreign currency transactions and foreign operations.

AS 22 – Accounting for Taxes on Income

Deals with current tax and deferred tax accounting.

5. Revenue-Based Accounting Standards

These standards focus on recognition of income.

AS 7 – Construction Contracts

Prescribes accounting treatment for revenue and costs related to construction contracts.

AS 9 – Revenue Recognition

Provides principles for recognizing revenue from sale of goods, rendering of services, and interest, royalties, and dividends.

6. Other Specialized Accounting Standards

AS 12 – Accounting for Government Grants

Provides guidance on recognition, treatment, and disclosure of government grants.

AS 14 – Accounting for Amalgamations

Prescribes accounting treatment for business combinations and mergers.

7. Accounting Standards for Consolidated Financial Statements

These standards apply when an enterprise controls or significantly influences other entities.

AS 21 – Consolidated Financial Statements

Prescribes principles for preparing consolidated financial statements of parent and subsidiary companies.

AS 23 – Accounting for Investments in Associates

Provides guidance for accounting investments in associate companies.

AS 27 – Financial Reporting of Interests in Joint Ventures

Deals with accounting treatment for joint venture arrangements.

Withdrawn Accounting Standards (For Knowledge)

Although no longer applicable, these standards are important for historical understanding.

- AS 6 – Depreciation Accounting

- AS 8 – Accounting for Research and Development

Their concepts are now covered under revised or newer standards.

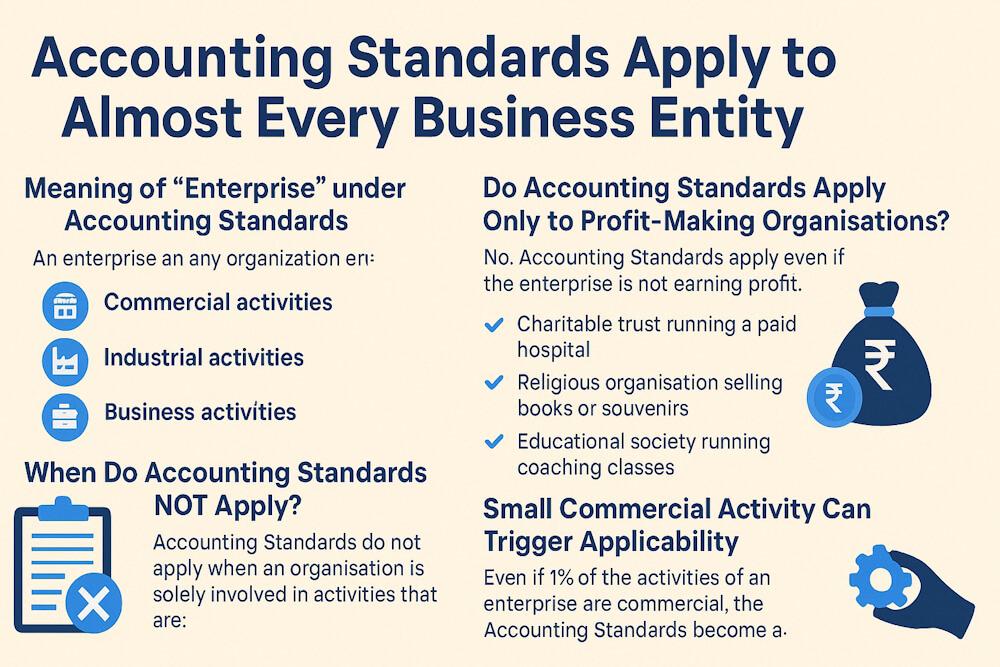

Applicability of Accounting Standards in India

Accounting Standards apply differently based on the type of entity:

- Corporate entities follow standards notified by MCA

- Non-corporate entities follow standards issued by ICAI

- Certain entities follow Ind AS instead of traditional AS

Understanding applicability is essential to ensure correct compliance.

Relationship Between AS and Ind AS

Traditional Accounting Standards (AS) continue to apply to many entities. However, large companies and listed entities may be required to follow Indian Accounting Standards (Ind AS), which are largely converged with international standards.

Both frameworks coexist to balance global alignment and domestic requirements.

Importance of Understanding the List of Accounting Standards

Knowing the complete list of Accounting Standards helps in:

- Ensuring compliance

- Improving financial reporting quality

- Avoiding penalties and misstatements

- Making informed accounting decisions

For students, it forms a strong conceptual base, and for professionals, it ensures accuracy and credibility.

Conclusion

The Accounting Standards in India, ranging from AS 1 to AS 29, provide a comprehensive framework for preparing financial statements that are transparent, consistent, and reliable. Although 29 standards were originally issued, 27 Accounting Standards are currently applicable, covering almost every aspect of financial reporting.

Understanding these standards is not just about memorizing numbers and names—it is about appreciating how financial information is standardized and protected in the interest of all stakeholders. As Indian accounting continues to evolve, these standards remain central to maintaining trust and integrity in financial reporting.

“If you are new to this topic, start with the meaning and importance of accounting standards, understand their benefits, learn who regulates them in India, and see how accounting standards are framed and notified.”

FAQs

1: How many Accounting Standards are applicable in India?

At present, 27 Accounting Standards are applicable in India. Although 29 were originally issued, AS 6 and AS 8 have been withdrawn.

2: Who issues Accounting Standards in India?

Accounting Standards are framed by the Institute of Chartered Accountants of India (ICAI) and notified by the Ministry of Corporate Affairs (MCA) for corporate entities.

3: What is AS 1 in Accounting Standards?

AS 1 deals with the disclosure of significant accounting policies used in the preparation of financial statements.

4: Are Accounting Standards mandatory in India?

Yes, Accounting Standards are mandatory for entities covered under the Companies Act and other regulatory frameworks, subject to applicability conditions.

5: What is the difference between AS and Ind AS?

AS are traditional Indian Accounting Standards, while Ind AS are IFRS-converged standards applicable to certain classes of companies.

6: Which Accounting Standards deal with consolidated financial statements?

AS 21, AS 23, and AS 27 deal with consolidated financial statements, associates, and joint ventures.

7: Why were AS 6 and AS 8 withdrawn?

AS 6 and AS 8 were withdrawn because their concepts were incorporated into revised standards such as AS 10 and AS 26.