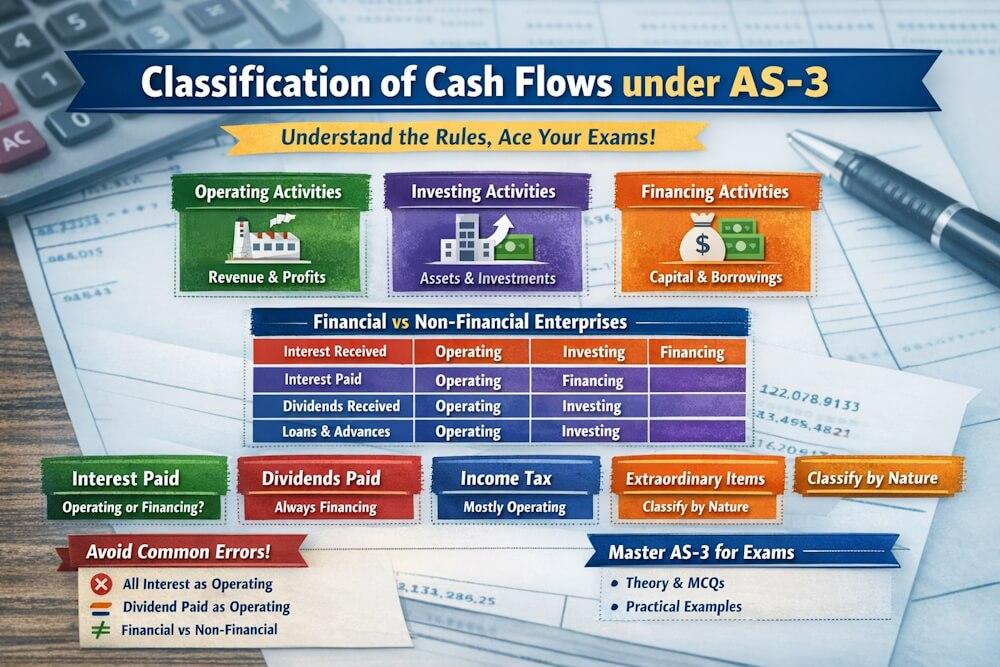

After understanding operating, investing, and financing cash flows, Accounting Standard 3 (AS-3) deals with certain special situations that do not arise regularly but are extremely important from both exam and practical perspectives. These include:

- Cash flows arising from purchase or disposal of business units

- Cash flows in foreign currency

- Non-cash investing and financing transactions

Incorrect treatment of these items can seriously distort a Cash Flow Statement. AS-3 therefore provides specific guidance to ensure clarity and consistency.

Cash Flows Arising from Purchase or Disposal of Business

Meaning of Business Purchase / Disposal

Purchase or disposal of a business refers to acquisition or sale of:

- A subsidiary

- A business unit

- An undertaking capable of operating independently

Such transactions usually involve large cash flows and are therefore treated separately under AS-3.

Classification of Cash Flows from Business Purchase or Disposal

AS-3 requires that aggregate cash flows arising from purchase or disposal of a business should be classified as investing activities.

This is because:

- These transactions involve long-term investments

- They affect the future earning capacity of the enterprise

How Cash Flows Are Shown in the Cash Flow Statement

When a business is purchased or disposed of, the Cash Flow Statement should show:

- Total purchase consideration paid (or received)

- Less: Cash and cash equivalents acquired (or disposed of)

Only the net cash flow is shown as an investing activity.

