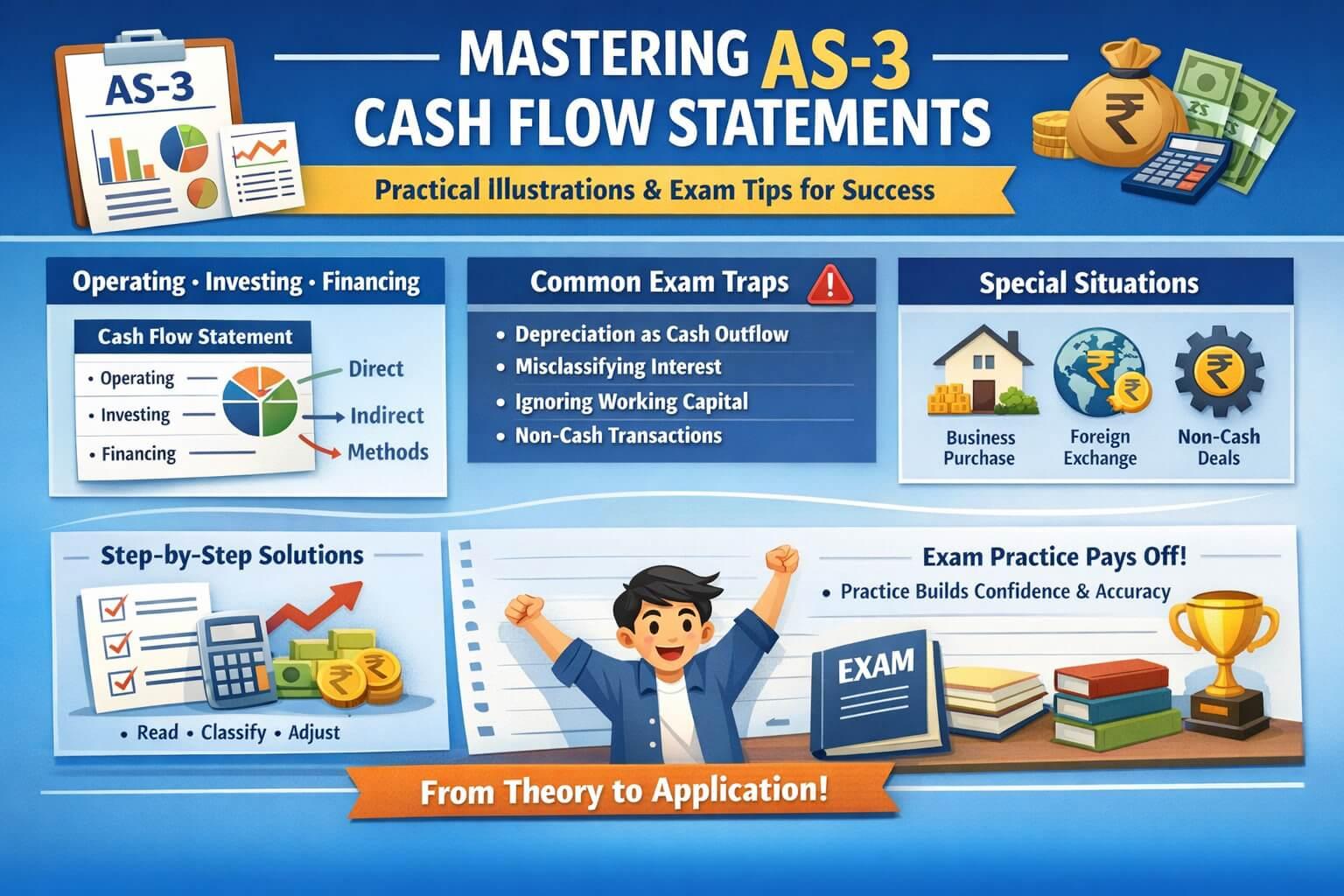

After understanding concepts like cash and cash equivalents, classification rules, operating cash flows, net basis reporting, and special situations, the real test of AS-3 begins with practical illustrations and exam problems. Most students lose marks not because they don’t know the theory, but because they misclassify items or miss key adjustments while preparing the Cash Flow Statement.