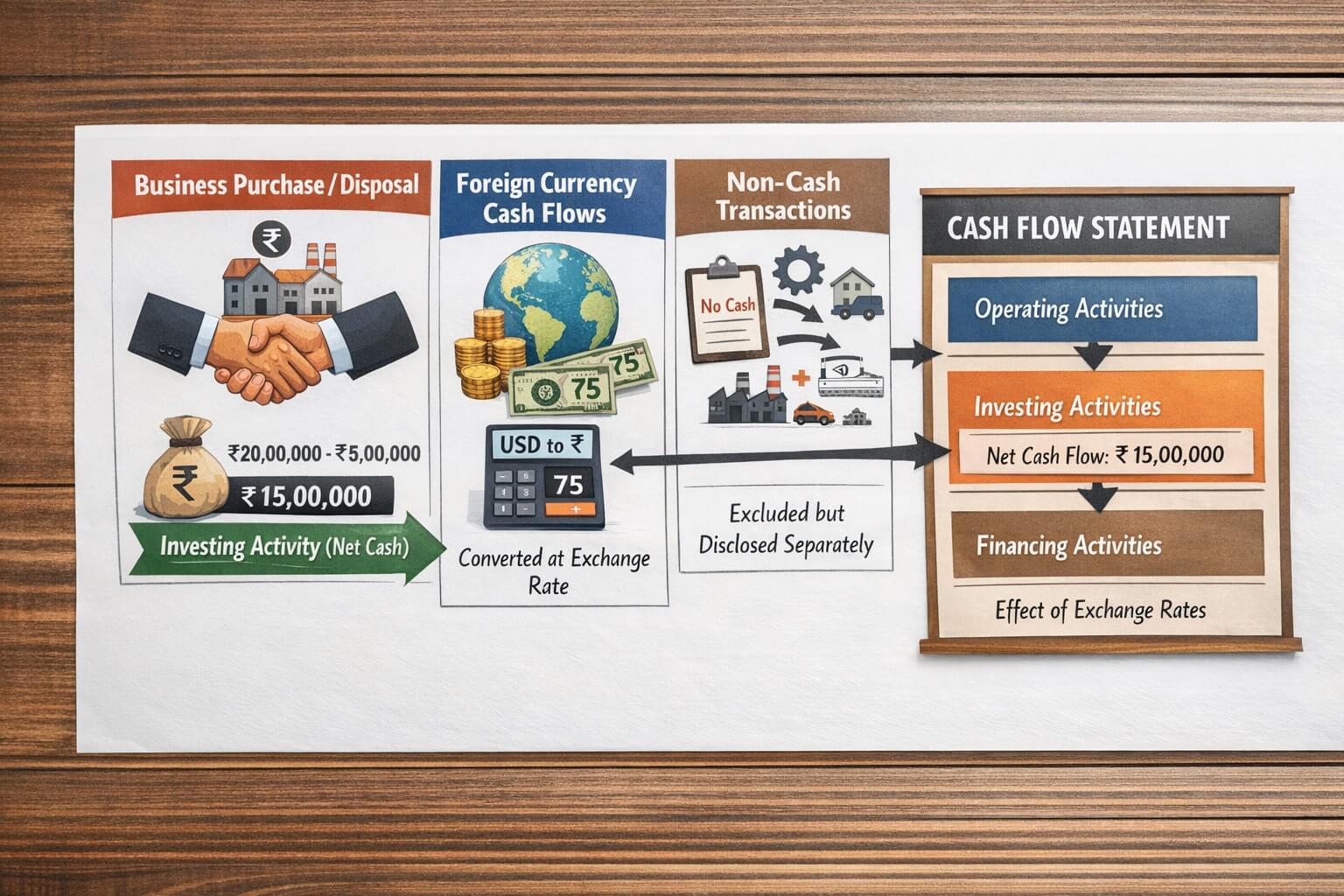

Illustration: Purchase of a Business

Suppose:

- Purchase consideration paid = ₹20,00,000

- Cash and bank balance of acquired business = ₹5,00,000

Then:

- Net cash outflow = ₹15,00,000

- Classified as investing cash outflow

This ensures that only actual cash movement is reflected.

Separate Disclosure Requirement

AS-3 requires that:

- Cash flows from purchase or disposal of business should be disclosed separately

- Such disclosure improves transparency

This helps users distinguish routine investing activities from major structural changes.