This blog brings together practical illustrations and exam-oriented guidance to help you apply AS-3 correctly and confidently.

How AS-3 Practical Questions Are Asked in Exams

Examination questions on AS-3 usually appear in one of the following forms:

- Prepare a Cash Flow Statement (full question)

- Compute cash flow from operating activities (direct or indirect method)

- Classify given cash flows

- Short notes / MCQs on special items like interest, dividends, tax, or non-cash transactions

Understanding the pattern helps you approach questions strategically.

Illustration 1: Basic Cash Flow Statement (Classification Focus)

Given Information

A company provides the following details:

- Cash received from customers

- Payment to suppliers

- Purchase of machinery

- Issue of shares

- Dividend paid

Required

Classify the above items under AS-3.

Solution (Conceptual)

- Cash received from customers → Operating activity

- Payment to suppliers → Operating activity

- Purchase of machinery → Investing activity

- Issue of shares → Financing activity

- Dividend paid → Financing activity

Exam Tip

Always classify based on the nature of activity, not the name of the item.

Illustration 2: Operating Cash Flow – Indirect Method

Given Information

- Net profit before tax: ₹4,00,000

- Depreciation: ₹60,000

- Profit on sale of machinery: ₹20,000

- Increase in debtors: ₹50,000

- Increase in creditors: ₹30,000

Required

Compute cash flow from operating activities.

Step-by-Step Solution

- Start with Net Profit = ₹4,00,000

- Add Non-Cash Expenses = Depreciation ₹60,000

- Remove Non-Operating Income − Profit on sale of machinery ₹20,000

- Adjust Working Capital Changes = (a) Increase in debtors → cash outflow → − ₹50,000, (b) Increase in creditors → cash inflow → + ₹30,000

Cash Flow from Operating Activities

₹4,00,000

- 60,000 − 20,000, − 50,000

- 30,000 = ₹4,20,000

Exam Tip

Never treat depreciation as a cash outflow. Never leave profit on sale of assets inside operating activities.

Illustration 3: Direct Method (Conceptual Understanding)

Given Information

- Cash sales

- Credit sales

- Opening and closing debtors

- Payments to suppliers

- Wages paid

Required

Compute cash received from customers.

Solution Logic

Cash received from customers =

- Sales

- Less: Increase in debtors

- Add: Decrease in debtors

Only actual cash receipts are considered.

Exam Tip

Direct method questions often test adjustments of sales and expenses, not full statements.

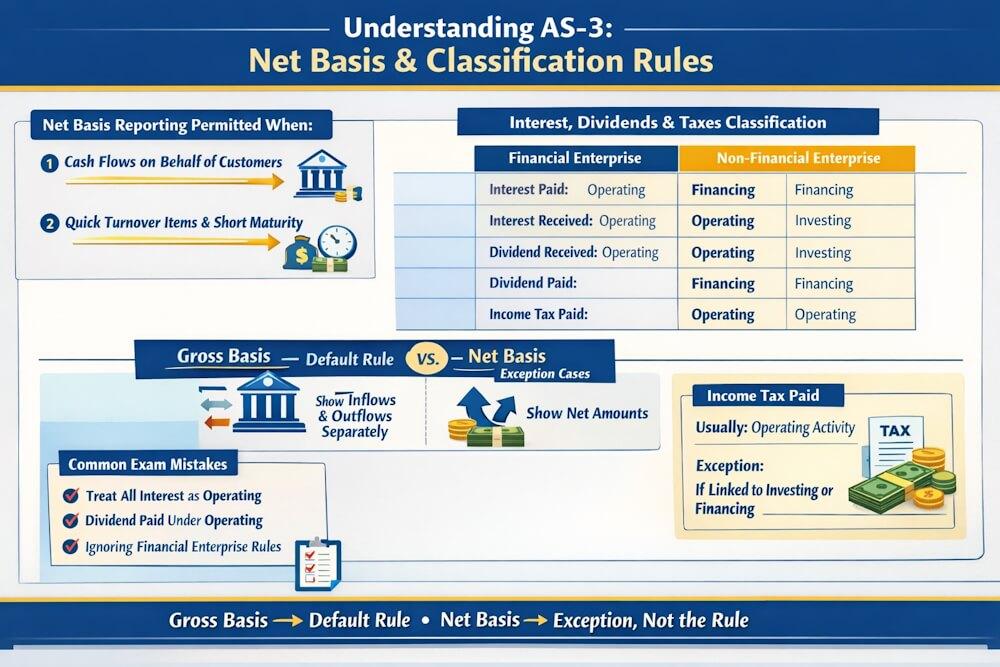

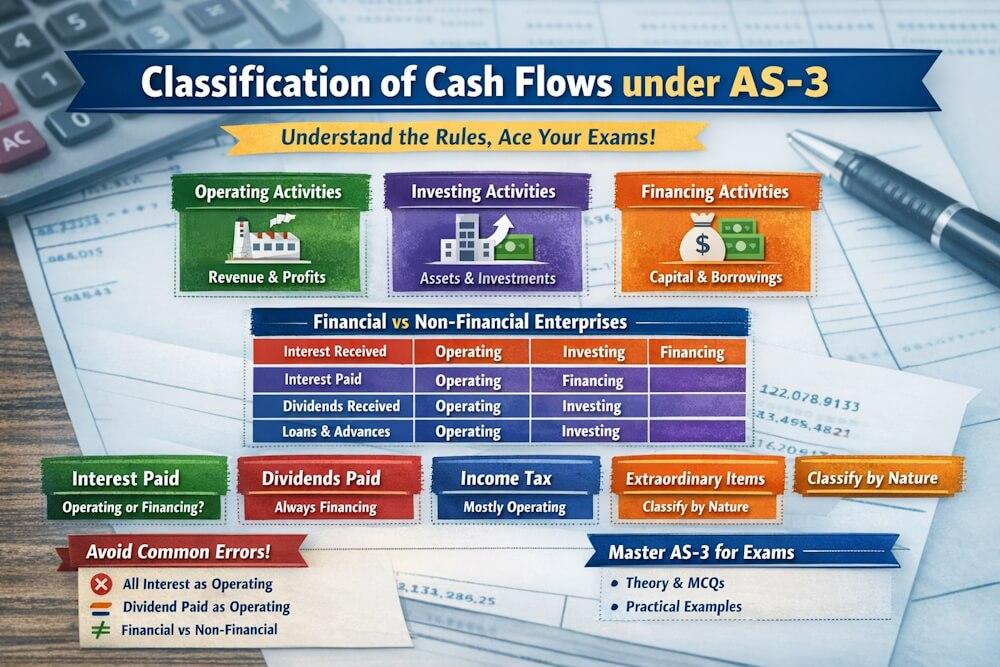

Illustration 4: Interest, Dividend & Tax Classification

Given Information

A non-financial company:

- Paid interest on loan

- Received interest on fixed deposit

- Paid dividend

- Paid income tax

Classification under AS-3

- Interest paid → Financing activity

- Interest received → Investing activity

- Dividend paid → Financing activity

- Income tax paid → Operating activity (generally)

Exam Tip

Always check whether the enterprise is financial or non-financial before classifying interest and dividends.

Illustration 5: Net Basis Reporting

Given Information

A bank:

- Accepts deposits

- Repays deposits

- Grants loans

- Recovers loans

Treatment under AS-3

For a financial enterprise, such items:

- Have quick turnover

- Large volumes

- Short maturity

They may be shown on a net basis.

Exam Tip

Net basis reporting is an exception, not the rule. Only apply it when specifically permitted.