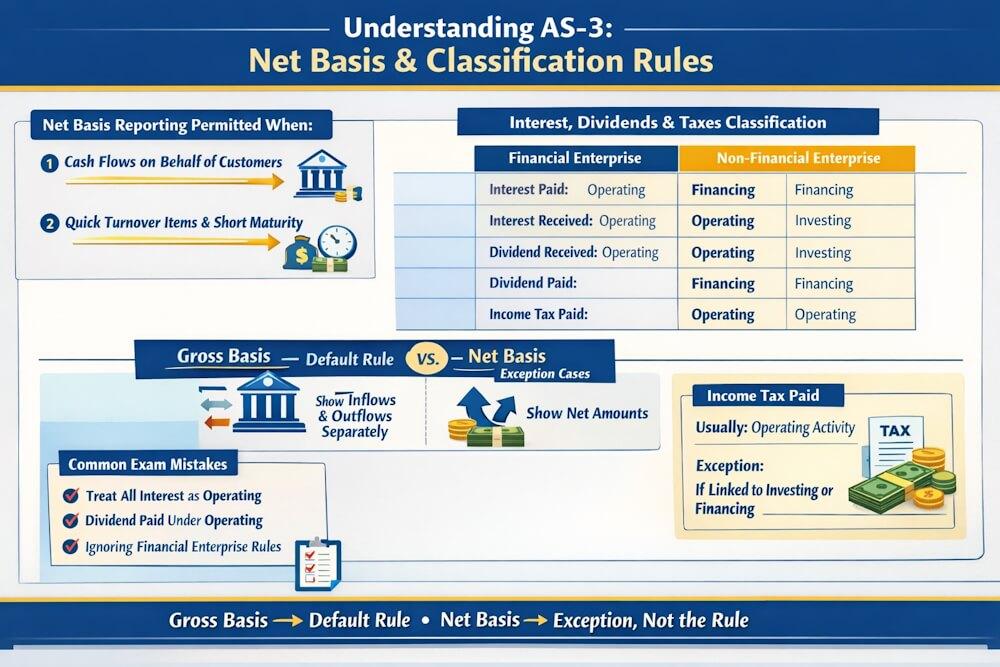

Foreign Currency Cash Flows under AS-3

Enterprises often deal in foreign currencies through:

- Export and import transactions

- Foreign bank balances

- Overseas operations

AS-3 provides clear guidance on how such cash flows should be reported.

Reporting of Foreign Currency Cash Flows

Cash flows arising from transactions in foreign currency should be:

- Recorded in reporting currency

- Converted using the exchange rate on the date of cash flow

This ensures consistency and accuracy.

Illustration: Foreign Currency Receipt

An enterprise receives USD 10,000 when:

- Exchange rate on receipt date = ₹75 per USD

Cash inflow recorded:

- ₹7,50,000

This amount is shown in the Cash Flow Statement.

Treatment of Exchange Differences

AS-3 makes an important clarification:

“Exchange differences arising from translation of foreign currency cash balances are NOT cash flows.”

These differences:

- Do not involve actual cash movement

- Arise only due to change in exchange rates

How Exchange Differences Are Shown

AS-3 requires that:

- Effect of exchange rate changes on cash and cash equivalents should be shown separately

- This is done to reconcile opening and closing cash balances

Illustration: Exchange Difference on Foreign Bank Balance

Suppose:

- Opening foreign bank balance = USD 5,000

- Exchange rate at beginning = ₹70

- Exchange rate at end = ₹72

Increase in rupee value:

- ₹10,000

This increase is not a cash inflow and is shown separately for reconciliation.

Why Exchange Differences Are Excluded from Cash Flows

Because:

- No receipt or payment of cash occurs

- It is only a valuation adjustment

Including such differences would misrepresent actual cash movements.