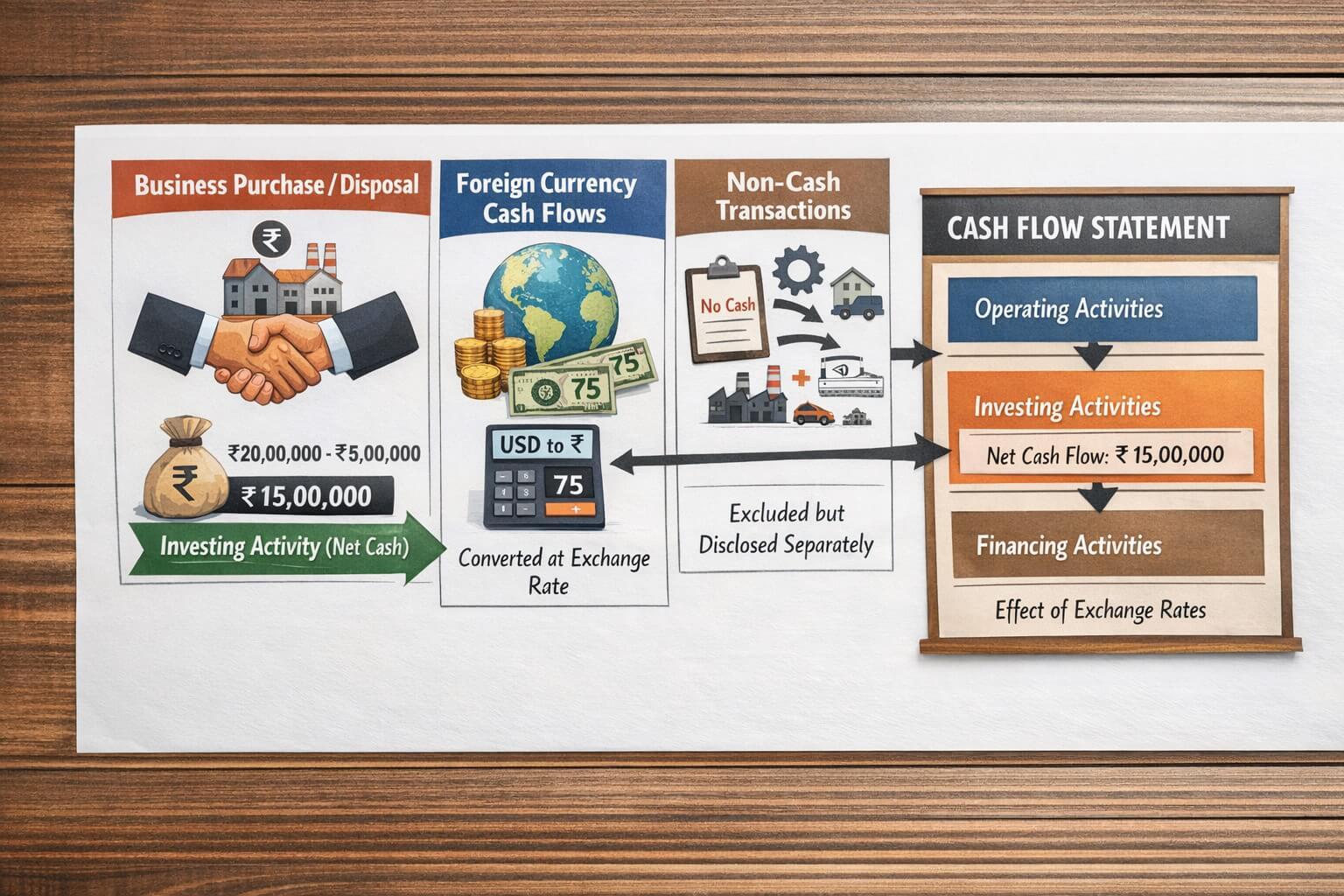

Illustration 6: Business Purchase

Given Information

- Purchase consideration paid: ₹25,00,000

- Cash balance of acquired business: ₹6,00,000

Treatment

Net cash outflow = ₹25,00,000 − ₹6,00,000 = ₹19,00,000

Classified as investing activity.

Exam Tip

Never show the full purchase consideration as cash outflow. Only show net cash movement.

Illustration 7: Foreign Currency Cash Balance

Given Information

- Opening foreign bank balance: USD 4,000

- Rate at beginning: ₹70

- Rate at end: ₹72

Explanation

Increase in rupee value is due to exchange rate change, not cash inflow.

Treatment

- Not a cash flow

- Shown separately for reconciliation

Exam Tip

Exchange differences are never operating, investing, or financing cash flows.

Illustration 8: Non-Cash Transactions

Given Information

- Machinery acquired by issuing equity shares

Treatment under AS-3

- No cash movement

- Excluded from Cash Flow Statement

- Disclosed separately

Exam Tip

If there is no cash, it should never appear in the Cash Flow Statement.

Common Exam Traps in AS-3

Students often lose marks due to:

- Treating depreciation as cash outflow

- Misclassifying interest and dividends

- Including non-cash transactions

- Ignoring working capital adjustments

- Showing exchange differences as cash flows

Avoiding these traps alone can significantly improve scores.

How to Approach Full Cash Flow Statement Questions

- Read the question twice

- Identify: (a) Nature of enterprise, (b) Method required (direct / indirect)

- List items under: (a) Operating, (b) Investing, (c) Financing,

- Apply AS-3 rules carefully

- Cross-check: (a) Non-cash items removed, (b) Proper classification

AS-3 MCQs: Conceptual Focus

MCQs usually test:

- Definitions

- Classification rules

- Exceptions

- Special cases

Example:

- Exchange differences on foreign currency cash balances are:

- Operating cash flows

- Investing cash flows

- Financing cash flows

- None of the above

Correct answer: d)

Why Practice Matters in AS-3

AS-3 is not about memorisation. It is about:

- Understanding logic

- Applying rules

- Avoiding common mistakes

Practising illustrations builds confidence and accuracy.

Importance from Exam Perspective

This is a high-weightage scoring area because:

- Steps are structured

- Answers are objective

- Partial marks are possible

Students who practise AS-3 problems consistently usually score well.

“To see how AS-3 concepts are applied in exams, read AS-3 Cash Flow Statement: Practical Problems Explained, which covers solved illustrations, exam patterns, and common mistakes.”

Conclusion

Accounting Standard 3 becomes easy only when its concepts are applied through practical illustrations. From operating cash flows to special situations like business purchase and foreign currency balances, AS-3 demands clarity, logic, and precision.

By understanding common exam patterns, avoiding frequent mistakes, and practising regularly, students can confidently handle both theory and practical questions related to AS-3. Mastering these illustrations completes your AS-3 preparation in a meaningful way.

FAQs

1: How are AS 3 questions asked in exams?

Answer: AS 3 questions are usually asked as full cash flow statement preparation, operating cash flow computation, classification problems, or MCQs based on concepts.

2: Which method is mostly used in AS 3 practical questions?

Answer: Most practical questions use the indirect method, though direct method concepts are also tested in short and conceptual questions.

3: What are common mistakes students make in AS 3 problems?

Answer: Common mistakes include treating depreciation as cash outflow, misclassifying interest and dividends, including non-cash transactions, and ignoring working capital changes.

4: Are exchange differences treated as cash flows under AS 3?

Answer: No, exchange differences arising from foreign currency cash balances are not treated as cash flows under AS 3.

5: How is business purchase shown in Cash Flow Statement?

Answer: Only net cash paid or received after adjusting cash and cash equivalents of the acquired or disposed business is shown as an investing activity.

6: Are non-cash transactions included in Cash Flow Statement?

Answer: No, non-cash investing and financing transactions are excluded from the Cash Flow Statement but must be disclosed separately.

7: How can students score well in AS 3 practical questions?

Answer: Students should clearly understand classification rules, practise step-wise solutions, and avoid common conceptual mistakes.