Non-Cash Investing and Financing Transactions

Meaning of Non-Cash Transactions

Non-cash transactions are those transactions that:

- Do not involve inflow or outflow of cash

- Affect assets, liabilities, or equity

Although important, such transactions are excluded from the Cash Flow Statement.

Examples of Non-Cash Investing Transactions

- Acquisition of machinery by issue of shares

- Purchase of assets through conversion of liabilities

- Exchange of assets without cash payment

Examples of Non-Cash Financing Transactions

- Conversion of debentures into equity shares

- Issue of shares to settle liabilities

Why Non-Cash Transactions Are Excluded

AS-3 focuses only on actual cash movements. Since non-cash transactions do not affect cash and cash equivalents, they are not included in the Cash Flow Statement.

However, ignoring them completely would reduce usefulness.

Disclosure of Non-Cash Transactions

AS-3 requires that:

- Significant non-cash investing and financing transactions should be disclosed separately

- Disclosure may be made in: (a) Notes to accounts, or (b) A separate statement

This ensures complete financial information without distorting cash flows.

Illustration: Machinery Acquired by Issue of Shares

If machinery worth ₹10,00,000 is acquired by issuing equity shares:

- No cash outflow occurs

- Transaction is not shown in Cash Flow Statement

- It must be disclosed separately

Combined Understanding of These Special Situations

| Situation | Treatment under AS-3 |

| Business purchase/disposal | Investing activity (net cash) |

| Foreign currency cash flows | Converted at date of cash flow |

| Exchange differences | Not cash flows |

| Non-cash transactions | Excluded but disclosed |

This summary is exam-critical.

Common Exam Mistakes to Avoid

Students often:

- Show total purchase consideration instead of net cash

- Treat exchange differences as operating cash flows

- Include non-cash transactions in Cash Flow Statement

- Forget disclosure requirements

Avoiding these mistakes can significantly improve marks.

Importance from Practical Perspective

Correct treatment ensures:

- Accurate liquidity analysis

- Clear distinction between cash and non-cash events

- Better comparability between enterprises

Analysts rely heavily on these disclosures.

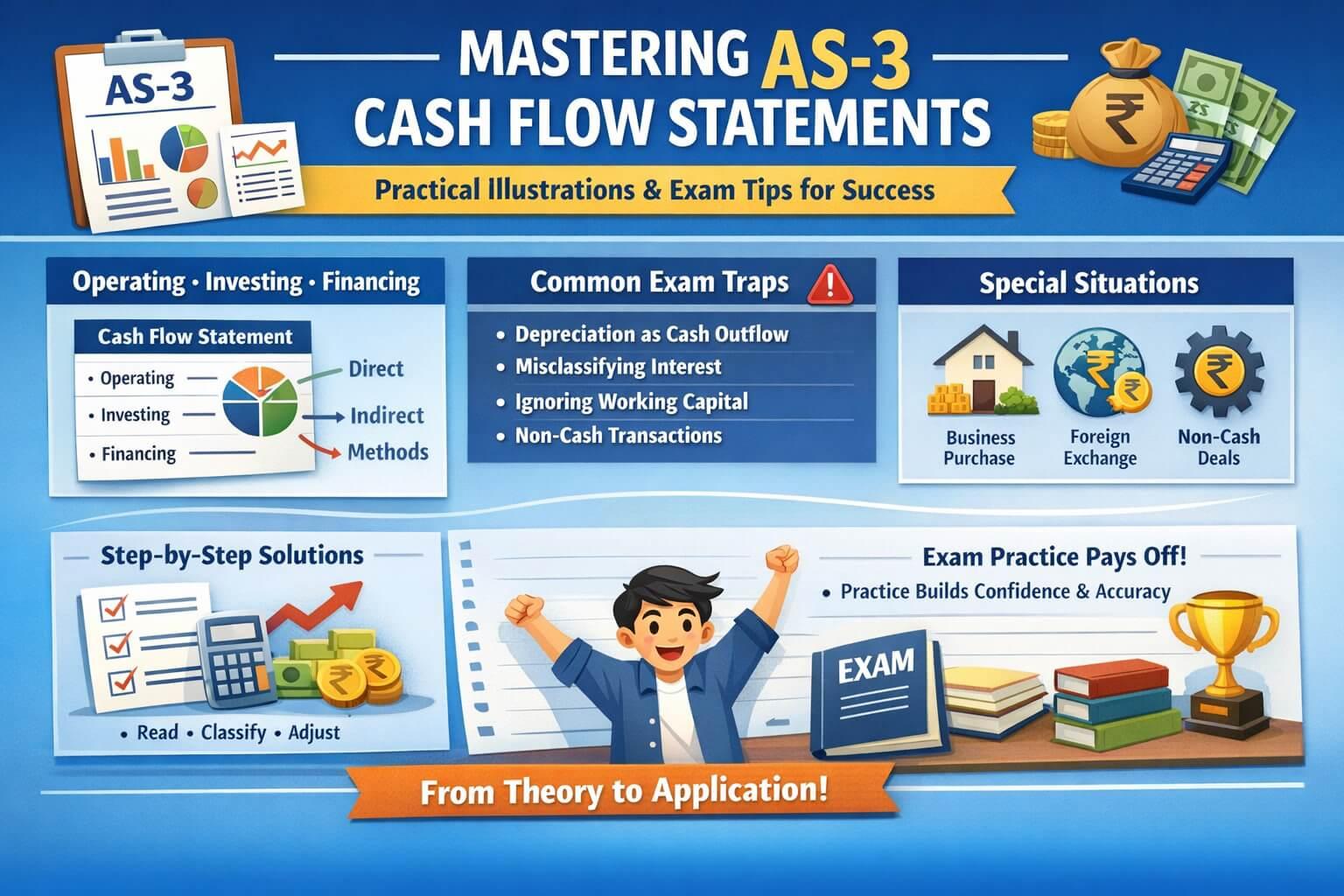

AS-3 from Examination Perspective

This topic is frequently tested through:

- Short notes

- MCQs

- Conceptual questions

- Adjustments in practical problems

Clear understanding is essential for scoring well.

Conclusion

Accounting Standard 3 provides clear guidance for handling special situations such as business purchase or disposal, foreign currency cash flows, and non-cash transactions. These items may not occur regularly, but when they do, their impact on cash reporting is significant.

By following AS-3 rules carefully and making appropriate disclosures, enterprises can ensure that their Cash Flow Statements present a true and meaningful picture of cash movements. For students, mastering this topic completes a major portion of AS-3 preparation.

“To see how all AS-3 concepts are applied together, continue with our Accounting Standard 3 (AS-3): Cash Flow Statement – Complete Guide.”

FAQs

1: How are cash flows from business purchase treated under AS 3?

Answer: Cash flows arising from purchase or disposal of a business are classified as investing activities and shown net of cash and cash equivalents acquired or disposed of.

2: How are foreign currency cash flows reported under AS 3?

Answer: Foreign currency cash flows are recorded in the reporting currency using the exchange rate on the date of the cash flow.

3: Are exchange differences treated as cash flows under AS 3?

Answer: No, exchange differences arising from translation of foreign currency cash balances are not considered cash flows under AS 3.

4: How are exchange differences disclosed in Cash Flow Statement?

Answer: Exchange differences are shown separately to reconcile opening and closing cash and cash equivalents.

5: What are non-cash investing and financing transactions?

Answer: These are transactions that do not involve cash, such as acquisition of assets by issue of shares or conversion of debentures into equity.

6: Are non-cash transactions included in Cash Flow Statement?

Answer: No, non-cash investing and financing transactions are excluded from the Cash Flow Statement but must be disclosed separately.

7: Why is disclosure of non-cash transactions important?

Answer: Disclosure ensures complete financial information and helps users understand significant investing and financing activities that do not involve cash.